CBS News

5 ways to buy a second home with no down payment

Getty Images

For many, the idea of purchasing a second home, whether as a vacation getaway, investment property or future retirement residence, is a tantalizing prospect. However, the down payment typically required to secure that dream property can be a major stumbling block, preventing would-be buyers from moving forward.

After all, the optimal down payment on a home is typically 20% of the purchase price. By putting at least that much down on a home, you can avoid paying for private mortgage insurance (PMI). And, borrowing requirements are typically more stringent on a second home, so having the money for a large down payment can make it easier to qualify for a mortgage loan.

That said, you don’t always have to have the down payment money on hand to purchase a second home. There are creative financing strategies that could help you buy a second home with no money down. Below, we’ll discuss what you need to know.

Explore your top home equity loan options online today.

5 ways to buy a second home with no down payment

If you want to buy a home with no down payment, here are some of the top options to consider:

Use your home’s equity for funding

If you already own a primary residence, tapping into the equity in that home can be an effective way to fund the down payment on a second property without paying out of pocket. There are two main ways to do this: a home equity loan or a home equity line of credit (HELOC).

A home equity loan allows you to borrow against the equity you’ve built up in your primary home using a lump-sum loan that you’ll repay over a set term. The interest rate is usually fixed on a home equity loan, making your monthly payments predictable. And, many lenders will let you borrow up to 90% of your home’s equity, which you can then use toward the down payment on your second home.

A HELOC, on the other hand, is a line of credit that taps into your home equity. It functions more like a credit card, giving you access to a revolving line of credit that you can draw from as needed. HELOCs typically have variable interest rates, so your monthly payments may fluctuate over time as rates go up or down. But HELOCs also offer more flexibility than a home equity loan, allowing you to borrow only what you need for the down payment on your second home.

The main benefit of using home equity to buy a second home is that you don’t have to come up with a large lump sum for the down payment. Your existing home’s equity serves as the collateral and you can use what you need for the down payment. But if you take this route, just keep in mind that it does increase your overall debt load and monthly housing costs.

Compare today’s best home equity loan rates online now.

Explore specialty loan programs

There are also several specialized mortgage programs designed to help make buying a second home more accessible, even with little to no down payment. You’ll have to qualify, of course, but using one of the following specialty loan programs could allow you to buy a second home this way:

- Veterans Affairs (VA) loans: If you or your spouse are a current or former member of the U.S. military, you may be eligible for a VA loan. These loans come with the option for a 0% down payment and don’t require PMI. Note, though, that VA loans are restrictive in terms of what they can be used for, and while there are ways to use a VA loan for a second home purchase, you’ll need to adhere to the requirements to use this type of loan.

- Investor cash flow loans: These loans, also known as rental property loans, are aimed at real estate investors. They allow you to purchase an investment property with as little as 15% down, and may even let you use the projected rental income from the property to qualify.

- Jumbo loan programs: For high-cost properties, jumbo loans can provide a path to homeownership with a down payment as low as 10-15% of the purchase price. The tradeoff with these programs is that you’ll typically need strong credit, a low debt-to-income (DTI) ratio and significant financial resources to qualify, but they can be a great option if you meet the criteria.

Tap into your retirement accounts

Your retirement savings can also be a source of funds for a second home down payment. While it’s generally not advisable to raid your retirement accounts, there are a few options to consider if you want to buy a second home without paying out of pocket for your down payment:

- 401(k) loan: If your employer allows it, you may be able to borrow against your 401(k) balance to use toward a down payment on a second home. However, you’ll need to pay back the loan, plus interest, over time.

- IRA withdrawal: First-time home buyers are allowed to withdraw up to $10,000 from a traditional IRA or Roth IRA for a home purchase without paying the standard early withdrawal penalty.

The main downside of these approaches is that they reduce your long-term retirement savings. But if buying a second home is a high priority, they could be worth exploring.

Consider a rent-to-own arrangement

For some prospective second-home buyers, a rent-to-own or lease-to-own agreement can provide a path to homeownership with little or no down payment. With these arrangements, you essentially rent the property for a set period, with a portion of the rent payments going toward the eventual purchase price.

At the end of the rental period, you have the option to buy the home using the accumulated “rent credits” as your down payment. This allows you to get your foot in the door without needing a large lump sum upfront. However, the overall purchase price is often higher under a rent-to-own deal, so you’ll want to carefully evaluate the long-term costs of entering this type of agreement.

Leverage seller financing

Another creative option is to negotiate with the seller of the second home to provide some or all of the financing themselves. This is known as seller financing or owner financing. The seller essentially acts as the lender, allowing you to purchase the home with a lower down payment.

The terms of the loan and down payment requirements will vary based on the seller’s willingness to participate, but if you find the right home and the right seller, you may be able to negotiate a no- or low-down-payment purchase of your second home. While these types of opportunities are rare, this can be a good solution to consider if traditional lenders aren’t an option or if you need more flexibility than a typical mortgage provides.

The bottom line

Buying a second home can be an exciting financial move, but the down payment requirement can be a major hurdle. Luckily, there are ways you can purchase that vacation home or investment property with little to no money down in some cases. You can start by exploring creative financing options like home equity loans, HELOCs, specialty mortgage programs, rent-to-own deals and seller financing, which may be a good alternative. Just be sure to carefully weigh the tradeoffs and risks of each approach to find the right fit for your financial situation.

CBS News

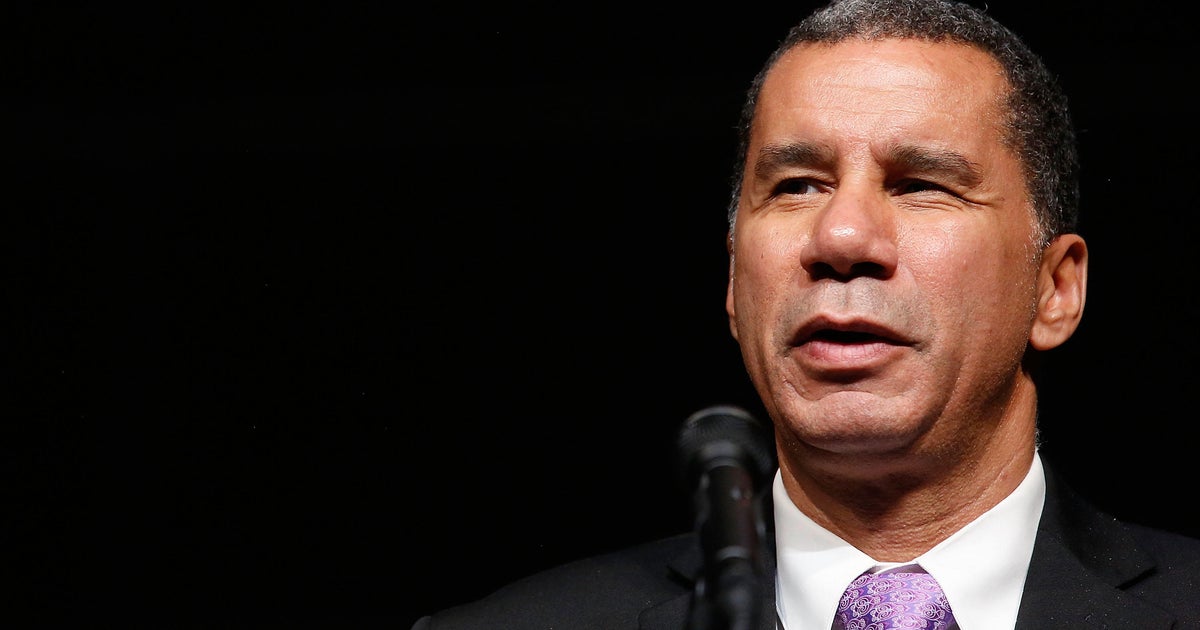

Former New York Gov. David Paterson, stepson attacked while walking in New York City

NEW YORK — Former New York Gov. David Paterson and his stepson were attacked in New York City on Friday night, authorities said.

The incident occurred just before 9 p.m. on Second Avenue near East 96th Street on the Upper East Side, according to the New York City Police Department.

Police said officers were sent to the scene after an assault was reported. When officers arrived, police say they found a 20-year-old man suffering from facial injuries and a 70-year-old man who had head pain. Both victims were taken to a local hospital in stable condition.

In a statement, a spokesperson for the former governor said the two were attacked while “taking a walk around the block near their home by some individuals that had a previous interaction with his stepson.”

The spokesperson said that they were injured “but were able to fight off their attackers.”

Both were taken to Cornell Hospital “as a precaution,” he added.

Police said no arrests have been made and the investigation is ongoing.

The 70-year-old Paterson, a Democrat, served as governor from 2008 to 2010, stepping into the post after the resignation of Eliot Spitzer following his prostitution scandal. He made history at the time as the state’s first-ever Black and legally blind governor.

CBS News

10/4: CBS Evening News – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Teen critically wounded in shooting on Philadelphia bus; one person in custody

A 17-year-old boy was critically injured and a person is in custody after a gunman opened fire on a SEPTA bus in North Philadelphia Friday evening, police said.

At around 6:15 p.m., Philadelphia police were notified about a shooting on a SEPTA bus traveling on Allegheny Avenue near 3rd and 4th streets in North Philadelphia, Inspector D F Pace told CBS News Philadelphia.

There were an estimated 30 people on the bus at the time of the shooting, Pace said, but only the 17-year-old boy was believed to have been shot. Investigators said they believe it was a targeted attack on the teenager and that he was shot in the back of the bus at close range.

According to Pace, the SEPTA bus driver alerted a control center about the shooting, which then relayed the message to Philadelphia police, who responded to the scene shortly.

Officers arrived at the scene and found at least one spent shell casing and blood on the bus, but no shooting victim, Pace said. Investigators later discovered the 17-year-old had been taken to Temple University Hospital where he is said to be in critical condition, according to police.

CBS Philadelphia

Through their preliminary investigation, police learned those involved in the SEPTA shooting may have fled in a silver-colored Kia.

Authorities then found a car matching the description of the Kia speeding in the area and a pursuit began, Pace said. Police got help from a PPD helicopter as they followed the Kia, which ended up crashing at 5th and Greenwood streets in East Mount Airy. Pace said the Kia crashed into a parked car.

The driver of the crashed car ran away but police were still able to take them into custody, Pace said.

Investigators believe there was a second person involved in the shooting who ran from the car before it crashed. Police said they believe this person escaped near Allegheny Avenue and 4th Street, leaving a coat behind.

According to Pace, police also found a gun and a group of spent shell casings believed to be involved in the shooting in the same area.

“It’s very possible that there may have been a shooting inside the bus and also shots fired from outside of the bus toward the bus,” Pace said, “We’re still trying to piece all that together at this time.”

This is an active investigation and police are reviewing surveillance footage from the SEPTA bus.