CBS News

Will homebuyer competition rise when mortgage interest rates are cut?

Getty Images/iStockphoto

Since the start of the pandemic, potential homebuyers have faced unprecedented challenges in navigating the U.S. real estate market. During the height of COVID-19, mortgage rates repeatedly hit record lows but home prices surged due to low supply and high demand. Then, in the post-pandemic era, home inventory remained constrained and prices remained elevated, but conditions became even more difficult for aspiring buyers as mortgage rates climbed to the highest levels since 2000.

Fortunately, buyers have seen some long-awaited good news recently, as mortgage rates have finally begun to decline in anticipation of the Federal Reserve cutting the benchmark interest rate. September rates are already down more than a full point since their peak and, while rates have a ways to go before they fall below 6%, the mortgage interest rate forecast for fall looks promising.

Unfortunately for would-be buyers eagerly preparing for a rate cut, a reduction in borrowing costs isn’t all good news. A further rate drop could complicate homebuying in important ways, including negatively impacting fall home prices. Buyers considering jumping into the market as mortgage rates fall must also come to terms with how rate reductions could potentially impact the competition they face.

Don’t wait for buyer competition to increase. Start comparing your best mortgage loan options now.

Reduced rates could lead to increased demand — and higher prices

Buyers hoping that upcoming mortgage rate cuts will increase home affordability could be in for an unpleasant surprise. That rate reduction may be accompanied by rapid home price increases that offset most or all of their savings from lower borrowing costs.

“Homebuyer competition will 1,000% increase when mortgage interest rates are cut,” says Sean Adu-Gyamfi, a real estate broker with Coldwell Banker Warburg. “Besides the fact that lower rates mean better affordability for most people, there has been a very real sense of FOMO from prospective buyers when they did not purchase in late 2020 through 2021.”

Aspiring owners who missed their window during the record-low rates of the pandemic era may not be willing to delay again as rates start to drop out of fear of missing the boat a second time. Instead, they may be eager to jump into the market with both feet, even if that means becoming involved in bidding wars.

“If a would-be buyer is waiting for interest rates to be cut before entering the market, they should expect competition to be greater since other potential buyers are in the same position, waiting on the sidelines.” agent Steven Gottlieb of Coldwell Banker Warburg says.

Unfortunately, if demand increases but supply doesn’t rise at least as quickly, this will create significant upward pressure on home prices — compounding a problem that already exists in the current market and has since the pandemic began.

The August Housing Market Update prepared by the U.S. Department of Housing and Urban Development suggests, unfortunately, that supply issues may persist since we’re starting with too few houses even as new buyers get ready to flood in.

The HUD report shows that construction of new homes was down 14.8% year-over-year in July of 2024. And, while the inventory of existing homes in July was up 19.8% year-over-year, it still represents just a 4-month supply. The National Association of Realtors says a six-month supply is needed for moderate price appreciation, with a lower level resulting in more rapid price increases.

Learn how affordable the right mortgage loan could be for you today.

Reduced mortgage rates could result in more inventory

The good news is that it’s possible that reduced mortgage rates won’t just create more potential homebuyers. It could also result in inventory increasing substantially from the current baseline. If this prediction pans out, it would mean that home prices don’t rise as rapidly as some have feared — or even increase much at all.

“Right now, we have a large number of homeowners with low rates locked in following the pandemic,” says Beverly Hankinson, senior vice president and mortgage loan advisor manager at Frost Bank. “Many of those folks have been on the sidelines of the housing market but lower rates could be the incentive they’ve been looking for to increase their space or move closer to work or school.”

In other words, a rate drop could finally push into action aspiring sellers who haven’t wanted to move because doing so meant giving up their current low rate. As borrowing costs decline and these would-be sellers no longer face the prospect of their rate nearly doubling if they relocate, the dam could break on new listings.

“We’re already seeing an increase in the supply of homes on the market and lower rates could help continue the trend, which would be good news for buyers despite the increased competition,” Hankinson says.

Since studies show around 71% of potential buyers have been waiting on a rate drop to act, ultimately the potential price increases will depend on whether more buyers or more sellers are motivated to make moves as rates decline. Unfortunately, this can be difficult for buyers to predict.

“Finding the right time to buy is not a science,” Hankinson says.

The bottom line

Aspiring homeowners frustrated with this continued uncertainty can and should be proactive about getting their finances in order. This will ensure they’re ready to buy when the right property at the right price comes along. Those steps can include:

- Setting a purchasing budget

- Pursuing mortgage pre-approval to understand costs and borrowing limits

- Beginning to look at homes in the local market to understand the options available.

“The time to buy is always when you are financially & emotionally ready,” says Adu-Gyamfi.

If you have your down payment and are approved for a loan you can afford, you can choose to take action now and refinance later if rates fall further. Or, you can wait until a rate cut happens and be ready with a competitive offer accompanied by proof of financing. This will give you a leg-up in getting an accepted offer, even in a market with more competition.

Either approach will hopefully lead to owning the home you love without regrets — as long as you made the financially smart choice not to buy more house than you could comfortably pay for.

CBS News

Good enough to eat: Noah Verrier’s paintings of comfort food

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

A study to personalize nutrition guidance just for you

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

CBS News poll finds Trump starts on positive note as most approve of transition handling

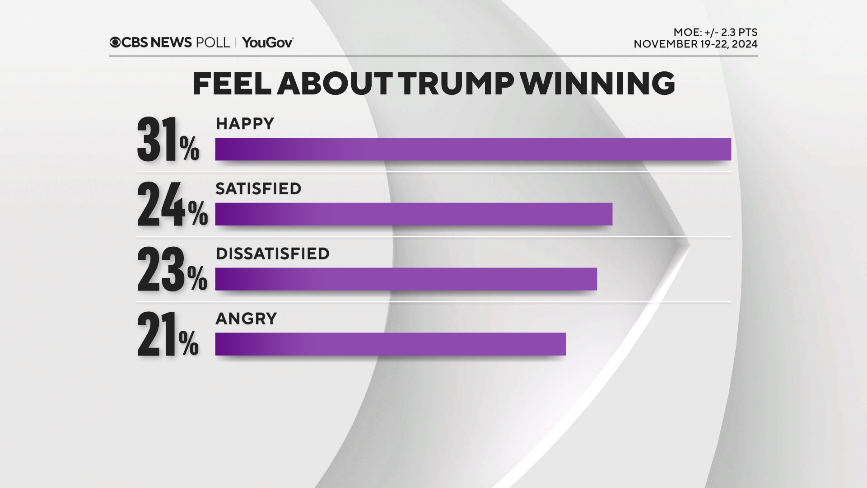

President-elect Donald Trump’s incoming administration starts off with mostly good will from the public: a majority of Americans overall are either happy or at least satisfied that he won and are either excited or optimistic about what he’ll do as president.

Trump’s handling of his presidential transition gets approval from most Americans overall and brings near-universal approval from his voters, along with a net-positive response about his selections for Cabinet posts, in particular, Sen. Marco Rubio, who is Trump’s pick to be secretary of state.

After inflation and the economy so dominated the election, Americans are more inclined to think his administration will bring down prices for food and groceries rather than raise them, and his voters overwhelmingly say that. Going into the election, his backers expected that, too.

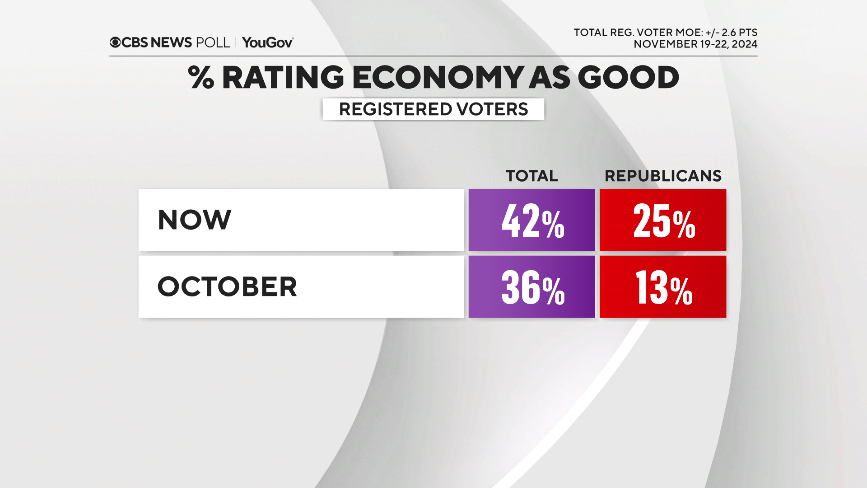

In a similar vein, Trump’s election already has some Republicans’ views of the economy improving.

Overall, Republicans today are more excited about what Trump will do as president now than they were in 2016 when he was first elected.

Democrats say they feel more scared about what Trump might do than they did in 2016, and a large majority of Democrats think as president he will threaten their rights and freedoms. But at the same time, there seems to be a sense of exhaustion, as fewer than half of Democrats feel motivated to oppose Trump right now.

Americans, and Democrats specifically, do think the Biden administration should work with the incoming Trump administration to ensure a smooth transition, and that congressional Democrats should work with Donald Trump on issues where they find common ground.

Trump and the economy

After winning comes expectations. There’s a net optimism about the incoming administration’s effect on food and grocery prices, especially among Trump’s voters. That comes as most Americans continue to say prices are currently rising. And inflation was a big factor in Trump winning in the first place.

It may be no surprise then that among many potential items for the incoming administration, Americans say plans to lower prices ought to be the top priority.

The percentage of Republicans who call the U.S. economy good, while still low, has gone up, as the percentage who call it very bad has dropped. That pushes voters’ overall evaluation of the economy slightly higher than it’s been this year — and further spotlights how much partisanship, along with optimism, always plays into these evaluations.

Trump selections of Cabinet and agency chiefs for his administration

Trump’s current selections for agency heads and Cabinet picks get rated overwhelmingly as good choices from Trump’s voters, and are net-positive as selections among Americans who have heard enough about them to say. (Many have not heard enough yet.)

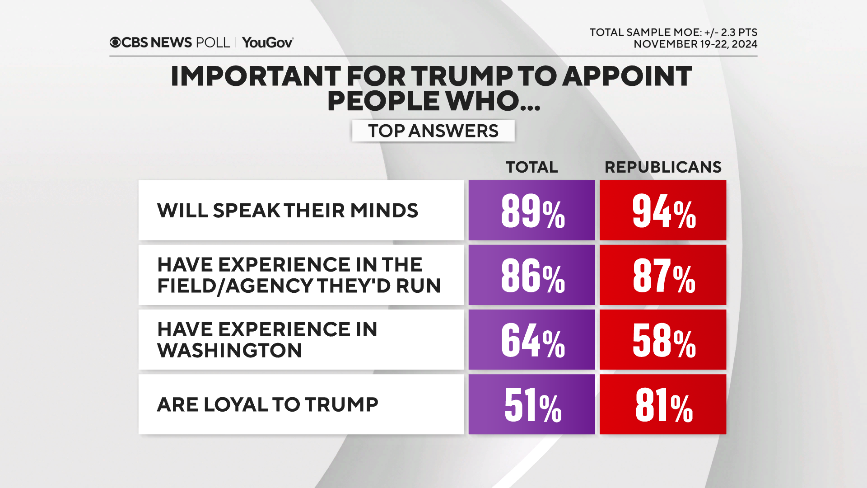

As a general rule, Americans want Trump to appoint people who’ll speak their minds and who have experience in the field or agency they’ll run. But in addition to those qualities, Republicans also want people who’ll be loyal to Trump.

A large majority of Republicans and Trump voters think Elon Musk should have at least some influence in the Trump administration. Americans overall are more split on that, largely along partisan lines.

Big majorities of Americans — and a slight majority of Republicans — would like to see the Senate hold hearings on his nominations, rather than let him make those appointments without it.

(Within self-identified Republicans, MAGA Republicans are relatively more inclined to say the Senate should skip the hearings.)

That sentiment holds whether or not people are told or reminded that the Constitution says the Senate should give advice and consent.

As a general matter, though, most of Trump’s voters and most Republicans do want Trump to have more presidential power this term than he did in his last. That sentiment is higher among Republican voters now than during the campaign.

Trump policies

On another economic front, Trump’s voters overwhelmingly favor the idea of tariffs: most of them don’t believe that will make prices higher. (For the third who believe tariffs will raise prices but support them anyhow, this is presumably a cost they’re willing to bear.)

For the public overall, opposition to tariffs goes hand in hand with the belief they’ll lead to higher prices.

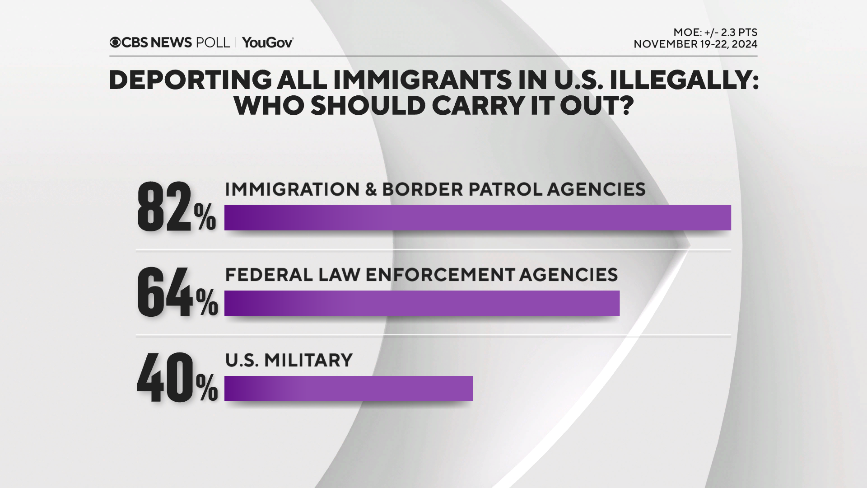

As was the case with voters throughout the campaign, most Americans would, in principle, approve of a new mass deportation program.

If the Trump administration does start a mass deportation program, most of the public would have it carried out by law enforcement or current immigration agencies — most would not have the U.S. military do it.

Elections and democracy

The 2024 results have shifted Republicans’ views of U.S. democracy and also returned some confidence to their view of U.S. elections. Few Republicans suspect fraud in 2024. They overwhelmingly did about 2020.

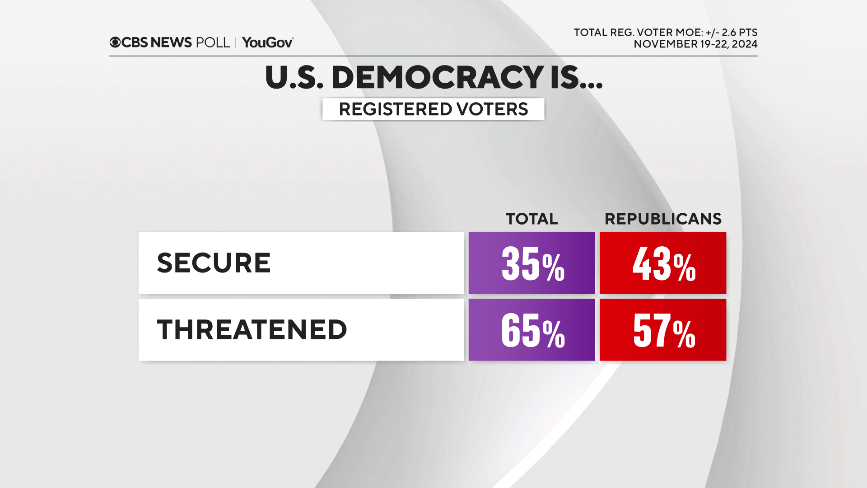

Following Trump’s victory, there’s been an increase in the number of Republicans who say democracy and rule of law is secure, though most Americans continue to say it is not.

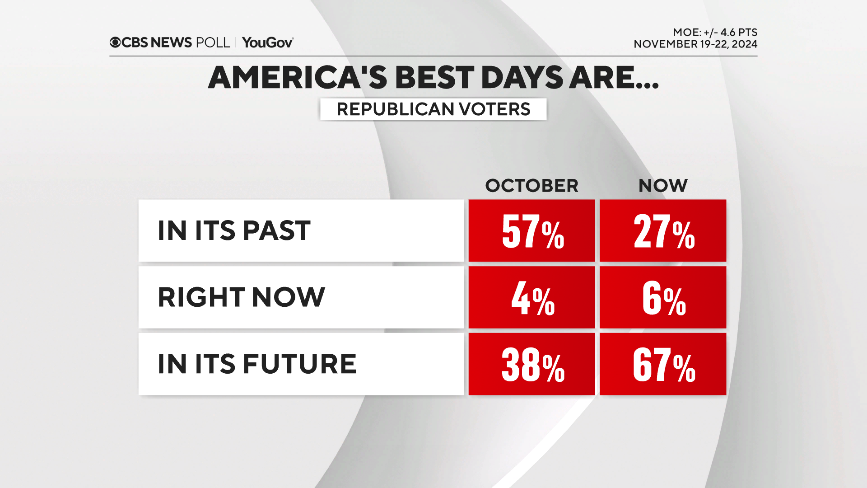

Looking ahead, there’s another shift along partisan lines. Throughout the campaign, Republicans said America’s best days were in its past, while Democrats felt they were in the future. These views are reversed now. After Trump’s win, most Republicans feel America’s best days are in its future.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,232 U.S. adults interviewed between November 19-22, 2024. The sample was weighted to be representative of adults nationwide according to gender, age, race, and education, based on the U.S. Census American Community Survey and Current Population Survey, as well as 2024 presidential vote. The margin of error is ±2.3 points.