CBS News

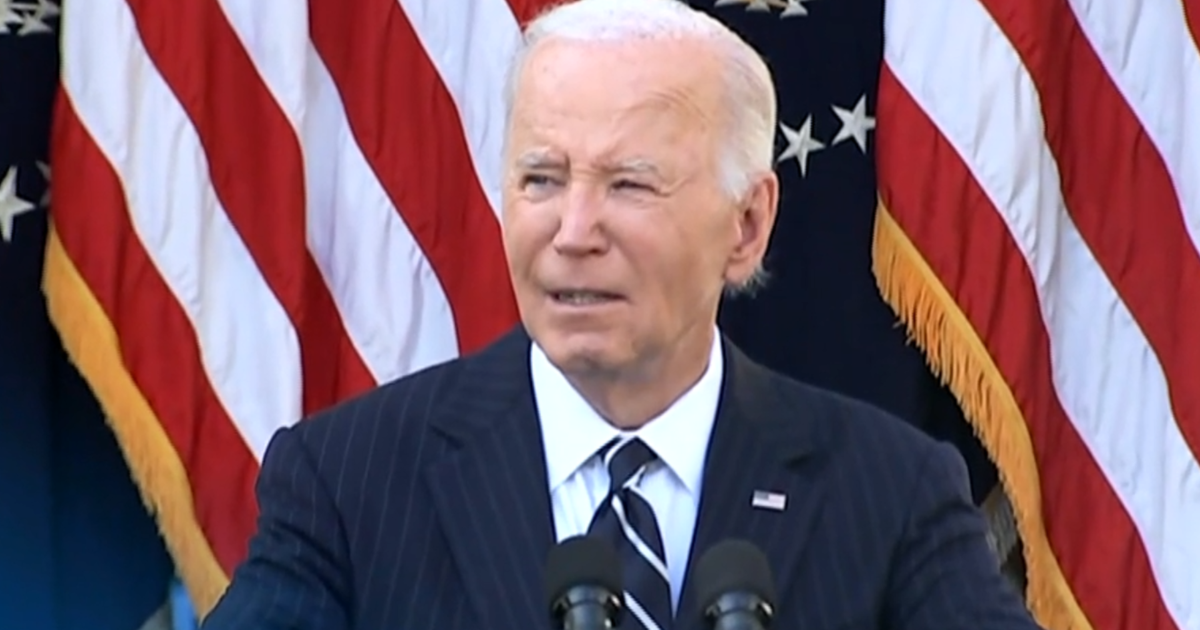

Biden administration says it wants to cap rent increases at 5% a year. Here’s what to know.

The Biden administration is proposing a new way to keep rents around the U.S. from soaring: limit corporate landlords to annual rent increases of no more than 5%, or else they would lose a major tax break.

The proposal comes as many households across the U.S. struggle to afford rents, which have surged 26% nationally since early 2020, according to a recent report from Harvard’s Joint Center for Housing Studies. Although costs for many items are easing as inflation cools, housing prices remain stubbornly high, rising 5.2% on an annual basis in June.

The idea behind the plan is to push midsize and large landlords to curb rent increases, with the Biden administration blaming them for jacking up rents far beyond their own costs. That has resulted in corporate landlords enjoying “huge profits,” the administration said in a statement.

“Rent is too high and buying a home is out of reach for too many working families and young Americans,” President Joe Biden said in a statement. “Today, I’m sending a clear message to corporate landlords: If you raise rents more than 5%, you should lose valuable tax breaks.”

To be sure, the proposal would need to gain traction in Congress, and such a price cap may not be palatable in the Republican-controlled House and some Democrats also potentially opposed.

But the idea, even if it doesn’t come to fruition, could prove popular with some voters ahead of the November presidential election, especially those who feel pinched by several years of rent increases. The proposal is one of a number of strategies the Biden administration is promoting to improve housing affordability, including a plan introduced in March to create a $10,000 tax credit for first-time home buyers.

How the 5% rent cap would work

The rent cap, which would need to be enacted through legislation, would require large and midsize landlords to either cap annual rent increases to no more than 5%. Those that failed to comply would lose the ability to tap faster depreciation that is available to rental housing owners.

The law would apply only to landlords that own more than 50 units, and the Biden administration said it would cover more than 20 million units across the U.S. That “accounts for roughly half of the rental market” in the U.S., according to National Economic Advisor Lael Brainard, who spoke on a call with reporters about the proposal.

Accelerated depreciation is a tax strategy that allows landlords to front-load costs associated with their properties, such as wear and tear. That’s useful because such write-offs can lead to paper losses that allow landlords to offset income from rent, for example. Residential landlords can depreciate their properties over 27.5 years, compared with 39 years for commercial landlords.

The risk of losing the tax benefit would incentivize landlords to raise the rent less than 5% per year because keeping the depreciation would prove to be a better deal financially, senior administration officials said on the call.

CBS News

Explosion at Louisville plant leaves 11 employees injured

At least 11 employees were taken to hospitals and residents were urged to shelter in place on Tuesday after an explosion at a Louisville, Kentucky, business.

The Louisville Metro Emergency Services reported on social media a “hazardous materials incident” at 1901 Payne St., in Louisville. The address belongs to a facility operated by Givaudan Sense Colour, a manufacturer of food colorings for soft drinks and other products, according to officials and online records.

Louisville Mayor Craig Greenberg said emergency teams responded to the blast around 3 p.m. News outlets reported that neighbors heard what sounded like an explosion coming from the business. Overhead news video footage showed an industrial building with a large hole in its roof.

WLKY-TV

“The cause at this point of the explosion is unknown,” Greenberg said in a news conference. No one died in the explosion, he added.

Greenberg said officials spoke to employees inside the plant. “They have initially conveyed that everything was normal activity when the explosion occurred,” he said.

The Louisville Fire Department said in a post on the social platform X that multiple agencies were responding to a “large-scale incident.”

The Louisville Metro Emergency Services first urged people within a mile of the business to shelter in place, but that order was lifted in the afternoon. An evacuation order for the two surrounding blocks around the site of the explosion was still in place Tuesday afternoon.

CBS News

Briefing held on classified documents leaker Jack Teixeira’s sentencing

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Aga Khan emerald, world’s most expensive green stone, fetches record $9 million at auction

A rare square 37-carat emerald owned by the Aga Khan fetched nearly $9 million at auction in Geneva on Tuesday, making it the world’s most expensive green stone.

Sold by Christie’s, the Cartier diamond and emerald brooch, which can also be worn as a pendant, dethrones a piece of jewelry made by the fashion house Bulgari, which Richard Burton gave as a wedding gift to fellow actor Elizabeth Taylor, as the most precious emerald.

In 1960, Prince Sadruddin Aga Khan commissioned Cartier to set the emerald in a brooch with 20 marquise-cut diamonds for British socialite Nina Dyer, to whom he was briefly married.

Dyer then auctioned off the emerald to raise money for animals in 1969.

FABRICE COFFRINI/AFP via Getty Images

By chance that was Christie’s very first such sale in Switzerland on the shores of Lake Geneva, with the emerald finding its way back to the 110th edition this year.

It was bought by jeweler Van Cleef & Arpels before passing a few years later into the hands of Harry Winston, nicknamed the “King of Diamonds.”

“Emeralds are hot right now, and this one ticks all the boxes,” said Christie’s EMEA Head of Jewellery Max Fawcett. “…We might see an emerald of this quality come up for sale once every five or six years.”

Also set with diamonds, the previous record-holder fetched $6.5 million at an auction of part of Hollywood legend Elizabeth Taylor’s renowned jewelry collection in New York.