CBS News

End of student loans grace period a potentially perilous time for borrowers

The 12-month grace period for student loan borrowers ended on Sept. 30. The “on-ramp” period helped borrowers who are struggling to make payments avoid the risk of defaulting and hurting their credit score.

“The end of the on-ramp period means the beginning of the potentially harsh consequences for student loan borrowers who are not able to make payments,” said Persis Yu, Deputy Executive Director at the Student Borrower Protection Center.

Around 43 million Americans have student loan debt, amounting to $1.5 trillion. Around eight million of those borrowers had enrolled in the SAVE plan, the newest income-driven repayment plan that extended the eligibility for borrowers to have affordable monthly student loan payments. However, this plan is currently on hold due to legal challenges.

With the on-ramp period and a separate program known as Fresh Start ending and the SAVE plan on hold, student loan borrowers who are struggling to afford their monthly payments have fewer options, added Yu. Student loan borrowers who haven’t been able to afford their monthly payments must consider their options to avoid going into default.

What you need to know if you have student loans

The Education Department implemented this grace period to ease the borrower’s transition to make payments after a three-year payment pause during the COVID-19 pandemic. During this year-long period, borrowers were encouraged to keep making payments since interest continued to accumulate.

“Normally, loans will default if you fall about nine months behind on making payments, but during this on-ramp period, missed payments would not move people towards defaulting and then being subject to forced collections. However, if you missed payments, you still would be falling behind, ultimately, on repaying your loans,” said Abby Shaforth, director of National Consumer Law Center’s Student Loan Borrower Assistance Project.

Since this grace period has ended, student loan borrowers who don’t make payments will go delinquent or, if their loans aren’t paid for nine months, go into default.

Borrowers who can’t afford to make payments can apply for deferment or forbearance, which pause payments, though interest continues to accrue.

Consequences of failing to pay

Borrowers who can’t or don’t pay risk delinquency and eventually default. That can badly hurt your credit rating and make you ineligible for additional aid and government benefits.

If a borrower missed one month’s payment, they will start receiving email notifications, said Shaforth. Once the loan hasn’t been paid for three months, loan servicers notify to the credit reporting agencies that the loan is delinquent, affecting your credit history. Once the borrower hasn’t paid the loan for nine months, the loan goes into default.

If you’re struggling to pay, advisers first encourage you to check if you qualify for an income-driven repayment plan, which determines your payments by looking at your expenses. You can see whether you qualify by visiting the Federal Student Aid website. If you’ve worked for a government agency or a non-profit organization, you could also be eligible for the Public Service Loan Forgiveness Program, which forgives student debt after 10 years.

When you fall behind on a loan by 270 days – roughly 9 months – the loan appears on your credit report as being in default.

Once a loan is in default, it goes into collections. This means the government can garnish wages (without a court order) to go toward paying back the loan, intercept tax refunds, and seize portions of Social Security checks and other benefit payments.

If your budget doesn’t enable you to resume payments, it’s important to know how to navigate the possibility of default and delinquency on a student loan. Both can hurt your credit rating, which would make you ineligible for additional aid.

If you’re in a short-term financial bind, you may qualify for deferment or forbearance – allowing you to temporarily suspend payment.

To determine whether deferment or forbearance are good options for you, you can contact your loan servicer. One thing to note: interest still accrues during deferment or forbearance. Both can also impact potential loan forgiveness options. Depending on the conditions of your deferment or forbearance, it may make sense to continue paying the interest during the payment suspension.

The U.S. Education Department offers several plans for repaying federal student loans. Under the standard plan, borrowers are charged a fixed monthly amount that ensures all their debt will be repaid after 10 years. But if borrowers have difficulty paying that amount, they can enroll in one of several plans that offer lower monthly payments based on income and family size. Those are known as income-driven repayment plans.

Income-driven options have been offered for years and generally cap monthly payments at 10% of a borrower’s discretionary income. If a borrower’s earnings are low enough, their bill is reduced to $0. And after 20 or 25 years, any remaining debt gets erased.

In August, the Supreme Court kept on hold the SAVE plan, the income-driven repayment plan that would have lowered payments for millions of borrowers, while lawsuits make their way through lower courts.

Eight million borrowers who had already enrolled in the SAVE plan don’t have to pay their monthly student loan bills until the court case is resolved. Debt that already had been forgiven under the plan was unaffected.

The next court hearing about this case will be held on Oct. 15.

The Fresh Start program, which gave benefits to borrowers who were delinquent prior to the pandemic payment pause, also closed on Sept. 30. During this limited program, student loan borrowers who were in default prior to the pandemic were given the opportunity to remove their loans from default, allowing them to enroll in income-driven payment plans or apply for deferment, among other benefits.

CBS News

How much would a $75,000 home equity loan cost per month after rate cuts?

Getty Images

If you’re considering a home equity loan, this could be an ideal time to explore your options. After all, homeowners have seen significant growth in their home equity over the past year and the average homeowner has about $327,000 in equity currently. Plus, with the Federal Reserve cutting its benchmark rate by 50 basis points recently, borrowing against that equity has become more affordable. So, for many, taking out a home equity loan now could be a cost-effective way to fund renovations, pay off high-interest debt or manage other large expenses.

Because home equity loans are secured by the value of your home, lenders are typically able to offer lower rates compared to other loan types — and the rates on home equity loans are fixed, providing you with predictable monthly payments, too. And when you factor in the recent rate reduction, you may be able to lock in an even better deal on this type of loan than normal, as home equity loan rates have dropped in recent weeks.

However, it’s important to carefully evaluate the monthly payment obligations tied to any home equity loan you take out, particularly now that rates have been adjusted. So, how much would a $75,000 home equity loan cost per month in the current environment?

Ready to tap into your equity? See what home equity loan rate you could qualify for here.

How much would a $75,000 home equity loan cost per month after rate cuts?

The monthly cost of a $75,000 home equity loan depends primarily on two factors: the interest rate you qualify for and the length of the repayment period. The rates you’re offered can vary depending on your credit score, debt-to-income (DTI) ratio and other factors, but there are two common repayment terms for home equity loans: 10 years and 15 years.

The average 10-year fixed home equity loan rate stands at 8.50% currently, while the average rate for a 15-year loan is slightly lower at 8.41%. Based on the current average rates and terms, here’s what you might expect to pay each month on a $75,000 home equity loan:

- 10-year fixed home equity loan at 8.50%: $929.89 per month

- 15-year fixed home equity loan at 8.41%: $734.60 per month

These figures illustrate the trade-off between shorter and longer repayment terms. While the 10-year loan offers a higher monthly payment, it allows you to pay off the debt more quickly and potentially save on total interest over the life of the loan. Conversely, the 15-year option provides lower monthly payments, which may be more manageable for some borrowers, but results in paying more interest over time.

Find out what home equity loan rates are available to you here.

The impact of future Fed rate cuts

While today’s home equity loan rates are attractive overall, there may be potential for even greater savings soon. Analysts expect that if inflation continues to remain low or decrease, the Federal Reserve could implement additional rate cuts later this year — one in November and one in December. If these rate cuts occur, we could see home equity loan rates fall even further, leading to even more affordable borrowing costs.

For example, if a 25-basis-point rate cut occurs in November and home equity loan rates were to decrease by the same amount, bringing the rate for a 10-year loan down to 8.25%, the monthly payment on a $75,000 loan would decrease to $919.89, saving you about $10 per month compared to what you would pay at today’s rates.

Similarly, if a 15-year loan rate dropped by 25 basis points to 8.16%, your monthly payment would fall to $723.68. That would result in monthly savings of $10.92 and total savings of about $1,980 in interest over the loan term.

Now let’s say that home equity rates were to fall by 50 basis points in total, dropping the average 10-year home equity loan rate to 8.00% and the average 15-year home equity loan rate to 7.91%. That would lower the monthly payment on a 10-year home equity loan to $909.96, while the monthly payment on a 15-year home equity loan would fall to $712.85.

While the potential savings are worth considering, waiting for additional rate cuts could be risky, as predicting future rate movements is not an exact science — and any number of factors outside of Fed rate cuts can have an impact on where rates head. Given the risks, it could make more sense to secure a loan at today’s favorable rates rather than gamble on further reductions.

The bottom line

The recent interest rate cuts have made home equity loans more attractive than they’ve been in recent years, with a $75,000 loan potentially costing between about $735 and $930 per month, depending on the repayment term and current interest rates. However, it’s crucial to remember that home equity loan rates can vary significantly from one lender to another, so if you’re considering tapping into your home equity, it’s typically smart to shop around, compare offers from multiple lenders and be prepared to act quickly when you find a rate that aligns with your financial goals and budget constraints.

CBS News

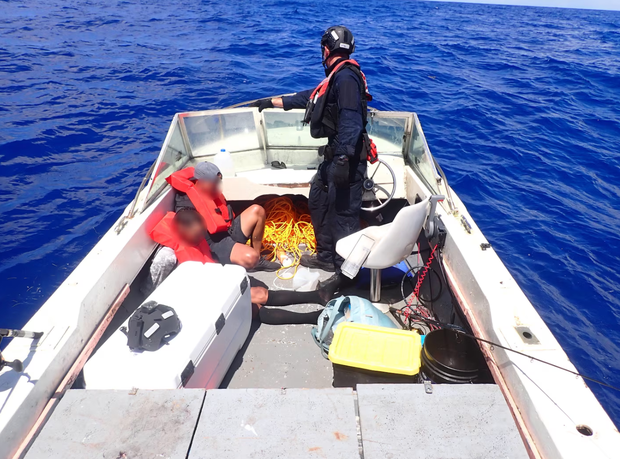

Coast Guard seizes $4.3 million of cocaine from boat off coast of Puerto Rico

Two men are in the custody of the Drug Enforcement Agency after Coast Guard officials seized nearly 400 pounds of cocaine from a boat in Puerto Rico.

The crew of a Coast Guard aircraft spotted a suspicious vessel in international waters on Sept. 28. The vessel was steering towards Rincón, a beach town on Puerto Rico’s western coast, the agency said in a news release on Wednesday. The Joseph Tezanos, a 154-foot fast response cutter craft ported in San Juan, Puerto Rico, was diverted to intercept the vessel.

The Joseph Tezanos stopped and searched the vessel, officials said, and Coast Guard crew members found 142 “brick-sized packages of suspected contraband” inside the boat.

U.S. Coast Guard

Those packages tested positive for cocaine, the Coast Guard said, with an estimated value of $4.3 million.

The two men who were aboard the ship were arrested and transferred to the custody of the DEA. Both men are United States citizens, and face federal charges including possession to with intent to distribute a controlled substance aboard a vessel subject to the jurisdiction of the United States, the Coast Guard said. The charges carry a minimum sentence of 10 years in prison and a maximum sentence of life in prison.

U.S. Coast Guard

“I congratulate the United States Coast Guard personnel for this successful interdiction of an international drug smuggling venture,” said United States Attorney W. Stephen Muldrow in the news release. “We greatly appreciate the U.S. Coast Guard’s unwavering support and dedication to keeping Puerto Rico and our nation safe.”

The seizure was made as part of the Caribbean Corridor Strike Force, which brings together task forces from multiple agencies to stop the flow of illicit substances in the region. The DEA, FBI, Coast Guard, Homeland Security, and ICE are all represented in the task force.

U.S. Coast Guard

It’s one of several large caches of cocaine seized by officials in recent months. Federal officials seized $33 million worth of cocaine left on a beach in Puerto Rico in early September. The 3,600 pounds of drugs were left on a beach on the popular tourist island of Vieques in the pre-dawn hours and the people who smuggled the drugs fled the area, officials said.

In August, two men from the Dominican Republic were arrested after they were found aboard a boat carrying more than 660 pounds of cocaine near Puerto Rico. In July, federal agents arrested two U.S. citizens and seized $4.6 million worth of cocaine west of the island.

Puerto Rico is considered a transit point for drugs being smuggled to the U.S. mainland and other countries.

CBS News

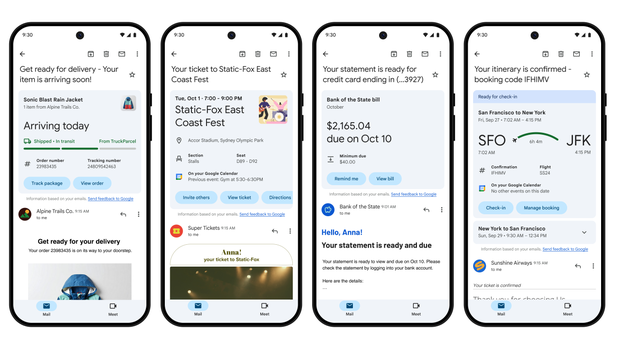

Gmail users get new summary cards to track purchases, events

Gmail users are getting an upgrade to their inboxes.

The email app’s summary cards have been redesigned to give users a snapshot of their purchases, including shopping receipts, travel confirmations, reservations and other information that used to be dispersed across apps and inboxes.

Summary cards are not new to Gmail, but they’ve been redesigned, and now have an inbox tab of their own, called “Happening soon,” according to Google.

If you buy tickets to a concert, the event’s summary card will have an action button that will allow you to add it directly to your calendar, or invite others to join the event, Google added.

The redesign also helps users set reminders to pay bills, and lets them know when they can expect a delivery, without having to dig deep into their inboxes and then follow a link.

The updated summary cards apply to four frequent types of emails, Google said. They include:

- Purchases: View order details and track package arrival dates.

- Events: See a summary of dinner reservation details or concert tickets, and add events to your calendar or invite friends to join you.

- Bills: View due dates for bills and set reminders to pay them.

- Travel: Manage reservations, check in for a flight and access travel details like a hotel’s check-out time all in one place.

The updated summary cards are now live. In the near future, Google will roll out the “Happening Soon” section at the top of inboxes where users can view updates without having to open emails.

Here’s what the new summary cards look like.