CBS News

The best gold bar sizes and weights to invest in, according to experts

Getty Images/iStockphoto

Although the pace of inflation has started to slow down, prices continue to rise, and interest rates remain high. Meanwhile, there’s continued economic uncertainty caused by issues such as geopolitical strife and upcoming elections. Against this backdrop, gold prices have reached record highs recently.

However, not all gold investments are the same. Not only do people have different motivations for investing in gold, such as portfolio diversification or trying to hedge against inflation, but investors also choose different ways to invest in gold. Some prefer gold stocks or gold ETFs for liquidity purposes, for instance, while others prefer to buy physical gold for more control.

Yet the choices for investing in gold don’t end there. If you decide to buy gold bullion, such as physical gold bars, there are different sizes and weights to consider, and that can affect areas like liquidity and price — so it’s important to understand which options may make the most sense for your portfolio.

Ready to invest in gold? Compare your best options here.

The best gold bar sizes and weights to invest in, according to experts

If you’re trying to decide the best weight and size of gold bullion to invest in, here are some scenarios to consider.

The case for gold bars smaller than one ounce

Some investors prefer small gold bars, particularly those weighing less than one ounce. Note that in the gold investing world, an ounce typically means a troy ounce, which at just over 31 grams is slightly more than a standard ounce that’s a little over 28 grams.

“The industry makes it somewhat confusing because typically smaller bars are weighed in grams and larger bars are weighed in troy ounces,” says Brandon Aversano, CEO and founder of Alloy.

Smaller gold bars can come in a variety of sizes, such as 1-gram, 5-gram and 10-gram, he adds.

You can also find 50-gram bars, for instance, though that might tip more into medium-sized bars, depending on your perspective.

In general, smaller gold bars, like those weighing less than an ounce, can make sense for those looking for an easier way to invest in gold.

“Small gold bars are easily transportable and highly liquid, which makes them great for buying and selling quickly. They also require less storage and are more readily available for purchase,” says Aversano.

However, this portability can come at a cost.

“It’s worth noting that bars smaller than one ounce often come with higher premiums, necessitating a balance between enhanced liquidity and flexibility with the higher cost,” says Andy Schectman, CEO at Miles Franklin.

Plus, smaller gold bars, because of their popularity, are more susceptible to counterfeiting, says Aversano.

Learn more about the benefits of gold investing here.

The case for 1-ounce gold bars

If you want a slightly larger gold bar, though still one that’s relatively small in the grand scheme of things, then you might opt for a 1-ounce gold bar.

“One-ounce gold bars boast very strong retail demand and liquidity, making them highly tradable assets. Their affordability also enables gradual accumulation, appealing to a much larger and more diverse investor base,” says Schectman.

These gold bars can also sit in a sweet spot in terms of pricing. While you do need to afford the overall price of an ounce of gold — the spot price is nearly $2,500 — you might pay lower premiums in comparison to smaller gold bars and gold coins that might just weigh a few grams. Premiums might still be higher than they are for larger gold bars, but that could be worth it.

“While investing in gold bars larger than one ounce may offer marginal savings, these savings are arguably not commensurate with the reduced demand and flexibility inherent in 10-ounce and kilo gold bars,” adds Schectman.

The case for gold bars larger than one ounce

As you move past 1-ounce gold bars, there can be a wide range of larger gold bars — some of which can still be easily transportable, while others are physically difficult to handle.

“Investors consider various sizes and weights of gold bars depending on their storage and investment capacity. Due to their large holdings, central banks tend to favor larger bars such as the Good Delivery bars, typically weighing 400 troy ounces,” says Bas Kooijman, CEO and assets manager at DHF Capital S.A.

“Other large investors and institutions also use smaller bars such as the one-kilogram bars. For individual investors seeking a balance between affordability and ease of storage, 100-gram bars are popular,” adds Koojiman.

Note, however, that these are still much larger than one ounce and thus cost several thousand if not tens of thousands of dollars to buy.

“Large gold bars are a solid long-term investment and are often purchased as a hedge against challenging macroeconomic conditions or geopolitical instability,” says Aversano. “While there is a higher cost to purchase overall, the premium on the cost is smaller because of the total amount of gold being purchased.”

Still, there are some possible drawbacks to consider.

“Due to the high value of each bar, larger gold bars are often held in depositories which carry a monthly fee. They are also more challenging to liquidate quickly,” he adds.

The bottom line

There are pros and cons to different gold bar sizes and weights. If you want more liquidity and lower overall cost, you might prefer a smaller gold bar. If you want to pay a lower per-ounce price and can afford more of an upfront investment, you might prefer larger gold bars. However, larger gold bars, such as those weighing several ounces or more, might prompt the usage of a depository, which can add fees but perhaps improve security.

CBS News

Couple charged for allegedly stealing $1 million from Lululemon in convoluted retail theft scheme

A couple from Connecticut faces charges for allegedly taking part in an intricate retail theft operation targeting the apparel company Lululemon that may have amounted to $1 million worth of stolen items, according to a criminal complaint.

The couple, Jadion Anthony Richards, 44, and Akwele Nickeisha Lawes-Richards, 45, were arrested Nov. 14 in Woodbury, Minnesota, a suburb of Minneapolis-St. Paul. Richards and Lawes-Richards have been charged with one count each of organized retail theft, which is a felony, the Ramsey County Attorney’s Office said. They are from Danbury, Connecticut.

The alleged operation impacted Lululemon stores in multiple states, including Minnesota.

“Because of the outstanding work of the Roseville Police investigators — including their new Retail Crime Unit — as well as other law enforcement agencies, these individuals accused of this massive retail theft operation have been caught,” a spokesperson for the attorney’s office said in a statement on Nov. 18. “We will do everything in our power to hold these defendants accountable and continue to work with our law enforcement partners and retail merchants to put a stop to retail theft in our community.”

Both Richards and Lawes-Richards have posted bond as of Sunday and agreed to the terms of a court-ordered conditional release, according to the county attorney. For Richards, the court had set bail at $100,000 with conditional release, including weekly check-ins, or $600,000 with unconditional release. For Lawes-Richards, bail was set at $30,000 with conditional release and weekly check-ins or $200,000 with unconditional release. They are scheduled to appear again in court Dec. 16.

Prosecutors had asked for $1 million bond to be placed on each half of the couple, the attorney’s office said.

Richards and Lawes-Richards are accused by authorities of orchestrating a convoluted retail theft scheme that dates back to at least September. Their joint arrests came one day after the couple allegedly set off store alarms while trying to leave a Lululemon in Roseville, Minnesota, and an organized retail crime investigator, identified in charging documents by the initials R.P., recognized them.

The couple were allowed to leave the Roseville store. But the investigator later told an officer who responded to the incident that Richards and Lawes-Richards were seasoned shoplifters, who apparently stole close to $5,000 worth of Lululemon items just that day and were potentially “responsible for hundreds of thousands of dollars in loss to the store across the country,” according to the complaint. That number was eventually estimated by an investigator for the brand to be even higher, with the criminal complaint placing it at as much as $1 million.

Richards and Lawes-Richards allegedly involved other individuals in their shoplifting pursuits, but none were identified by name in the complaint. Authorities said they were able to successfully pull off the thefts by distracting store employees and later committing fraudulent returns with the stolen items at different Lululemon stores.

“Between October 29, 2024 and October 30, 2024, RP documented eight theft incidents in Colorado involving Richards and Lawes-Richards and an unidentified woman,” authorities wrote in the complaint, describing an example of how the operation would allegedly unfold.

“The group worked together using specific organized retail crime tactics such as blocking and distraction of associates to commit large thefts,” the complaint said. “They selected coats and jackets and held them up as if they were looking at them in a manner that blocked the view of staff and other guests while they selected and concealed items. They removed security sensors using a tool of some sort at multiple stores.”

CBS News contacted Lululemon for comment but did not receive an immediate reply.

CBS News

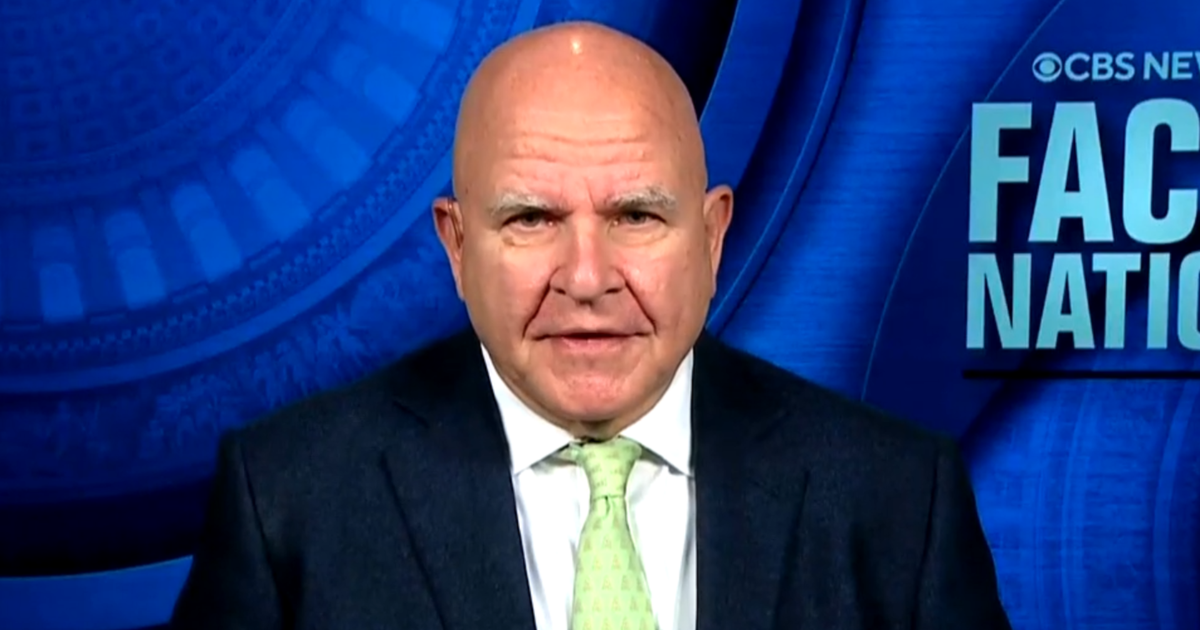

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.