CBS News

When should you sell your gold investment?

Getty Images/iStockphoto

Amidst a backdrop of high inflation and the subsequent high interest rates meant to temper it, many investors decided to buy gold. That uptick in demand for gold investment helped contribute to a run-up in the metal’s price, with gold reaching a record high of over $2,350 per ounce as of April 10.

With this recent high, many of those who decided to invest in gold and have experienced gains may now be wondering whether they should sell their gold investment or wait for a future event that could prompt them to sell. So what’s the right time to sell your gold investment? Here’s what you should know.

Find out what your top gold investing options are now.

When should you sell your gold investment?

While the answer to this question depends on your situation, such as your desire for portfolio diversification and your outlook on various asset classes, some scenarios where you might decide to sell your gold investment include:

When inflation cools

Gold is considered an inflation hedge, and if you think inflation has already tempered or will be soon, that might prompt you to sell your gold investment. This could be especially true if you increased your gold allocation relative to other assets due to recent conditions.

“Gold has been in demand as an investment in times of high inflation and political instability,” says David Kass, clinical professor of finance at the University of Maryland.

With gold hitting new price peaks and “with inflation being reduced close to target levels of about 2% in both the United States and abroad, it would appear that now would be a good time for investors to reduce their stakes in this precious metal and return to their normal asset allocation,” he adds.

Explore how gold could add value to your investment portfolio today.

When economic conditions are less uncertain

Related to inflation normalizing, you might decide to sell your gold investment if you think that economic conditions will be more stable or positive going forward.

“Any major reduction in latent uncertainty is likely to be followed by a decline in the demand for, and thus prices for, gold,” says Peter C. Earle, senior economist at the American Institute for Economic Research.

“If an emergency subsides, or if questionable prospects for economic growth suddenly resolve into positive circumstances — for example, if an uncertain inflationary picture of the future shifts to suggest stable prices in the near term — the price of gold may fall suddenly,” he adds.

When gold’s value is too far out of sync with other precious metals

While gold’s value doesn’t exactly track that of other precious metals, like silver, there’s often a correlation between them. And if things get too out of sync, that might prompt you to consider selling gold.

Currently, the gold/silver ratio, which is based on the price of gold divided by the price of silver, is around 88, “where historically it has averaged in the mid-to-high 60s, indicating a possible overvaluation of gold relative to silver,” explains Rohan Reddy, director of research at Global X ETFs.

However, it’s important to remember that a high ratio doesn’t automatically mean gold is or isn’t overvalued, as there can be other drivers. Yet low prices for other precious metals could be a sign of economic trouble.

“The sources of demand for other precious metals like silver, platinum, and palladium are greatly influenced by other industrial applications, and their relative price performance may signal other factors in the global economy,” says Reddy.

When gold prices don’t track fundamentals

Investment prices can be based on fundamental factors, i.e., those that indicate a fair value for an asset, or they could be based on technical factors, like a market rally that indicates rising prices.

For gold, fundamentals could include factors like bond yields. In many cases, high bond yields temper gold prices, as investors may want to earn predictable returns that way rather than speculating on the price of gold.

So, when gold gets too separated from fundamentals, that could be a reason for selling your gold investment.

“Gold performed surprisingly well in 2023, despite prevailing market conditions that have historically been unfavorable for the asset class. Despite slowing inflation and increasingly competitive real yields, gold saw its value persevere despite historic correlations that indicate it should have fared otherwise,” says Reddy.

“We’ve seen much of the recent rally being driven by technical factors, predominately by global central banks buying to diversify reserves. In theory, this buying has its limits, which may implore investors to consider selling while gold prices remain bid up,” he adds.

The bottom line

These different scenarios could prompt some investors to sell some or all of their gold investments, but these aren’t strict rules to follow. Much of this decision depends on your circumstances, such as your investment goals, time horizon and risk tolerance, along with your outlook on gold value compared to other assets. And just because gold has reached a record high that doesn’t mean that it can’t continue to increase in value.

CBS News

Former Israeli hostages released in truce 1 year ago call for action to release those still held

Former Israeli hostages who were freed from Hamas captivity during a week-long humanitarian pause in fighting exactly one year ago Sunday called for immediate action to secure a deal for the release of those still held.

The only truce in the ongoing Israel-Hamas war on Nov. 24, 2023 – fewer than two months after fighting began – led to the release of 80 Israelis held by militants in Gaza. They were freed in exchange for 240 Palestinians detained in Israeli jails.

Repeated efforts since then by mediators from Qatar, Egypt and the United States to secure another truce and hostage release have failed. Qatar early this month said it was suspending its mediation role until the warring sides show “seriousness.”

Mostafa Alkharouf/Anadolu via Getty Images

Gabriella Leimberg was kidnapped during the Oct. 7, 2023, Hamas attack and was released along with her daughter, Mia, and sister Clara.

“For 53 days, the one thing that kept me going is that we, the people of Israel, the Jewish people, sanctify life — we don’t leave anyone behind,” she said.

Leimberg added: “Everything has already been said and now action is required. We don’t have any more time.”

Around 100 hostages are still in Gaza, and at least a third are believed to be dead.

“I survived and I was fortunate to get my entire family back,” Leimberg said. “I want and demand this for all the families of the hostages.”

Hamas wants Israel to end the war and withdraw all troops from Gaza. Israel has offered only to pause its offensive.

The Palestinian death toll from the war surpassed 44,000 this week, according to Gaza’s Health Ministry, which does not distinguish between civilians and combatants in its count.

Maya Alleruzzo / AP

Danielle Aloni, who was kidnapped with her five-year-old daughter, Emelia, and freed after 49 days, spoke at the ceremony of the “increasing danger” those still being held face every day.

She said those still in captivity “suffer physical, sexual, and psychological abuse, their identity and dignity crushed anew each day”.

“It took the Israeli government about two months to secure a deal for me and 80 other Israeli hostages. Why is it taking over a year to reach another deal to free them from this hell?” asked Aloni, whose brother-in-law, David Cunio, and his brother, Ariel Cunio, are still being held.

She emphasized that, even though she and the other hostages gained their freedom a year ago, “we haven’t really left the tunnels,” — referring to Hamas’ underground tunnels where many of the hostages were held.

“The feeling of suffocation, the terrible humidity, the stench — these sensations still envelop us,” Aloni said.

“If people could truly understand what it means to be held in subhuman conditions in tunnels, surrounded by terrorists for 54 days — there’s no way they would allow hostages to remain there for 415 days!” said Raz Ben Ami, who was released in the deal a year ago.

Her husband, Ohad, is still among those being held.

Ben Ami called for a ceasefire to “bring back all the hostages as quickly as possible”.

CBS News

Couple charged for allegedly stealing $1 million from Lululemon in convoluted retail theft scheme

A couple from Connecticut faces charges for allegedly taking part in an intricate retail theft operation targeting the apparel company Lululemon that may have amounted to $1 million worth of stolen items, according to a criminal complaint.

The couple, Jadion Anthony Richards, 44, and Akwele Nickeisha Lawes-Richards, 45, were arrested Nov. 14 in Woodbury, Minnesota, a suburb of Minneapolis-St. Paul. Richards and Lawes-Richards have been charged with one count each of organized retail theft, which is a felony, the Ramsey County Attorney’s Office said. They are from Danbury, Connecticut.

The alleged operation impacted Lululemon stores in multiple states, including Minnesota.

“Because of the outstanding work of the Roseville Police investigators — including their new Retail Crime Unit — as well as other law enforcement agencies, these individuals accused of this massive retail theft operation have been caught,” a spokesperson for the attorney’s office said in a statement on Nov. 18. “We will do everything in our power to hold these defendants accountable and continue to work with our law enforcement partners and retail merchants to put a stop to retail theft in our community.”

Both Richards and Lawes-Richards have posted bond as of Sunday and agreed to the terms of a court-ordered conditional release, according to the county attorney. For Richards, the court had set bail at $100,000 with conditional release, including weekly check-ins, or $600,000 with unconditional release. For Lawes-Richards, bail was set at $30,000 with conditional release and weekly check-ins or $200,000 with unconditional release. They are scheduled to appear again in court Dec. 16.

Prosecutors had asked for $1 million bond to be placed on each half of the couple, the attorney’s office said.

Richards and Lawes-Richards are accused by authorities of orchestrating a convoluted retail theft scheme that dates back to at least September. Their joint arrests came one day after the couple allegedly set off store alarms while trying to leave a Lululemon in Roseville, Minnesota, and an organized retail crime investigator, identified in charging documents by the initials R.P., recognized them.

The couple were allowed to leave the Roseville store. But the investigator later told an officer who responded to the incident that Richards and Lawes-Richards were seasoned shoplifters, who apparently stole close to $5,000 worth of Lululemon items just that day and were potentially “responsible for hundreds of thousands of dollars in loss to the store across the country,” according to the complaint. That number was eventually estimated by an investigator for the brand to be even higher, with the criminal complaint placing it at as much as $1 million.

Richards and Lawes-Richards allegedly involved other individuals in their shoplifting pursuits, but none were identified by name in the complaint. Authorities said they were able to successfully pull off the thefts by distracting store employees and later committing fraudulent returns with the stolen items at different Lululemon stores.

“Between October 29, 2024 and October 30, 2024, RP documented eight theft incidents in Colorado involving Richards and Lawes-Richards and an unidentified woman,” authorities wrote in the complaint, describing an example of how the operation would allegedly unfold.

“The group worked together using specific organized retail crime tactics such as blocking and distraction of associates to commit large thefts,” the complaint said. “They selected coats and jackets and held them up as if they were looking at them in a manner that blocked the view of staff and other guests while they selected and concealed items. They removed security sensors using a tool of some sort at multiple stores.”

CBS News contacted Lululemon for comment but did not receive an immediate reply.

CBS News

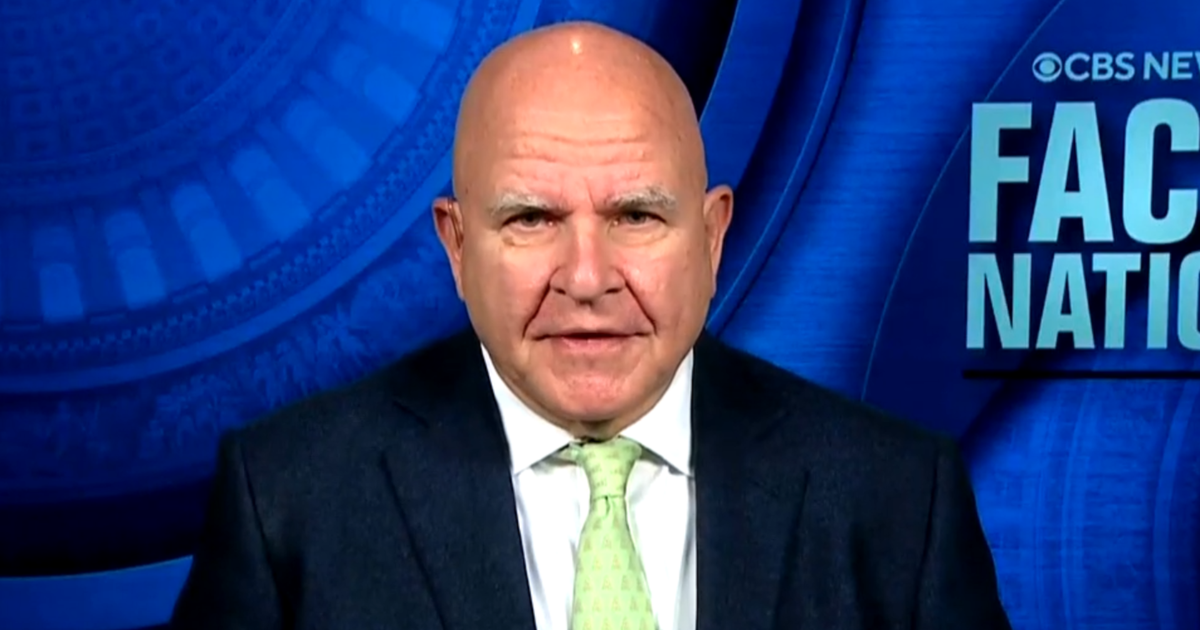

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”