CBS News

Boeing Starliner hatch closed, setting stage for unpiloted return to Earth Friday

With its problematic mission finally winding down, Boeing’s Starliner capsule was rigged for re-entry and its hatch closed Thursday, setting the stage for undocking and an unpiloted return to Earth overnight Friday in the final chapter of a disappointing test flight.

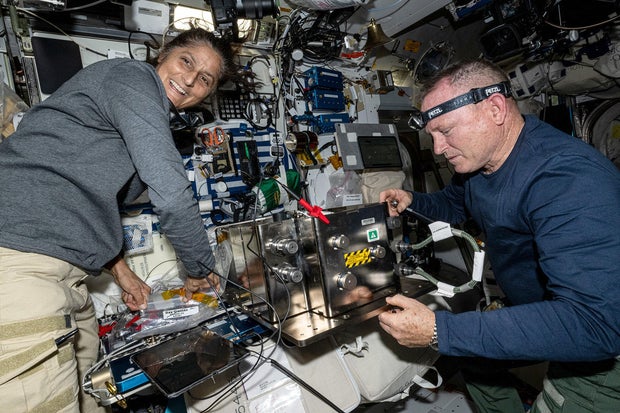

Ninety-two days after launching aboard the Starliner — a mission originally expected to last a little more than a week — commander Barry “Butch” Wilmore and co-pilot Sunita Williams kept their thoughts to themselves as the hatch was closed at 1:29 p.m. EDT.

NASA

Leaving Wilmore and Williams behind, the Starliner is expected to undock from the International Space Station’s forward Harmony module just after 6 p.m. Friday. Five hours and 15 minutes later, the spacecraft’s powerful braking rockets are programmed to fire for about 59 seconds to drop the ship out of orbit.

After a fiery southwest-to-northeast plunge across the Baja Peninsula, the Gulf of California and northern Mexico, the Starliner is expected to descend under its three main parachutes to an airbag-assisted 4-mph touchdown just after midnight at White Sands, N.M., were Boeing and NASA recovery teams will be standing by.

Astronauts’ return delayed until February

Wilmore and Williams will return to Earth next February, hitching a ride home aboard a SpaceX Crew Dragon ferry ship scheduled for launch Sept. 24. When they finally get back next year, they’ll have logged 262 days in space.

On Wednesday, as she worked inside the Starliner helping arrange return items to ensure the right balance and center of gravity, Williams said “it’s bittersweet to be packing up Starliner and putting our simulators in our seats. But, you know, we want to do the best we can to make sure she’s in good shape.”

NASA

She assured flight controllers “we’ll tidy it all up tomorrow (Thursday), make sure everything’s squared away and do a last couple of things for the closeout before hatch closure. Thanks for backing us up, thanks for looking over our shoulder and making sure we’ve got everything in the right place. We want her to have a nice, soft landing in the desert.”

When Williams and Wilmore blasted off aboard the Starliner on June 5, they expected to be at the controls when the ship returned to Earth to close out its first piloted test flight. Boeing was equally confident the ship would be certified to carry long-duration crews to and from the station starting in early 2025.

But during rendezvous with the space station the day after launch, the Starliner suffered multiple helium leaks in its propulsion pressurization system and five maneuvering jets were “deselected” by the flight computer after exhibiting degraded thrust.

Boeing and NASA then began an exhaustive series of tests and analyses to determine what caused the problems and whether they might get worse or otherwise pose a threat to a safe re-entry and on-target landing.

Based on the test data, Boeing engineers concluded the problems were understood, would not get worse and that the Starliner could safely bring Wilmore and Williams back to Earth. They argued the departure and re-entry maneuvers would be much less stressful than what the thrusters experienced during the rendezvous.

But those jets are critical. They must fire as needed to safely move the Starliner away from the space station and then to keep it properly oriented and stable during the de-orbit rocket firing that will drop the ship out of orbit.

In the end, NASA managers did not accept Boeing’s flight rationale, deciding too much uncertainty remained to risk bringing Wilmore and Williams down aboard the Starliner.

“We view the data and the uncertainty that’s there differently than Boeing does,” said NASA Associate Administrator Jim Free.

While different, more powerful thrusters are used for the actual braking burn, the smaller reaction control jets are needed to ensure the ship stays on the right trajectory to reach the White Sands landing site.

“Spaceflight is hard. The margins are thin. The space environment is not forgiving,” said Norm Knight, director of flight operations at the Johnson Space Center. “And we have to be right.”

CBS News

Trump created the controversial $10,000 SALT deduction cap. Now he wants to end it.

Former President Donald Trump, an avowed proponent of tax cuts, is floating the idea of reversing a measure passed during his tenure in the White House that effectively raised taxes for many U.S. homeowners.

In a post Tuesday on Truth Social, Trump suggested he would scrap a $10,000 cap on deducting state and local taxes (SALT) that was passed as part of the 2017 Tax Cuts and Jobs Act — a massive revamp that he has said boosted economic growth.

Now, in the run-up to the November election, Trump said in the post he would “get SALT back, lower your taxes, and so much more,” although he stopped short of offering details. Trump made the post ahead of a speech he’s giving Wednesday at the Nassau Coliseum on Long Island.

Trump’s new proposal for getting rid of his $10,000 SALT deduction cap comes as the presidential hopeful is pitching several additional tax cuts that would, if enacted, reduce taxes for major groups of voters. He’s also vowed to eliminate taxes on Social Security benefits, a pledge that could get support from the nation’s senior citizens, as well as to end income taxes on tipped workers and on overtime pay, ideas that would help lower- and middle-income Americans.

Yet Trump’s reversal on the SALT deduction has sparked skepticism from lawmakers as well as economists and policy experts.

“So … now Trump is against the SALT tax cap which *checks notes* is a key part of the — only — major piece of legislation passed during his administration?” noted Chris Koski, a political science professor at Reed College in Portland, Oregon, on X.

Rep. Tom Suozzi, a Democrat from Nassau, Queens, said in a statement on Wednesday that he is “happy that the former president is saying that he has finally reversed his devastating decision in 2017 to cap the State and Local Tax (SALT) deduction.” He also urged Trump to convince Republican lawmakers to vote to restore the full deduction “if he is truly serious.”

The SALT deduction cap “has been a body blow to my constituents for the past 7 years,” Suozzi added.

Senator Chuck Schumer, a Democrat from New York, wrote on X,”Donald Trump took away your SALT dedications and hurt so many Long Island families. Now, he’s coming to Long Island to pretend he supports SALT. It won’t work.”

Asked for details about Trump’s proposal to restore the SALT writeoff, a spokeswoman for the Trump campaign told CBS MoneyWatch: “While his pro-growth, pro-energy policies will make life affordable again, President Trump is also going to quickly move tax relief for working people and seniors.”

Here’s what to know about the SALT deduction.

What is the SALT deduction?

The state and local tax deduction allows taxpayers who itemize to deduct property taxes, sales taxes and state or local income taxes from their federal income taxes. Prior to the Tax Cuts and Jobs Act, there was no limit on how much people could deduct through the SALT deduction.

But the 2017 tax overhaul passed under Trump limited the deduction to $10,000 – a blow to many homeowners in states with high property taxes, many of which are Democratic leaning. At the time of the law’s passage, the Treasury Department estimated that almost 11 million taxpayers in high-tax states like New York and New Jersey would forfeit $323 billion in deductions.

Who benefits from the SALT deduction?

Homeowners with high property taxes, such as people in New York, New Jersey and California, were the biggest beneficiaries of the the full SALT deduction.

But some experts also noted that the SALT deduction primarily put more money in the pockets of higher-earning Americans. About 80% of the full SALT deduction had helped people earning more than $100,000 a year, according to the Tax Foundation.

What happened after Trump capped the SALT deduction at $10,000?

The limit has increasingly impacted middle-class homeowners across the U.S. because of rising property taxes and incomes. Some lawmakers have also sought to either repeal or increase the SALT cap, but none of those efforts have borne fruit.

Earlier this year, some lawmakers sought to double the SALT deduction cap to $20,000 for married couples, with the change retroactive for the 2023 tax year. But that bill was blocked in the House in February.

Won’t the SALT deduction cap expire anyway?

Yes, the SALT deduction cap is a provision that’s due to expire in 2025, as are many other parts of the Tax Cuts and Jobs Act, such as a reduction of the individual tax brackets. But Trump has previously indicated he wants to extend the provisions in his signature tax law.

How much would it cost the U.S. to repeal the SALT deduction cap?

It won’t be cheap, according to the the Committee for a Responsible Federal Budget, a think tank that focuses on budget and policy issues.

Eliminating the $10,000 deduction limit “would increase the cost of extending the 2017 Tax Cuts and Jobs Act (TCJA) by $1.2 trillion over a decade,” the group estimates, adding that such a measure would be a “costly mistake.”

Extending the TCJA’s tax cuts would increase the nation’s deficit by $3.9 trillion over the next decade, the group estimates. By adding in a expiration or repeal of the SALT deduction cap, that would grow to $5.1 trillion, it added.

“Lawmakers should not extend the TCJA without a plan to – at a minimum – offset the costs of extension, but ideally the plan would raise revenues relative to current law and help put the nation’s debt on a better trajectory,” the group said in a statement.

CBS News

What Kamala Harris told Latinos at Congressional Hispanic Caucus event

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Craigslist founder Craig Newmark makes $100 million cybersecurity pledge

Craig Newmark, the founder of online classified-ads site Craigslist, thinks the U.S. has a cybersecurity problem.

The entrepreneur turned philanthropist has pledged to donate $100 million to help safeguard the country from potential future cyberattacks, the Wall Street Journal first reported. Newmark will allocate $50 million to protect infrastructure, like power grids, from cyberattacks, including from foreign nations. The other half of his donation will be put toward educating the general public about how to safeguard their personal information, according to the report.

Newmark, 71, retired from the company he founded in 2018.

“The country is under attack,” Newmark told the Wall Street Journal. He said that cybersecurity experts who are working to protect the country from attack “need people to champion them.”

Today, many households make use of connected appliances or smart devices that can make them vulnerable to being hacked by criminals. At the corporate level, cyberattacks have become increasingly common.

“In the current cyberwar, the fight is on our own shores, and we all need to play an active role for the protection of our country and ourselves,” Newmark writes on his website.

In June, a hacking group took down CDK Global’s software platform, crippling auto dealerships across the U.S. CDK said that hackers demanded a ransom in order to restore its systems. In February, hackers infiltrated payments manager Change Healthcare, paralyzing segments of the U.S. Health care system. They are but two examples of the tremendous repercussions a cyberattack can have on an industry.

As part of his latest commitment, Newmark, who has pledged to give away nearly all of his wealth to charity, is making donations to a project out of the University of Chicago’s public policy school that trains cybersecurity volunteers to strengthen local infrastructure. Child internet-safety group Common Sense Media, is another beneficiary, according to the WSJ report.

The large majority of the $100 million pledge has not yet been allocated, and organizations can apply for donations through Newmark’s philanthropic organization, Craig Newmark Philanthropies.

On the foundation’s website, Newmark says he likes to donate to organizations that he believes in and lets them spend the money as they see fit. “Okay, what I do is find people who are really good at their jobs, and who can tolerate my sense of humor. I provide them with resources, and then get outta their way,” he states.

In addition to cybersecurity, other causes Newmark champions include support for military families and veterans, safeguarding trustworthy journalism and pigeon rescue.