CBS News

How far will credit card interest rates fall in October?

Getty Images

Americans have been keeping a close eye on interest rate trends in recent months, hoping for some relief from the pressure of high borrowing costs. And, in September, they got it when the Federal Reserve decided to slash its benchmark rate by 50 basis points — the first rate cut in four years. The ripple effects of that rate cut then helped to drive down the rates on mortgages and other types of loans. However, credit card interest rates have remained at record highs despite the Fed’s move.

At an average of nearly 23%, today’s credit card rates are straining the budgets of the millions of Americans who are carrying a balance. This is particularly concerning because the average cardholder has nearly $8,000 in credit card debt currently — meaning that the interest charges are compounding quickly for borrowers. Given today’s high cost of credit card debt, a reduction in interest rates could be a lifeline for those struggling to stay afloat.

But while loan rates tend to shift quickly with the Fed’s rate decisions, credit card rates don’t always follow suit. So, how far will credit card interest rates fall in October now that the Fed has slashed rates? That’s what we’ll discuss below.

Learn how debt relief could help you lower your credit card costs now.

How far will credit card interest rates fall in October?

Despite the recent positive economic indicators — like cooling inflation and the Fed policy shifts — the outlook for significant drops in credit card interest rates this October remains cautious. While there’s potential for some downward movement, cardholders shouldn’t expect dramatic changes in the near term.

The primary reason for this tempered expectation is the nature of credit card interest rates themselves. Unlike mortgage rates or personal loan rates, which tend to respond quickly to changes in the federal funds rate, credit card rates operate with a degree of independence. That’s because card rates are typically tied to the prime rate, which, while influenced by Federal Reserve actions, is not directly controlled by them.

Credit card issuers have also been historically slow to pass on the benefits of rate cuts to consumers. While they’re often quick to raise rates in response to Federal Reserve hikes, the reverse process tends to be more gradual. This asymmetry in rate adjustments means that even if there’s downward pressure on interest rates in the broader economy, credit card rates may lag behind.

Another factor to consider is the current high-rate environment. With average rates already at record levels, any reductions are likely to be modest in the context of overall rates. For example, even another substantial 50 basis point cut would only bring a 23% APR down to 22.5% – a change that, while helpful, might not provide significant relief to those struggling with large balances.

It’s also worth noting that credit card interest rates are influenced by factors beyond just the federal funds rate. Market competition, especially in the rewards card sector, regulatory changes and evolving risk assessments by issuers all play a role in determining rates. These factors have contributed to the upward trend in rates over recent years and are unlikely to reverse course dramatically in the space of a single month.

That said, some issuers may implement small rate reductions in October. However, widespread, significant drops are improbable, so cardholders should probably prepare for a scenario where rates remain relatively stable or see only minor decreases.

Explore your credit card debt relief options and get the help you need today.

How to lower your credit card rates now

Waiting for credit card interest rates to fall this October may not be the most effective strategy, especially considering that any reductions that may occur would be minimal. Luckily, there are some proactive steps you can take to lower your credit card interest rates now instead.

One option is to take advantage of balance transfer offers that could lower your rate temporarily. Many credit card companies offer promotional 0% APR balance transfer cards, allowing you to move high-interest debt to a card with no interest for a set period — which typically ranges from 12 to 18 months. During this period, you can focus on paying down your principal balance without the burden of accumulating interest.

Another option is debt consolidation. By consolidating multiple credit card balances into a single loan with a lower interest rate, you can simplify your payments and reduce the overall interest you’re paying. This can be an effective way to manage high-rate card debt while maintaining predictable monthly payments.

You may also want to explore debt management programs. These programs, offered by credit counseling agencies, help you negotiate lower interest rates with your creditors and create a structured repayment plan. While it won’t eliminate your debt, it can make it more manageable by reducing the interest you pay.

The bottom line

While the Federal Reserve’s actions could eventually influence credit card interest rates, it’s unlikely that cardholders will see significant reductions in the near term. So for those carrying high balances, waiting for interest rates to fall may not be the best solution. There are other options to consider though, like balance transfers, debt consolidation or debt management programs, which may provide quicker and more substantial relief instead.

CBS News

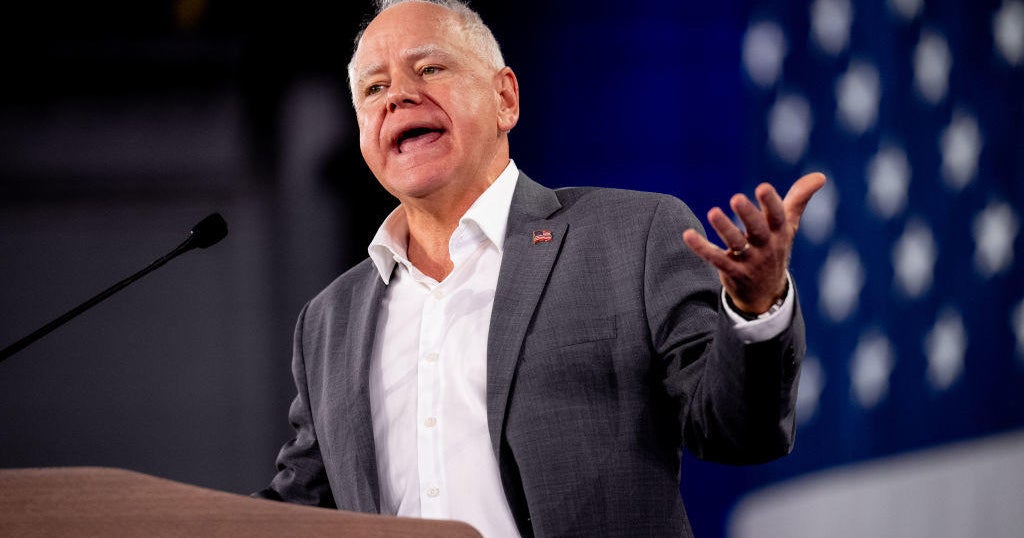

Tim Walz says he had his dates wrong, admits he didn’t travel to China until August 1989

At his first campaign stop since the vice presidential debate, Tim Walz sought to clarify comments he has made about his travel to China and Hong Kong in 1989 as bloody pro-democracy protests took place.

Walz admitted during the debate that he had previously misspoken in 2014 when he said he was in mainland China between April and June 1989, during the Tiananmen Square protests, which took place between April 15 and June 4 of that year. After that concession, however, Walz repeated the mistatement, saying, “So, I was in Hong Kong and China during the democracy protests, went in, and from that I learned a lot of what needed to be in governance.”

Butan Alliance Times-Herald news report from May 1989 shows then-Staff Sgt. Walz was in the U.S. and toured a Nebraska Army National Guard armory. A news radio station also reported in another Nebraska newspaper in August 1989 that Walz said he would “leave Sunday en route to China,” which was after the protests.

Responding to a question about his remarks from CBS News in Middleville, Pennsylvania, Walz corrected himself and admitted he had his dates wrong, adding that he needs to be clearer when he speaks.

“So, my clarity, to take away from the message, is something I want to be very clear — August of ’89 into Hong Kong, into China,” said the Minnesota governor, who often talks fast and in shorthand.

Walz also clarified a verbal misstatement from the debate, when he said he was friends with school shooters. The moment was quickly seized upon by Republicans and former President Donald Trump, who posted on Truth Social about it.

Walz, a former teacher and football coach, said that although he misspoke, it is “pretty damn clear” that he has stood with school shooting victims and passed legislation in an effort to curb such violence.

In the same conversation at the debate on Tuesday night, Walz mentioned that his teenage son, Gus, was a witness to a shooting. On the campaign trail, Walz often says that even though he supports the Second Amendment, he doesn’t think that should allow children to be shot dead in the hallways.

Walz’s rally Wednesday in York, Pennsylvania, was filled with supporters who defended him.

“Who can remember where they were 30 years ago?” Joan Nagy, of Lancaster, Pennsylvania asked.

“Anybody can make a mistake,” Les Ford said, adding, “When’s the last time you heard Donald Trump or his running mate correct themselves?”

After rolling into the rally on the Harris-Walz campaign bus to address a crowd of around 2,000, Walz leaned in further on his debate performance.

“Anybody watch the debate last night? Not bad for a football coach, huh?,” he quipped.

“Now, look, there is a reason Mike Pence was not on that stage with me,” he said. Walz added, “I served with Mike Pence in Congress. We disagreed on most issues, but in Congress and as a vice president, I never criticized Mike Pence’s ethics and commitment to this country, Walz said. “And he made the decision for the Constitution. Mike Pence did his duty. He honored his oath, and he chose the Constitution over Donald Trump,” Walz said.

“Senator Vance made it clear he will always make a different choice than Mike Pence made,” Walz said, referring to Pence’s refusal to give in to pressure by Trump to not certify the 2020 presidential election. Vance has said that he wouldn’t have certified the election, as Pence had, which Walz said “should be absolutely disqualifying if you’re asking to be the vice president of the United States.”

During their debate, “CBS Evening News” anchor Norah O’Donnell noted that Vance has said he wouldn’t have certified the last presidential election and would have asked the states to submit alternative electors, and she asked, “Would you again seek to challenge this year’s election results, even if every governor certifies the results?”

Vance did not directly answer, saying only, “What President Trump has said is that there were problems in 2020 and my own belief is we should fight about those issues, debate those issues peacefully in the public square.”

CBS News

How presidential immunity ruling impacts Trump’s election interference case

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Israeli monument honors hostages as families celebrate Rosh Hashanah

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.