CBS News

Will mortgage rates continue to drop this August? Here’s what experts say

Getty Images/iStockphoto

On top of record-high home prices, a high interest rate environment has made it too expensive for many Americans to purchase a home. According to the Federal Reserve, the median sales price in the U.S. is $412,300, roughly 30% higher than in 2020. Meanwhile, 30-year fixed-rate mortgage rates have remained elevated for the past couple of years.

However, the mortgage market has seen positive signs recently, with average mortgage rates hitting a four-month low in July. According to Freddie Mac, average rates on 30-year fixed-rate mortgages have dropped below 7% and currently stand at 6.73%.

If buying a home or refinancing your mortgage is part of your near-term plans, monitoring mortgage rate trends could inform your decision. We asked several mortgage rate experts for their projections on how mortgage rates will trend in August and beyond as the rate climate evolves.

See how low of a mortgage rate you could lock in here now.

Will mortgage rates continue to drop in August?

The experts we spoke to were split on the future of mortgage interest rates this month. Here’s what they predicted:

Mortgage rates could continue to drop in August

All eyes are on the Federal Reserve, watching when the central bank may lower interest rates. Several experts said the anticipated rates are already factored into today’s interest rates. However, other economic factors like inflation and the unemployment rate can also come into play.

Daniel McKeever, an assistant professor at the School of Management at Binghamton University, State University of New York, anticipates a modest rate drop. “My best guess is another slight decrease (in mortgage rates),” he says. “The labor market is softening a bit, and inflation continues to ease.”

McKeever points out that inflation is trending toward the Fed’s stated target rate of 2%, which could prompt the central bank to drop the federal funds rate in September. “Mortgage rates track closely with the Fed funds rate and can sometimes serve as a leading, rather than lagging, indicator if creditors are anticipating a lower rate environment in the near future.”

Learn more about your current mortgage rate options online.

Mortgage rates won’t drop in August

Other experts we spoke with agree that any Federal Reserve rate cuts are accounted for in the current mortgage rate, but project rates to hold steady for August.

“The markets are already expecting the Federal Reserve to reduce the rates in September with a likely reduction of 0.25%,” says Jeremy Schachter, a branch manager at Fairway Independent Mortgage Corporation. “This is already being anticipated, and mortgage rates are already counting on that. So a further reduction in rates for August is not expected.”

Ralph DiBugnara, president of Home Qualified, points out that mortgage rates recently hit four-month lows in July, largely due to widespread speculation about a potential Fed rate cut in September. He states, “Those bets have built most of that anticipated cut into the rates already, so I anticipate August rates staying steady at July’s averages until we get a definitive decision from the Fed Chairman.”

Factors that could influence mortgage rates

Several factors contribute to market mortgage rates that bear close watching if you plan on financing a new home or refinancing your current one. Here are a few of the most common drivers that affect mortgage rates.

- The Federal Reserve: Changes in the Fed rate often lead to adjustments in the prime rate for mortgages. Consequently, mortgage lenders must change the rates accordingly.

- Inflation: When inflation is high, the value of the dollar declines. To compensate for the change, lenders charge higher interest rates on their mortgages. Conversely, lower inflation can lead to reduced mortgage rates.

- Bond market: Mortgage rates are also influenced by mortgage-backed securities, which are collections of mortgages sold on the bond market. When demand for these bonds is high, it often results in lower mortgage rates and vice-versa.

- Overall state of the economy: When unemployment is low, consumer spending is up, and other economic indicators are strong, mortgage rates often rise. The opposite is also true, with a weaker economy leading to lower rates.

Inflation is one of the primary factors contributing to the current mortgage rate environment. The Federal Reserve followed an aggressive rate hike schedule through much of 2022 and 2023 to curb inflation, and mortgage rates followed suit.

“Inflation has been the greatest adversary to lowering interest rates over the last two years,” says DiBugnara. “A drop in the inflation rate, as well as lower consumer spending and higher unemployment, are what’s most likely to have a positive impact on rates being reduced.”

See how far mortgage interest rates have already been reduced here.

The bottom line

Inflation is beginning to cool, but it could take time to reach the Fed’s 2% inflation rate target. While the central bank is projected to lower rates in September, the consensus indicates more meaningful mortgage rate changes may not happen until late 2024 or early 2025. As such, if you find a home that meets your needs, it may not be a good idea to wait for mortgage rates to fall.

CBS News

Biden approves Ukraine’s use of U.S.-made long-range weapons inside Russia

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

4 risks of waiting for home equity loan interest rates to fall further

Getty Images/iStockphoto

Home equity borrowing is becoming cheaper again. Interest rates on home equity lines of credit (HELOCs) are down by around 1.5 points since the start of the year, while rates on home equity loans have dropped by around half a percentage point since January. This is great news for borrowers, particularly knowing that the average homeowner has approximately $330,000 worth of equity right now.

Still, the economic climate has been evolving all year as inflation declined and interest rate cuts started being issued. With one rate cut of 50 basis points issued in September and another quarter-point reduction in November, borrowers considering accessing their home equity may be wondering if they should delay action to better secure a lower interest rate.

For a variety of reasons, however, that could be a mistake. Below, we’ll detail four risks associated with waiting for home equity loan interest rates to fall further.

Start by seeing how low of an interest rate you could lock in here today.

4 risks of waiting for home equity loan interest rates to fall further

The risks of waiting for home equity loan interest rates are numerous. Here are four of the biggest ones right now:

Rates could increase

Home equity loan interest rates, more so than mortgage interest rates, are closely tied to the federal funds rate. And that’s been reduced twice this year already. But inflation for October ticked up, which is something the Federal Reserve was hoping to avoid. If it rises again in November and December, then, the federal funds rate may be paused or, possibly, even hiked again. Waiting for this scenario to become more realistic would be risky, particularly when you can still secure the lowest home equity loan rate in years right now.

Get started with a home equity loan online today.

Your debt may become unmanageable

Credit card interest rates just surged to an average of slightly over 23%. So if you were planning to use your home equity to consolidate your debt or to pay it off, waiting would be risky as your outstanding debt balance could quickly become unmanageable. With the holiday season quickly approaching and a forecast of higher spending versus 2023, it’s highly unlikely that waiting for a slight reduction in a home equity loan rate will offset any additional growth in your already expensive debt.

You could delay a tax deduction

Waiting for an unknown interest rate will also delay a critical tax deduction, should you be planning on using your home equity for major home projects or repairs. That’s because the interest paid on home equity loans and HELOCs is tax-deductible if used for qualifying purposes. But if you wait until January 1 to secure your funding you won’t be able to write off any of the interest paid until you file your next tax return — in 2026. And, depending on your intended usage, that could mean a significant tax deduction delayed just to secure a slightly lower (but not guaranteed) interest rate.

Your credit score could change

It’s important to remember that the home equity loan interest rates you see offered on lender websites are for those borrowers with the highest credit scores. If you have a good or great credit score now — but damage it by overspending during the holidays or by failing to repay high-interest debt — the home equity loan rate you’re ultimately offered may easily negate any potential future rate drops.

This is a major risk of waiting to act. So, if you need the home equity funds now — and have a good enough credit score to qualify for today’s best rates — it may make sense to act promptly.

Learn more about the best home equity loan options available to you now.

The bottom line

When borrowing money, there’s always an inherent risk in waiting to act versus being proactive. But with home equity borrowing, particularly in today’s unique economic climate, these risks become more pronounced. So weigh the above scenarios carefully against your financial needs right now to better determine which course of action works best for you. And consider speaking to a financial advisor or lender who can help answer any specific question you may have.

CBS News

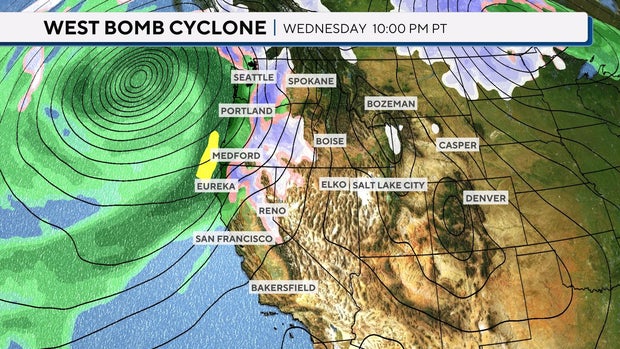

A bomb cyclone and atmospheric river are developing in the Pacific. What does that mean for the West Coast?

The Northwest is bracing for a strong storm system to move in this week, delivering gusty winds, heavy rain and mountain snow. The National Weather Service says this is the first major storm of the season. An atmospheric river and bomb cyclone are what make this storm so powerful — but what do those terms mean?

What is an atmospheric river?

Atmospheric rivers are no strangers to the western U.S., especially during the fall and winter months. Atmospheric rivers, or “ARs,” are elongated, narrow regions of moisture that travel outside of the tropical regions.

CBS News

They are responsible for producing heavy rain and snow, especially when pushed up against mountain ranges like the Cascades and Sierra Nevada. A well-known type of atmospheric river is called a “Pineapple Express” because it flows from the Hawaiian Islands.

Strong ARs transport water vapor roughly equivalent to 7.5 to 15 times the average flow of the Mississippi River. Annually, 30% to 50% of the West Coast’s precipitation occurs with just a few atmospheric river events.

What is a bomb cyclone?

Bomb cyclones are low pressure systems that undergo what meteorologists call “bombogenesis.” Bombogenesis occurs when a midlatitude cyclone (“midlatitude” meaning the area between the tropics and the polar regions) rapidly intensifies over a 24-hour period.

CBS News

In most regions, if the atmospheric pressure drops at least 24 millibars within 24 hours, it is considered a bomb cyclone.

Bomb cyclones can occur when a cold air mass collides with a warm air mass, which is how some significant winter storms can happen.

When an atmospheric river and bomb cyclone occur at the same time, a major weather event is expected. Atmospheric rivers provide the moisture, and the bomb cyclone provides the intensity and increased winds.

The major event this week has rainfall totals upwards of 10-20 inches in some spots. Mountain snow totals are expected to be over a foot in most areas; higher elevations could receive upwards of 2 to 3 feet.