CBS News

6 creative ways to find a lower mortgage rate this summer, according to experts

Getty Images/iStockphoto

Inflation has been stubbornly high, hovering at over 3% throughout the first half of 2024. As a result, the Federal Reserve has been forced to keep interest rates higher for longer, hoping to quell spending and send inflation down with it. Unfortunately, that has also meant higher mortgage rates. Right now, the average 30-year mortgage loan rate sits at just above 7% — nearly 2% higher than it was just two years ago.

But while the high mortgage rates we’re facing now may give homebuyers pause, it’s important to consider the potential benefits of buying sooner rather than later. By acting now, you can start building equity and take advantage of rising home values. It could also help you avoid higher home prices down the line (if rates do drop, it could lead to increased competition, which would drive up prices.)

And, fortunately, waiting it out isn’t your only option if high mortgage rates are a concern.

Find out how much you could save with the right mortgage loan now.

6 creative ways to find a lower mortgage rate this summer, according to experts

Here are a few creative ways experts say you can get a lower mortgage rate today.

Buy mortgage points

The first thing you can do is buy points. These are sometimes called “mortgage points” or “discount points,” but the idea is the same: You pay an upfront fee (essentially prepaying interest), and in exchange, the lender gives you a lower interest rate for the life of the loan.

Traditionally, you’ll pay 1% of the loan amount for a 0.25 reduction in your interest rate, though the exact cost and rate reduction varies depending on the lender and market conditions.

“In the current market, you are seeing a spread in some circumstances of close to 0.75% to a full percent in interest rate differential,” says Matt Ricci, a home loan specialist at Churchill Mortgage. “This is an anomaly that exists in rapidly increasing rate environments and is not one that should be ignored — nor is one that we have seen in many years.”

If you do choose to buy points, calculate your breakeven point before pulling the trigger. This is the month in which the savings the points net you — that saved interest — outweighs the cost of the points. For example, if the points cost you $5,000, and they save you $125 per month, it would take you 40 months to break even on your costs.

“Paying points only makes sense if you feel you will hold on to the loan long enough to recoup the cost,” says Suzanne Downs, co-owner of Palm Beach Mortgage Group.

Explore your top mortgage loan options and compare lenders today.

Ask for a rate buydown

You can also explore rate buydowns. These are a similar strategy to points, except someone else pays for them — usually the seller, builder or in some cases, the lender.

Buydowns can offer permanent rate reductions, as with points, but more commonly, they’re temporary, offering a lower rate for the first few years of the loan. In a 2-1 buydown, for instance, you’d get a 2% lower interest rate in the first year and a 1% lower interest rate in the second. The loan would revert to your originally quoted rate in Year 3.

According to David Kakish, branch manager and home loan expert at Anchor Home Loans, temporary buydowns can be a smart option right now, as the Fed is largely expected to cut interest rates in the near future.

“It creates a window to wait for rates to decrease naturally,” Kakish says.

Then, once your buydown expires and rates have fallen, you can refinance to take advantage of lower rates more permanently.

Find the right lender

Shopping around for your lender can help lower your rate, too, as every company approaches risk, pricing, and eligibility differently. In fact, according to Freddie Mac, you can save about $1,200 per year just by getting at least four loan quotes.

When you get quotes, “Make sure you are comparing apples to apples,” says Michelle White, national mortgage expert at The CE Shop. “The loan terms, fees, closing costs, and APRs should be the same.”

You can also negotiate with the lenders you’re working with.

“Many banks are offering deals and discounts to remain competitive. Asking your lender if they can match or beat competing offers is a great way to get a lower rate without the hassle of starting the loan process over again,” Brian Shahwan, a vice president and mortgage banker at William Raveis Mortgage, says.

Improve your credit score

Another smart way to reduce your rate is to increase your credit score before applying for your loan. According to ICE Mortgage Technology, the average 30-year conventional mortgage rate for someone with an 800 or higher credit score was 6.96% over the last month. For borrowers in the 640 to 659 range, it was 7.55%.

“Lenders price rates based on credit score bands — 740 to 759, 760 to 779, 780-plus,” Kakish says. “Moving from a 779 to a 780 could save you 0.125% to 0.25% on your rate, which can amount to $30,000 or more in savings over the life of the loan.”

To improve your score, work on reducing your debts and make sure you’re paying your bills on time. You can also dispute errors you find on your credit card and avoid opening any new accounts.

Use a mortgage broker

You might also consider using a mortgage broker. Unlike loan officers, who are employed directly by a single lender, mortgage brokers work with dozens of companies. They can help you pinpoint the best lender and loan program for your needs and budget, and they can assist with filing your application and comparing quotes.

“Mortgage brokers typically have relationships with several banks — even some borrowers may not have heard of before,” Shahwan says. “The broker will then be able to shop the lowest rates and best incentives across all lenders.”

Brokers are usually paid a commission by the lender you end up going with — typically a small percentage of the loan amount. You won’t need to pay them directly.

Ask this question

Finally, make sure to ask any lender you consider if they offer “float-downs.” A float-down lets you take advantage of lower rates after you’ve locked your mortgage rate.

For instance, if you locked your rate at 7%, but market rates drop to 6.5% before you can close on your loan, a float-down would let you drop your rate to 6.5%. Some lenders will do this for free, while others charge a fee.

CBS News

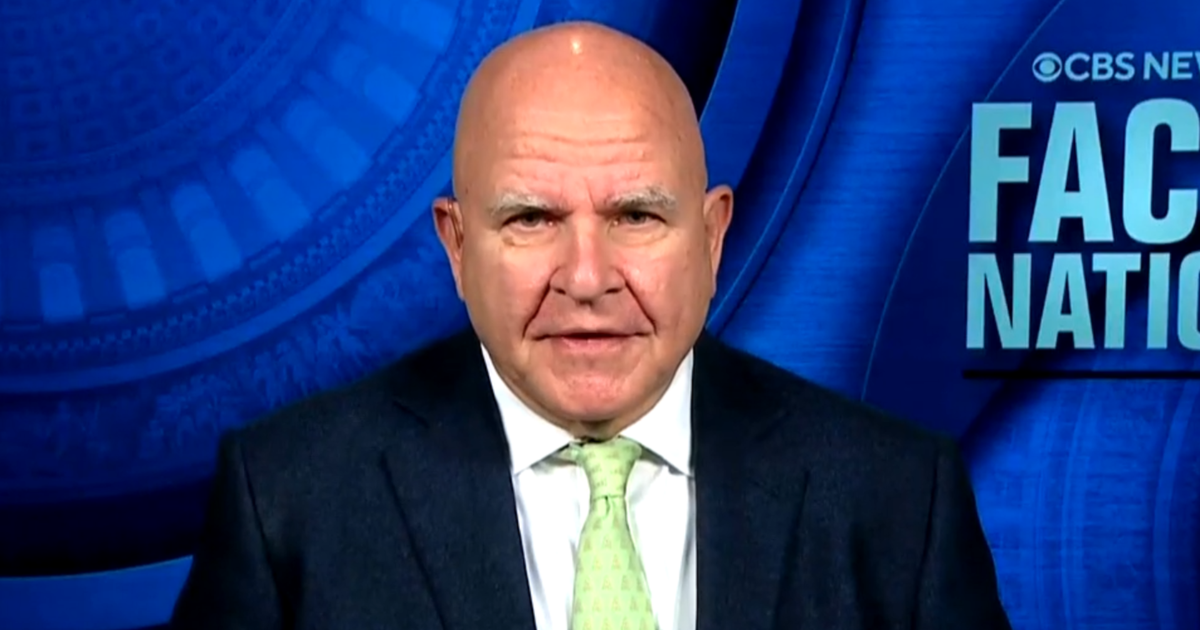

Former Trump national security adviser says next couple months are “really critical” for Ukraine

Washington — Lt. Gen. H.R. McMaster, a former national security adviser to Donald Trump, said Sunday that the upcoming months will be “really critical” in determining the “next phase” of the war in Ukraine as the president-elect is expected to work to force a negotiated settlement when he enters office.

McMaster, a CBS News contributor, said on “Face the Nation with Margaret Brennan” that Russia and Ukraine are both incentivized to make “as many gains on the battlefield as they can before the new Trump administration comes in” as the two countries seek leverage in negotiations.

With an eye toward strengthening Ukraine’s standing before President-elect Donald Trump returns to office in the new year, the Biden administration agreed in recent days to provide anti-personnel land mines for use, while lifting restrictions on Ukraine’s use of U.S.-made longer range missiles to strike within Russian territory. The moves come as Ukraine marked more than 1,000 days since Russia’s invasion in February 2022.

Meanwhile, many of Trump’s key selection for top posts in his administration — Rep. Mike Waltz for national security adviser and Sens. Marco Rubio for secretary of state and JD Vance for Vice President — haven’t been supportive of providing continued assistance to Ukraine, or have advocated for a negotiated end to the war.

CBS News

McMaster said the dynamic is “a real problem” and delivers a “psychological blow to the Ukrainians.”

“Ukrainians are struggling to generate the manpower that they need and to sustain their defensive efforts, and it’s important that they get the weapons they need and the training that they need, but also they have to have the confidence that they can prevail,” he said. “And any sort of messages that we might reduce our aid are quite damaging to them from a moral perspective.”

McMaster said he’s hopeful that Trump’s picks, and the president-elect himself, will “begin to see the quite obvious connections between the war in Ukraine and this axis of aggressors that are doing everything they can to tear down the existing international order.” He cited the North Korean soldiers fighting on European soil in the first major war in Europe since World War II, the efforts China is taking to “sustain Russia’s war-making machine,” and the drones and missiles Iran has provided as part of the broader picture.

“So I think what’s happened is so many people have taken such a myopic view of Ukraine, and they’ve misunderstood Putin’s intentions and how consequential the war is to our interests across the world,” McMaster said.

On Trump’s selections for top national security and defense posts, McMaster stressed the importance of the Senate’s advice and consent role in making sure “the best people are in those positions.”

McMaster outlined that based on his experience, Trump listens to advice and learns from those around him. And he argued that the nominees for director of national intelligence and defense secretary should be asked key questions like how they will “reconcile peace through strength,” and what they think “motivates, drives and constrains” Russian President Vladimir Putin.

Trump has tapped former Rep. Tulsi Gabbard to be director of national intelligence, who has been criticized for her views on Russia and other U.S. adversaries. McMaster said Sunday that Gabbard has a “fundamental misunderstanding” about what motivates Putin.

More broadly, McMaster said he “can’t understand” the Republicans who “tend to parrot Vladimir Putin’s talking points,” saying “they’ve got to disabuse themselves of this strange affection for Vladimir Putin.”

Meanwhile, when asked about Trump’s recent selection of Sebastian Gorka as senior director for counterterrorism and deputy assistant to the president, McMaster said he doesn’t think Gorka is a good person to advise the president-elect on national security. But he noted that “the president, others who are working with him, will probably determine that pretty quickly.”

CBS News

Sen. Van Hollen says Biden is “not fully complying with American law” on Israeli arms shipments

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Rep.-elect Sarah McBride says “I didn’t run” for Congrees “to talk about what bathroom I use”

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.