CBS News

Bomb dropped by U.S. in World War II explodes at airport in Japan, causing runway damage and cancellation of 80 flights

An unexploded U.S. bomb from World War II that had been buried at a Japanese airport exploded Wednesday, causing a large crater in a taxiway and the cancellation of more than 80 flights but no injuries, Japanese officials said.

Land and Transport Ministry officials said there were no aircraft nearby when the bomb exploded at Miyazaki Airport in southwestern Japan.

Officials said an investigation by the Self-Defense Forces and police confirmed that the explosion was caused by a 500-pound U.S. bomb and there was no further danger. They were determining what caused its sudden detonation.

Kyodo via AP Images

A video recorded by a nearby aviation school showed the blast spewing pieces of asphalt into the air like a fountain. Videos broadcast on Japanese television showed a crater in the taxiway reportedly about 7 yards in diameter and 3 feet deep.

Chief Cabinet Secretary Yoshimasa Hayashi said more than 80 flights had been canceled at the airport, which hopes to resume operations on Thursday morning.

“There is no threat of a second explosion, and police and firefighters are currently examining the scene,” Hayashi said.

A fire department “received a call from the airport at 7:59 am that there was an incident involving smoke,” its spokesman told AFP.

Miyazaki Airport was built in 1943 as a former Imperial Japanese Navy flight training field from which some kamikaze pilots took off on suicide attack missions.

A number of unexploded bombs dropped by the U.S. military during World War II have been unearthed in the area, Defense Ministry officials said.

Other unexploded ordinance dropped by the United States was reportedly found at a nearby construction site in 2009 and 2011.

Hundreds of tons of unexploded bombs from the war remain buried around Japan and are sometimes dug up at construction sites.

A total of 2,348 bombs weighing 41 tons were disposed of during fiscal year 2023, the Reuters news agency reported, citing the Self-Defense Force.

Last year, a World War II bomb that was found in England exploded in what authorities are calling an “unplanned” detonation.

AFP contributed to this report.

CBS News

Will it snow on Christmas? Maps show weather forecasts for 2024

With Christmas only a few days away, many Americans may be dreaming of a white Christmas, but few will end up walking in a winter wonderland. The warm and above-average temperatures in the weather forecast across the continental U.S. for Christmas week of 2024 are expected to keep any precipitation that falls as rain, not snow, for many parts of the country.

Where is most likely to get snow on Christmas?

If you’re looking for fluffy white flakes, some spots have a better chance than others.

This year, the only parts of the U.S. likely to see a white Christmas will be in the Rocky Mountains and along the U.S. border with Canada. That includes some northern areas of North Dakota, Minnesota, Wisconsin, Michigan, upstate New York, Vermont, New Hampshire and Maine.

Weather forecast for holiday travel

For those who are trying to travel on Monday, the more difficult regions will be in the Upper Midwest and in the northern Rockies. Falling snowflakes can be found in states like Idaho, western Montana, northern Minnesota, Wisconsin and northern Michigan. Interstate travel will be hazardous through parts of I-15, I-90, I-84, I-94 and I-75.

CBS News

The wintry weather conditions shift from the Great Lakes region into the Northeast on Tuesday. Cold air pushes through to bring upwards of a half a foot of snow to the interior Northeast.

Moisture from the Gulf of Mexico will bring rain showers to the Mississippi Valley. In the West, the next atmospheric river will deliver rain to the lower elevations, with snow falling in the Cascade Mountains. Hazardous interstate travel conditions will be found along I-5, I-90, I-94, I-80, I-81 and even parts of I-95 up the East Coast.

CBS News

Map of snow forecast for Christmas Day 2024

On Wednesday, Christmas Day, not many locations will see the fresh snowfall of picture-book holidays.

The definition of a “white Christmas” by the National Weather Service is having at least 1 inch of snow on the ground on Christmas morning. The only areas likely to meet that qualification on Christmas Day this year will be in the Rockies and along the U.S.-Canada border.

The moisture from the atmospheric river in the West will move into the Rockies to bring light snow to the higher elevations.

CBS News

Elsewhere, rain showers stick around in the Mississippi Valley, making for a soggy Christmas Day. Temperatures are forecast to be well above the freezing mark most places, which means precipitation will mainly be rain. Messy travel on Christmas could be found along Interstate 40, I-55, I-40, I-70, I-80 and I-90.

On Thursday, the next round of weather moves into the Northwest. Lower elevation rain can be expected along I-5, while in the interior Northwest.heavier snowfall is forecast in the Cascades and down into the Sierra Nevada mountains. Lingering rain showers continue in the Mississippi Valley and into parts of the Midwest.

Are white Christmases getting rarer?

The National Oceanic and Atmospheric Administration has tracked snowfall data across the U.S. for years, and says there have been some notable changes over the past four decades, “consistent with the reality of long-term warming.”

When comparing the average probability of Christmas snowfall from 1981-2010 to the period from 1991-2020, NOAA says, “More areas experienced decreases in their chances of a white Christmas than experienced increases.”

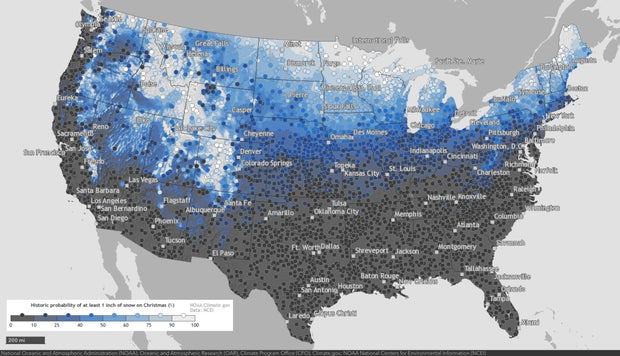

The NOAA map below shows areas with the highest historic probability of seeing a white Christmas. Areas shaded in light blue have a higher than average chance, while the northern and mountain locations marked in white have historically had snow on Christmas at least 90% of the time.

NOAA/Climate.gov

You can explore an interactive version of the map on NOAA’s website here.

CBS News

Tyler Perry and Kerry Washington on bringing the untold story of “Six Triple Eight” to the big screen

Hollywood powerhouses Tyler Perry and Kerry Washington have joined forces to tell the remarkable story of the 6888th Postal Battalion, which was the only women’s Army Corps unit of color to be stationed in Europe during World War II. Perry — who wrote, directed and produced the film — describes “Six Triple Eight” as an important chapter in U.S. history.

The film centers on the women of the 6888th who were sent to Europe with the daunting task of delivering a backlog of nearly 17 million pieces of mail to U.S. soldiers and their families. The women not only completed the mission, but did so in just 90 days, defying expectations. Kerry Washington stars as Major Charity Adams, the real-life commanding officer of the unit and the highest-ranking Black female officer during the war.

At Joint Base Myer-Henderson Hall near Washington, D.C., Perry and Washington discussed the significance of sharing this story.

Washington’s portrayal of Adams was a key part of the project. Perry explained his choice of Washington for the role, saying, “I thought, ‘Let’s show the world that there’s something so different here from you. I know they know Olivia Pope. But when we’re done, they’re going to see no one but Charity Adams.'”

The film also brought intense moments of historical reflection. Perry recounted a personal encounter with Lena King, one of the last surviving members of the 6888th, who was 99 years old at the time and home on hospice.

“I actually wanted all of the surviving members to see it,” he said. “Lena was the only one who got a chance to. I rushed a cut together and bought it to her.”

King’s reaction to the film was unforgettable for Perry.

“We watched it and she was in tears. And at the end of it, she’s saluting and she’s crying. And she says, ‘Tyler, thank you for letting the world know that black women contributed into war effort,'” Perry recalled.

Both Perry and Washington recognized the story’s importance, emphasizing that the women of the 6888th had been overlooked historically.

“There were 855 Black women and women of color who served in World War II, and no one knew it,” Perry said. Washington added, “And went overseas to represent this country.”

The film also explores the strength of these women who faced immense odds.

“It really is about exceeding expectations and being able to achieve against all odds and being able to stand up to people who don’t believe in you to say, ‘I believe in me. And I believe in we,'” Washington said.

You can stream “Six Triple Eight” on Netflix.

CBS News

Hours left to prevent government shutdown after Trump slams Johnson bill

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.