CBS News

These 4 costs are negotiable when buying a home, experts say

Getty Images

Elevated mortgage rates continue to drag on the housing market well into 2024. There’s a shortage of homes for sale, with many homeowners opting to stay put and keep the historically low interest rates they secured in 2020 and 2021, when rates averaged 3.20% and 3.06%, respectively. The housing shortage, combined with elevated mortgage rates and high home prices, has many homebuyers looking for ways to save money on their home purchase.

Securing a lower mortgage, however, may be more difficult in this high-rate environment. For one, many lenders are tightening their lending practices due to the uncertainty of the economy. And with buyers already facing high costs to purchase a home, the option of buying points to lower the mortgage rate isn’t an option for many. However, there are other ways to save when you’re buying a home, experts say.

Compare today’s top rates to see how you can save on a mortgage loan.

These 4 costs are negotiable when buying a home, experts say

There are a number of costs buyers may negotiate during the home-buying process, including the following:

Negotiate the purchase price

Buying a home may be the most expensive purchase you make in your lifetime. Fortunately, the most significant negotiable cost when buying a home is the home itself. But, before haggling with the seller, it’s wise to get a thorough understanding of the market conditions in your local market as well as the seller’s circumstances.

“It’s important to be as aggressive as possible when first trying to put the home under contract,” says Atlanta Realtor Michael Ellman. “Negotiations are all dependent on the sellers’ circumstances. A good agent tries to get details on the seller’s motivation and will use those details, along with the number of days on the market and listing history, to determine an entry offer price. If a home has only been on the market for three days, sometimes the key is just to get the home under contract as quickly as possible and then renegotiate during due diligence.”

Find out how affordable the right mortgage loan can be here.

Mortgage rate and loan fees

The average mortgage rate on a 30-year fixed-rate mortgage loan is currently 7.17% (as of May 31, 2024). However, that doesn’t mean you can’t do better. Remember, lenders want your business and will compete for it. That’s why it’s always a good idea to get rate quotes from multiple lenders to find the best mortgage rate.

Jennifer Sisson, a Utah-based writer and editor, recently secured a lower mortgage loan rate offer by working with three different lenders.

“Just when I thought I’d gotten the best deal, the other guy came in with the same cash to close and a .5% better rate,” says Sisson.

Lisa Gaffikin, a home loan specialist at Churchill Mortgage, says the most popular negotiable item she’s seeing is a seller concession for mortgage points.

“The buyer may ask the seller to pay points to reduce the mortgage interest rate for the entire term of the loan, or in some cases, for the first, second and/or third year,” Gaffikin says. “This negotiation is very successful if all parties understand the benefits and if the principals to the transaction come to a sales price that saves the buyer money and at the same time helps the seller meet their net dollar expectation.”

Home repairs

Including a home inspection contingency in the sales contract allows you to back out of a home purchase if pricey home repairs are discovered during the inspection. If you still want the home, though, you can ask the seller to make the necessary fixes or reduce the home price to offset the repair costs.

“I commonly have sellers kick in for roof, HVAC, plumbing and electrical repairs,” says Joel Carson, president and principal broker at Utah Real Estate. “The way we typically handle that is to show a reduction in the price of the home. It’s built into the loan. The buyer receives the money rather than having the seller make the repairs or upgrades.”

Work with your agent to exercise discretion when negotiating the costs for home repairs.

“I feel the most common repairs that buyers are successful in negotiating with sellers fall into the category of safety issues,” says Gaffikin.

Sellers are often turned off by buyers who negotiate for visible or dated items after the offer is negotiated, Gaffikin says, a practice known as “nickel and diming.”

Don’t forget closing costs

Closing costs, such as appraisal and loan origination fees, can add another 2% to 7% of the home’s purchase price on top of the loan amount. In other words, if you purchase a $350,000 home, expect to pay another $7,000 to $24,000 in closing costs.

Thankfully, closing costs may also be negotiable, as many motivated sellers are willing to cover a portion of the costs to make the home more affordable. Sellers can contribute up to 6% of the purchase price towards the buyer’s closing costs with most loans. In competitive markets, this practice may be less common. Still, it’s worth exploring because paying some closing costs is one way a seller can push a deal across the finish line, and receive a tax credit in the process

CBS News

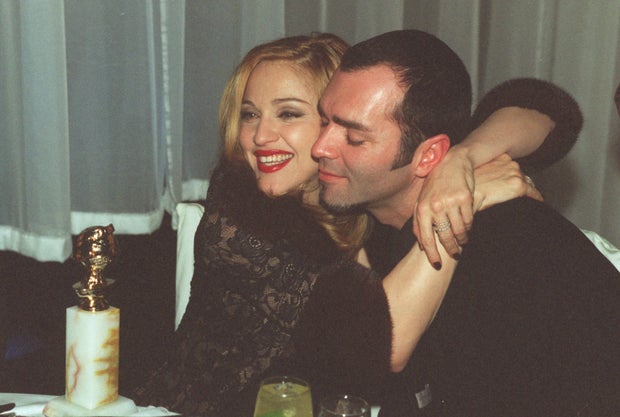

Christopher Ciccone, artist and Madonna’s younger brother, dies at 63

Christopher Ciccone, an artist and former dancer who was also singer Madonna’s younger brother, has died, his rep Brad Taylor confirmed to CBS News. He was 63.

He died from cancer on Oct. 4, surrounded by his husband, Ray Thacker, Taylor said in a statement.

Born on Nov. 22, 1960, in Pontiac, Michigan, Ciccone was an artist, interior decorator and designer, who began his career as a dancer. He joined the Le Group de La Palace Royale in Ottawa in 1980 before moving to New York two years later to support his older sister’s music career as a backup dancer.

Gary Friedman/Los Angeles Times via Getty Images

As Madonna’s career grew, Ciccone became more involved — serving as the art director on his sister’s Blond Ambition World Tour in 1990 and as the tour director for her The Girlie Show in 1993. He also directed music videos for megastars Dolly Parton and Tony Bennett in the 1990s.

His role expanded away from music when Ciccone took on the role of interior designer within the homes his sister owned and occupied in New York, Miami, and Los Angeles.

In 2012, Ciccone released his own shoe line, The Ciccone Collection, at London Fashion Week.

He told CBS News at the time that his goal is to make the brand “accessible to everybody” and not too pricey.

“The great thing about doing shoes is that potentially everyone could have a pair. When you’re doing art, there’s only one,” Ciccone said

Ciccone, who was openly gay, claimed that his sister outed him during her 1991 interview with The Advocate.

Mike Coppola/Getty Images for OUT Magazine

Ciccone released a tell-all autobiography called “Life With My Sister Madonna,” leading to reports that the two had been estranged, but Ciccone told CBS News in 2012 that he was glad he wrote the book.

“I don’t regret any of that,” he said. “I think because of that it sort of led me to this. It gave people an opportunity to think of me as a creative person, as an artist and not just as Madonna’s brother, which is a tag I’m going to wear forever,” Ciccone said in 2012. “But I’m hopeful that at some point it will be Christopher Ciccone first. It’s cool…I’m perfectly happy being what I am.”

The two eventually made up.

“Our relationship is fine as far as I’m concerned,” he told CBS News.

Ciccone and Thacker — a British-born actor — married in 2016.

Ciccone’s death comes fewer than two weeks after the death of his and Madonna’s stepmother, Joan Clare Ciccone, from cancer. His eldest brother Anthony died in 2023.

CBS News

One year after Oct. 7 attack, the toll on civilians remains high

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Open: This is “Face the Nation with Margaret Brennan,” Oct. 6, 2024

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.