CBS News

9/22: The Takeout: State election administration panel

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Why you should open a CD now that inflation is rising again

Getty Images

Savers concerned about dwindling interest rates on their money woke up to some welcome news on Wednesday with the latest inflation reading showing an uptick in October. While not a positive development for the wider economy, a rise in inflation could slow interest rate cuts, two of which have been issued in the last three months. Now at 2.6%, inflation jumped from September’s 2.4%, coming in higher after September’s Fed rate cut and ahead of the November cut issued last week. That’s still higher than the Federal Reserve’s target 2% goal.

Against this volatile backdrop, savers may want to take a final chance at exploiting this inflation cycle by opening a high-yield savings or certificate of deposit (CD) account. CDs, in particular, can still be advantageous now, despite the wider rate climate cooling this fall. Below, we’ll detail three reasons why it may be worth opening a CD now that inflation is rising again.

See how much more you could be earning on your money with a top CD here now.

Why you should open a CD now that inflation is rising again

Here are three reasons why you should consider opening a CD now that inflation just rose again:

Rates are still relatively high

Sure, CD interest rates have declined this year, with 1-year CD terms feeling the greatest effect. But that doesn’t mean that rates are at the 1% mark (or less) from 2020, either. Right now, you could still secure a 4.50% rate on a 1-year CD or 4.85% on a 6-month CD. Even 3-year CDs have rates over 4% currently. But, as has been shown for most of 2024, these rates are unlikely to remain this high for much longer. So you should consider acting now in case the next inflation reading shows a move back toward that 2% goal.

Get started with a top CD account online today.

Rates could fall if inflation drops again

If inflation falls again in November or December, interest rates on CDs could fall again – even without a formal Fed rate cut being issued. If inflation and other economic indicators lead lenders to expect more rate cuts, they may start reducing their CD offers in advance, as is the norm. And Wednesday’s inflation report didn’t come in so hot that it’s unrealistic to expect additional rate reductions ahead, even if they may not be issued exactly when previously expected. Understanding this, then, it makes sense to lock in a high CD rate while you still can.

You’ll protect your money until this inflation cycle ends

CD interest rates are high – and fixed. Unlike those on regular savings accounts and even high-yield savings accounts, this fixed-rate nature ensures accurate calculations so you’ll know exactly how much you stand to earn upon account maturity. And that locked rate will remain the same even if additional rate reductions are issued during the CD’s full term. So not only will you earn a high rate, but you’ll continue to earn that high rate and thus protect your money until this inflation cycle ends.

The bottom line

The window of opportunity to open a high-rate CD account is closing, but as this week’s inflation reading underlines, it hasn’t closed completely just yet. Rates on these accounts are still relatively high but they could fall again due to any number of economic indicators. But by opening a CD now, you’ll lock in an elevated rate and add a layer of protection against additional rate volatility to come. Just be sure to only deposit an amount of money that you can easily afford to part with for the full CD term or you’ll risk having to pay an early withdrawal penalty to regain access to your funds.

CBS News

Lacey Chabert on new holiday films

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

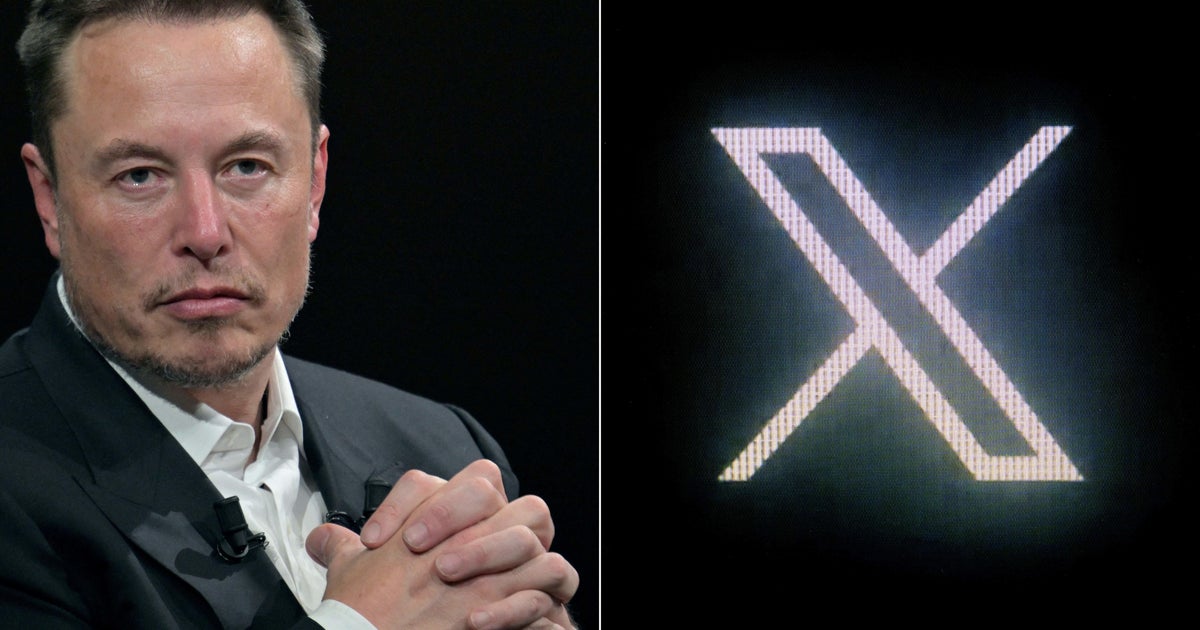

The Guardian to stop posting on X, calling it “a toxic media platform”

The Guardian will no longer post its content under its official account on X, the British newspaper announced on Wednesday.

The Guardian stated the move had been under consideration for a while, “given the often disturbing content promoted or found on the platform, including far-right conspiracy theories and racism.” The media outlet added that the U.S. presidential election campaign underscored its view that the social media platform is “toxic” and that its owner, Elon Musk, used it to shape political discourse.

The London-based paper’s announcement comes as President-elect Donald Trump named Musk as co-head of what he called his “Department of Government Efficiency.” Musk, the billionaire owner of Tesla and SpaceX, was heavily involved in Trump’s campaign.

X had been Twitter before its board agreed to be acquired by Musk in 2022 in a deal that valued the platform at $44 billion.

X users will still be able to share Guardian articles on the platform, and the newspaper’s journalists will at times use it for news-gathering purposes, just as they use other social networks.

“We can do this because our business model does not rely on viral content tailored to the whims of the social media giants’ algorithms — instead we’re funded directly by our readers.”

The Guardian’s X account bio now describes itself as an archived page and points readers to its website and app.

X did not immediately respond to a request for comment.

The move by the Guardian comes in the wake of an exodus by advertisers on X, with companies including Apple, Coca-Cola and Disney removing paid ads from X last year. The company’s difficulties persisted into 2024, with the World Bank halting all paid ads on the platform in early September after a CBS News investigation found its advertisements showing up under a racist post from an account that prolifically posts pro-Nazi and white nationalist content.

More recently, a survey of marketers by Kantar found a quarter of advertisers plan to reduce spending on X in 2025.