CBS News

White-coated candy recalled nationwide over salmonella risk

A range of white confectionary products sold nationwide is being recalled because the treats could be contaminated with salmonella, a potentially dangerous bacteria, an Iowa company said Monday.

The recalled items were sold in retailers including Dollar General, HyVee, Target and Walmart, Sioux City-based Palmer Candy stated in a recall notice.

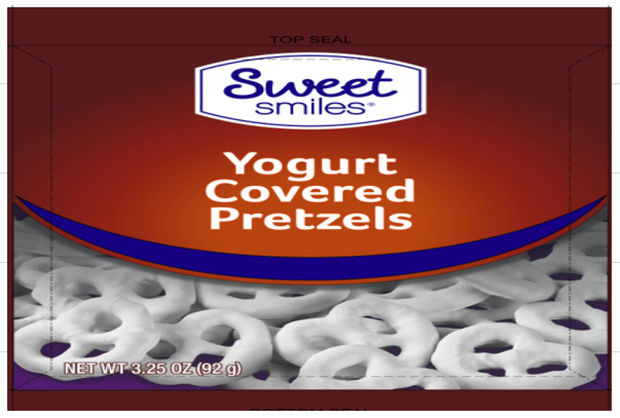

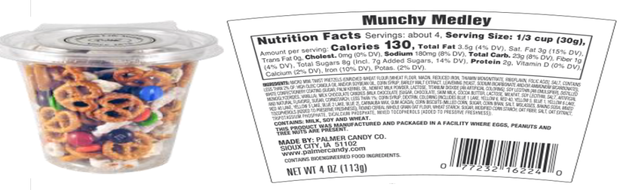

U.S. Food and Drug Administration

The company was notified by its liquid coating supplier that there was potential for contamination from an ingredient potentially tainted with salmonella by one of the supplier’s suppliers, Palmer Candy said.

Salmonella can cause serious and sometimes fatal infections in the young, frail or elderly as well as in those with weakened immune systems, according to the notice posted by the Food and Drug Administration. It can also cause symptoms including abdominal pain, nausea, fever and vomiting in the otherwise healthy.

Food and Drug Administration

The recalled products comes in a variety of retail packaging, including bags, pouches and tubs.

Food and Drug Administration

People who bought any of the recalled products should return them to the place of purchase for a refund. Consumers with with questions can call (800) 831-0828 Monday through Friday from 8 a.m. to 5 p.m.

The recall includes the following products and best-by dates:

- Caramel Swirl Pretzels 4-ounce 12/28/2024

- Caramel Swirl Pretzels 6 -ounce 12/19/2024 and 01/19/2025

- Classic Yogurt Pretzels 28# 12/11/2024 – 01/08/2025

- Cookies & Cream Yummy Chow 14# 12/06/2024 – 01/08/2025

- Enrobed Pretzels Rods 8-ounce 01/22/2025

- Favorite Day Bakery White Funde Mini Cookies 7-ounce 04/04/2025, 04/05/2025 and 04/18/2025

- Frosted Munchy Medley Bowl 15-ounce 01/03/2025

- Frosted Patriot Frosted Pretzels 28# 01/02/2025 and 01/03/2025

- Frosted Pretzels 6-ounce 01/23/2025

- Munchy Medley 15# 12/14/2024 and 01/03/2025

- Munchy Medley 4-ounce 12/27/2024, 12/28/2024 and 01/19/2025

- Munchy Medley 6-ounce 12/20/2024

- Munchy Medley To Go 4-ounce 12/25/2024 and 01/19/2025

- Patriotic Munchy Medley Bowl 15-ounce 01/19/2025

- Patriotic Pretzels 14-ounce 01/25/2025 and 01/26/2025

- Patriotic Pretzels 6-ounce 01/19/2025

- Patriotic Red, White & Blue Pretzel Twists 14-ounce 12/13/2024 and 01/15/2025

- Patriotic Snack Mix 13-ounce 01/19/2025 and 02/01/2025

- Patriotic White Fudge Cookies 7-ounce 04/23/2025

- Peanut Butter Snack Mix 12-ounce 11/13/2024 and 12/15/2024

- Peanut Butter Snack Mix To Go 4.5-ounce 01/18/2025

- Snackin’ With The Crew! Mizzou Munchy Medley 7-ounce 12/18/2024 and 12/19/2024

- Snackin’ With The Crew! Tiger Treats 7-ounce 12/18/2024 and 12/19/2024

- Star Snacks Chow Down 25# 12/06/2024 and 12/07/2024

- Strawberry Yogurt Coated Pretzels 10-ounce 01/05/2025 and 01/23/2025

- Sweet Smiles Yogurt Covered Pretzels 3.25-ounce 12/18/2024 – 01/04/2025

- Vanilla Yogurt Covered Pretzels 10-ounce 01/05/2024 and 01/22/2025

- Yogurt Pretzel 14# 12/14/2024 – 12/21/2024

- Zebra Fudge Cookies 7-ounce 03/13/2025, 04/01/2025 – 04/02/2025

CBS News

Georgia appeals removes Fani Willis from Trump 2020 election case

Washington — The Georgia Court of Appeals on Thursday ruled that Fulton County District Attorney Fani Willis must be removed from the 2020 election case against President-elect Donald Trump, reversing a trial judge’s decision that allowed her to remain on the case.

Trump and more than a dozen allies were charged last year by Fulton County prosecutors related to what they said was an alleged scheme to overturn the results of the 2020 election in Georgia. The president-elect pleaded not guilty.

“After carefully considering the trial court’s findings in its order, we conclude that it erred by failing to disqualify DA Willis and her office,” the Georgia Court of Appeals said in its decision.

This is a breaking news story and will be updated.

CBS News

Page Not Found: 404 Not Found

The page cannot be found

The page may have been removed, had its name changed, or is just temporarily unavailable.

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Will credit card rates climb in 2025? Experts weigh in

Mark Evans/Getty Images

Credit card debt has been surging nationwide — and with rates where they are, it’s no wonder why. According to the Federal Reserve, the average credit card rate sits at over 23% right now — up from just 14% just a couple of years ago and the highest rate on record.

Today’s sky-high credit card rates have made it incredibly hard for consumers to get out of debt. In fact, delinquencies on credit cards have more than doubled on credit cards since 2021 alone.

But credit card rates are variable, so they — and your monthly payment — can change fast. Will rates on credit cards climb in the new year, though?

Find out how to get rid of your existing credit card debt here.

Will credit card rates climb in 2025? Experts weigh in

Want to know where your rates may be headed in the next year? Here’s what experts had to say.

Credit card rates may remain the same

The Federal Reserve reduced its federal funds rate at its last three meetings — a move that typically results in interest rate dips on variable-rate products like credit cards and HELOCs.

But future rate cuts aren’t certain — especially with recent reports showing inflation ticking back up.

“As the Federal Reserve digests the recent election results and economic reports on inflation, housing, and employment, it appears they may be in a rate pause for 2025,” says Jason Fannon, senior partner at Cornerstone Financial Services. “This neutral stance would keep the average credit card interest rate near 21% annually.”

Compare your credit card debt relief options online now.

…or fall slightly

If the Fed does opt to cut rates, credit card rates could fall too — but likely not significantly.

“I don’t expect any significant change to credit card interest rates,” Fannon says. “If the Fed does cut or raise the Fed Funds rate, it would have to be a sizable move in either direction to change the average credit card interest rate.”

Could credit card rates fall below the 20% mark if the Fed reduces its rate? It’s doubtful, pros say.

“It’s hard to predict beyond 12 months from now but if consumers want to see below-20% rates, then we need a variety of things to align,” says Eric Elkins, founder and CEO of Double E Financial Solutions. “We need inflation to remain below 3% for at least 15 months, we need to see average wage increases above 3%, we probably would need government regulations passed to limit the APR on the credit card institutions, and we’d need the Fed to continue reducing interest rates for borrowers. Lots of things need to occur.”

Other factors that impact your credit card rates

It’s not just the Fed and other economic conditions that weigh on credit card rates. Your credit score can impact what rate you get, too. So, if your score is on the lower end, improving it could help you snag a lower rate on a new card, which you could then transfer your existing credit card balance to.

“Having a good to excellent credit score could make you attractive to other companies,” says Troy Young, founder and president of Destiny Financial Group. “With a high score, you may be able to sell your debt to another company for a lower rate — in other words, refinance it by doing a balance transfer.”

The bottom line

If credit card debt is weighing you down, consider your debt relief options. There are debt consolidation, debt settlement, debt forgiveness and many other strategies that can help you tackle that debt more efficiently. Here are the best debt relief companies to consider if you need professional debt relief guidance.