CBS News

A search for a biological father, and the surprise of a lifetime

Matt Katz is a lifelong Mets fan. Playing ball with his son, Reuben, is what Father’s Day memories are made of. But growing up, Matt’s experience of Father’s Day was about as complicated as a triple play. “Did my birth father like baseball? Does he like baseball?” Katz asked. “And because I had for many years no contact with my birth father, I would wonder about little things like that.”

Matt was raised by his Jewish mother, Roberta, and Richard, his Jewish stepfather, who said, “As far as I’m concerned, he is my son.”

“His father was out of the picture, and he felt rejected,” said Roberta. “He tried to see him, but it didn’t work out.”

Richard said, “No matter how much of a dad I am, he still needed to know where he came from.”

But as a boy, Matt rarely got any answers to that question: “Why isn’t he interested in hanging out with me? Why isn’t he interested in knowing me? Where is he?”

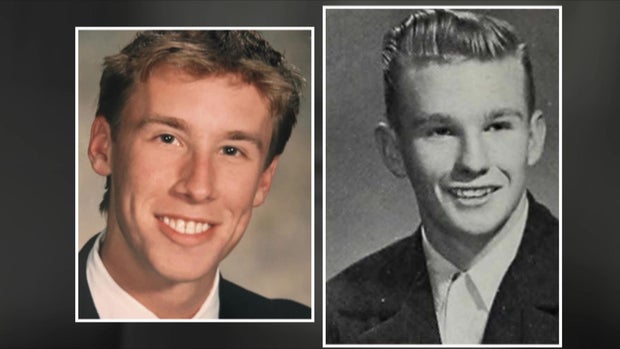

When he was about the age his daughter Sadie is now, Matt noticed something: “I looked different from other people in my family, and also a little bit different from other people at Hebrew school. I had lighter features, redder hair.”

Family Photo

Matt’s wife, Deborah, is of Ashkenazi Jewish descent; so is Matt’s mom, and so was his presumed biological father.

Deborah recalled, “My elderly grandmother was like, No, he’s not Jewish.”

So, where in the world did those fair features come from?

“I took a DNA test, as did my wife, just to see if we could, you know, figure out a little bit more about our people,” Matt said. “I was expecting to find out I was a hundred percent Jewish. Instead, I found out I was just half-Ashkenazi, Eastern European Jewish, and I was half-Irish.”

It seemed inconceivable, and yet it sort of made sense. “I would look at myself in the mirror and I’d be like, Wow, you know, holy crap, you DO look like a half-Jewish, half-Irish guy!” he laughed.

Just like a four-leaf clover, Matt’s family tree started to blossom. He found out he had three half-siblings as well. Deborah said, “It’s, like, wild to be, like, middle-aged and all of a sudden have sisters-in-law and cousins that never existed before.”

But here’s the thing: none of them knew their dad, either. But one of them knew something the others didn’t: “She tells me that she was conceived via sperm donor,” Matt said. Which likely meant he was, too.

And yes, that led to an awkward conversation with his mom. “I was very nervous about it,” he said.

We should preface what follows by saying Matt is a Peabody Award-winning journalist at WNYC Public Radio in New York City. He’s used to tracking down answers and asking tough questions … but not of his own mother.

Roberta said, “I remember sitting on the couch, and he prefaced the conversation with how much he loves me and how much he loves Richard. And then, he threw the bombshell!”

CBS News

“I said, ‘Did you ever get fertility assistance when you were trying to have me?'” Matt recalled. “She says yes, they tried to get pregnant for many years, and it was hard.”

She said they had indeed gone to a doctor, who discovered the problem wasn’t hers, but his. “I wasn’t hiding anything from anyone,” Roberta said. “The only thing I was hiding was the fact that I had artificial insemination. But I thought it was with my former husband.”

“I told her, ‘That’s not what happened – it was donor sperm that you were inseminated with,'” Matt said. “And she put her hand over her mouth, and she might have used the S-word!”

What Roberta didn’t know is that back then, doctors treating male infertility would sometimes mix a husband’s genetic material with an anonymous donor’s, ostensibly to help improve the couple’s chances.

Matt was born happy and healthy, but the secrecy of it all left him in the dark about his true dad, and his mom wondering with whom she had had a child: “I could have walked down the street, and he could have been there and, you know, I wouldn’t have known,” she said.

He was a shadow from 1970s Manhattan – a ghost who, it seemed, didn’t want to be found.

Some of Matt’s friends even questioned if Matt should keep trying.

Cowan said, “The devil you know might be better than the devil you don’t, right? You had no idea where this was going?”

“No, there’s a risk there,” said Matt. “You don’t know what you’re gonna find. You don’t know if there’s more hurt.”

But Matt and his half-siblings doubled down. A professional DNA sleuth was brought in, and eventually, a picture turned up of a man with the same long face, same eyes, same hairline, as all of them. His name was Vincent McNally.

CBS News

But Matt needed more proof. “He had to have been in New York City on the day I was conceived,” Matt said.

Sure enough, in an old 1976 New York City phone book, a Vincent McNally was listed with an address on MacDougal Street in Greenwich Village. It was just brick and mortar, but to Matt it was gold. Standing outside the building, Matt said, “I feel it in my body, I do, I feel like a sensation; he was here, and he was in my presence in some way.”

Turns out Vincent McNally was a professional stage actor; he donated sperm as a way to earn extra money. Matt found pictures of him, theater reviews, and Playbills, including an eerie description of one of his final performances, in “A Sea of White Horses.” “One of those plays, his estranged children, adult children, come back and find him,” Matt said.

But the ghost Matt has been chasing all his life eluded him one final time. Just before Matt was going to call him to tell him the news, he found a death notice. Vincent McNally had passed away just four years prior.

“Maybe we were never supposed to meet in person,” he said.

Just yesterday, Matt celebrated his daughter’s bat mitzvah. Two of his three half-siblings were there, too – a blending of a now-extended family, long overdue.

Family photo

His smile makes clear Matt has finally made peace with his past, in part, he believes, because talking about it has been healthy. He turned his journey into a podcast, “Inconceivable Truth,” that has found an audience of other people whose ancestry search is still ongoing.

For Matt, he’s just thankful for the stepdad that he’s celebrating on this Father’s Day – the only man in Matt’s life, it turns out, truly worthy of the title Dad.

Cowan said, “You don’t need to keep searching anymore.”

“I don’t,” Matt said, “but I can keep telling the story, because it’s a cool story!”

For more info:

Story produced by Wonbo Woo. Editor: Steven Tyler.

CBS News

UATX says it fights college censorship culture with a focus on free speech | 60 Minutes

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

“The Future of Money” | 60 Minutes Archive

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

60 Minutes returns to Notre Dame

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.