CBS News

Is a $30,000 home equity loan or HELOC better right now?

Getty Images/iStockphoto

There are several reasons why you may need access to $30,000 right now. As inflation persists, the cost of living continues to increase. So, when unexpected expenses arise – like home repairs, medical bills and more – it may be difficult to find the money you need to cover them in your budget.

But, your home equity can help. In today’s high interest rate environment, home equity loans and home equity lines of credit (HELOCs) can open the door to borrowing power at single-digit interest rates. That’s a significant benefit when compared to other options like personal loans and credit cards that typically come with double-digit rates.

But, which home equity borrowing option is better right now? Should you take out a home equity loan or open a HELOC if you need to borrow $30,000 worth of your equity?

Find out how affordable borrowing against your home equity can be now.

Is a $30,000 home equity loan or HELOC better right now?

There are a few important factors to consider when you decide if a home equity loan or HELOC is better given your unique financial situation. The first of those is the monthly cost of the loan or credit line. Here’s what you can expect from each:

- 10-year home equity loan: Today’s 10-year home equity loans come with an average interest rate of 8.77%. Your payments on a $30,000 10-year loan at 8.77% would be $376.30 per month and you would pay $15,156.38 in interest over the life of the loan.

- 15-year home equity loan: Today’s 15-year home equity loans come with an average interest rate of 8.75%. At that rate, your payments on a $30,000 15-year home equity loan would be $299.83 and you would pay $23,970.23 in interest over the life of the loan.

- HELOC (with a 15-year repayment period): HELOCs have variable interest rates. That means your interest rate and payment on these lines of credit are subject to change from time to time. At the moment, HELOCs have an average interest rate of 9.16%. If that rate stayed the same through the life of your credit line, and your credit line had a 15-year repayment period, your monthly HELOC payments would be $307.14 through the repayment period on a $30,000 balance. You would pay $25,285.56 in interest over the life of the repayment period (in the unlikely chance that your interest rate and payments remain the same throughout the entire repayment period.)

It’s also important to note that home equity loans and HELOCs come with different features. Home equity loans offer your financing in one lump sum. HELOCs provide a credit line that you can use as needed through your draw period. And, home equity loans typically have fixed interest rates. So, which is better right now?

Compare leading home equity borrowing options today.

When a $30,000 home equity loan would be better

A $30,000 home equity loan may be your better option if you need predictable payments. Since HELOCs usually come with variable rates, their payments may rise or fall over time. But, home equity loan interest rates are fixed. So, you’ll know how much your payments will be each month regardless of the overall interest rate environment. That stability may be important considering the fact that the cost of living is on the rise.

Fixed rates are also beneficial if you believe overall interest rates will rise in the future. If you lock in today’s rates with a home equity loan, and interest rates head up in the future, your rate will remain the same.

When a $30,000 HELOC would be better

A HELOC could be better if you need more flexibility in your financing. After all, having a credit line with a single-digit interest rate to tap into when you need it can be beneficial in today’s inflationary environment.

“If you don’t know how much you need and won’t need the money all at once, a HELOC currently comes with a higher rate but it offers flexibility to draw it down over time,” explains Alex Blackwood, CEO and co-founder of the real estate investing platform, Mogul Club. “At this moment, HELOC interest rates are higher but give you the flexibility, an advantage if rates come down in the future.”

So, a HELOC makes sense if you believe interest rates will fall. If they do, your HELOC rate could follow, bringing your payments down.

Finally, if you need a lower payment in the near term, a HELOC can help. Because of the nature of the draw period, you’ll only usually be required to pay interest during this period – which could lead to low monthly payments for the first five to 10 years of your credit line (the term of your draw period).

Compare HELOCs among leading financial institutions now.

The bottom line

Home equity loans and HELOCs both make sense under different circumstances. If you need a fixed payment or believe that interest rates will rise ahead, a home equity loan could be your better option. If you need a lower payment early on and more flexible access to funding, a HELOC may be the better choice. That’s especially true if you believe that interest rates will drop in the future. Compare your home equity borrowing options now.

CBS News

Gold pocket watch given to captain who rescued Titanic survivors sells for record price

A gold pocket watch given to the ship captain who rescued 700 survivors from the Titanic sold at auction for nearly $2 million, setting a record for memorabilia from the ship wreck.

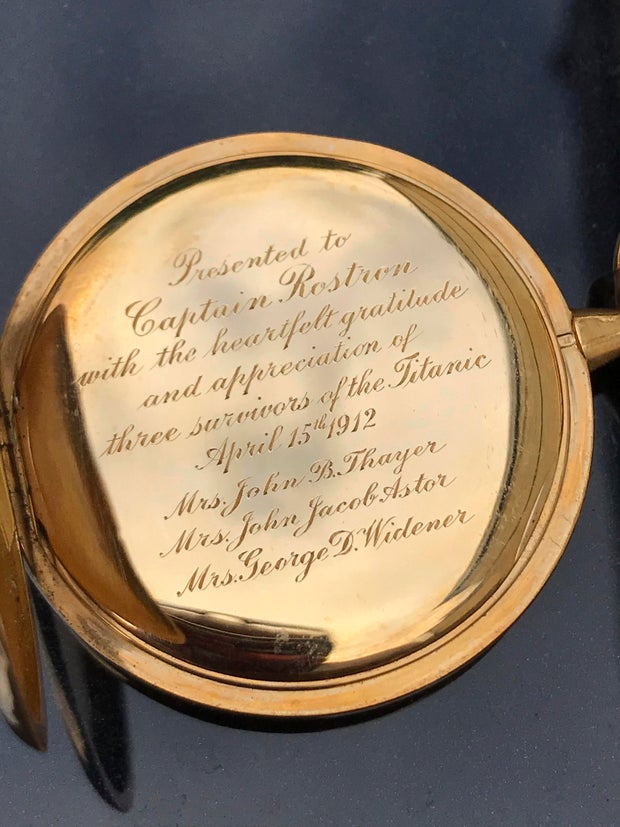

The 18-carat Tiffany & Co. watch was given by three women survivors to Capt. Arthur Rostron for diverting his passenger ship, the RMS Carpathia, to save them and others after the Titanic struck an iceberg and sank in the north Atlantic on its maiden voyage in 1912.

Andrew Aldridge/Henry Aldridge and Son via AP

Auctioneers Henry Aldridge and Son, who sold the watch to a private collector in the United States on Saturday for 1.56 million British pounds, said it’s the most paid-for piece of Titanic memorabilia. The price includes taxes and fees paid by the buyer.

The watch was given to Rostron by the widow of John Jacob Astor, the richest man to die in the disaster and the widows of two other wealthy businessmen who went down with the ship.

Astor’s pocket watch, which was on his body when it was recovered seven days after the ship sank, had previously set the record for the highest price paid for a Titanic keepsake, fetching nearly $1.5 million (1.17 million pounds) from the same auction house in April.

Auctioneer Andrew Aldridge said the fact that Titanic memorabilia has set two records this year demonstrates the enduring fascination with the story and the value of the dwindling supply and high demand for ship artifacts.

“Every man, woman and child had a story to tell, and those stories are told over a century later through the memorabilia,” he said.

Rostron was hailed a hero for his actions the night the Titanic sank and his crew was recognized for their bravery.

Andrew Aldridge/Henry Aldridge and Son via AP

The Carpathia was sailing from New York to the Mediterranean Sea when a radio operator heard a distress call from the Titanic in the early hours of April 15, 1912 and woke Rostron in his cabin. He turned his boat around and headed at full steam toward the doomed vessel, navigating through icebergs to get there.

By the time the Carpathia arrived, the Titanic had sunk and 1,500 people perished. But the crew located 20 lifeboats and rescued more than 700 passengers and took them back to New York.

Rostron was awarded the U.S. Congressional Gold Medal by President William Howard Taft and was later knighted by King George V.

Madeleine Astor, who had been helped into a lifeboat by her husband, presented the watch to Rostron at a luncheon at her mansion on Fifth Avenue in New York.

The inscription says it was given “with the heartfelt gratitude and appreciation of three survivors.” It lists Mrs. John B. Thayer and Mrs. George D. Widener alongside Astor’s married name.

“It was presented principally in gratitude for Rostron’s bravery in saving those lives,” Aldridge said. “Without Mr. Rostron, those 700 people wouldn’t have made it.”

CBS News

Extended interview: Cher – CBS News

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Josh Seftel’s Mom on Fall

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.