CBS News

Here’s what a $70,000 home equity loan costs monthly now that rates are falling

Getty Images

Searching for a way to secure a five-figure sum of cash is often difficult, but it’s been especially so in recent years. As inflation soared, interest rates rose in tandem. That caused credit card rates to surge to a near-record 23%, where they are currently. Personal loan rates also rose and are close to 13% now. Both products also come with inherent maximum limits, depending on the lender and the borrower’s profile.

Fortunately, homeowners have a cost-effective way to access a large sum of money via their home equity. With a home equity loan, owners can easily secure a sum of $70,000 or more and they can do so at a significantly lower interest rate than most popular alternatives. And with rates on the decline, this unique borrowing product could become even cheaper soon. It’s critical to calculate these potential monthly costs in advance, however, as your home serves as the collateral in these circumstances.

So, what would a $70,000 home equity loan cost monthly now that rates are falling? That’s what we’ll calculate below.

See what home equity loan rate you could secure here now.

Here’s what a $70,000 home equity loan costs monthly now that rates are falling

The average home equity loan rate is 8.37% as of October 9, but it’s slightly higher when tied to two common repayment periods. Here’s what borrowers could expect to pay monthly for a $70,000 home equity loan if they open one now:

- 10-year home equity loan at 8.47%: $866.78 per month

- 15-year home equity loan at 8.38%: $684.40 per month

So while your payments on a 15-year home equity loan will be almost $200 cheaper per month, you’ll get stuck making an extra five years’ worth of payments compared to the shorter term. Plus, the 15-year home equity loan comes with an interest total of $53,192.49 while the 10-year loan has a total of $34,013.25 – a difference of approximately $19,180 saved. Weigh the monthly lower payments versus the total savings, then, to better determine which option is better for your financial situation.

Get started with a home equity loan online today.

Should you wait for interest rates to fall further?

It may be tempting to wait for home equity loan interest rates to fall further to lock in an even lower rate, but that could be risky. There’s no guarantee that rates will be cut. And even if the Fed issues two 25 basis point cuts, home equity loan rates are unlikely to fall by that exact amount as lenders start pricing in these presumed rate reductions in advance.

Finally, a 25 basis point cut (or two) is only likely to have a negligible effect on home equity loans compared to what they are currently. For many, it may be better to lock in a rate now and look to refinance at some later point when rates are materially lower than they are today.

The bottom line

A $70,000 home equity loan comes with payments ranging between $867 and $685 monthly for qualified borrowers. While those payments could become even cheaper as rates drop, they’re unlikely to become so much more affordable that it’s worth waiting to act. Instead, borrowers should start calculating their potential costs now and begin shopping around for lenders to find a home equity loan with the best rates and terms. And remember that the lowest rates will be reserved for borrowers with the highest credit scores, so make sure your credit is in top shape before applying for a loan.

CBS News

Recovery efforts underway in aftermath of Hurricane Milton

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

Why some people in Hurricane Helene’s path didn’t get emergency alerts

Zoe Dadian’s front yard became a front line when the remnants of Hurricane Helene caused catastrophic flooding in her community of Swannanoa, North Carolina.

“It’s just like a horror show, just standing there on solid ground while full houses floated by with people sitting on top, like screaming for their lives,” Dadian said.

When the floodwaters receded, neighbors started talking about the warnings that came before.

Severe weather watches and warnings are sent by the National Weather Service, but evacuation orders come from local authorities.

Many use the Federal Emergency Management Agency’s Integrated Public Alert and Warning System — or IPAWS — which pushes messages to cellphones, TVs and radios in disaster-impacted areas.

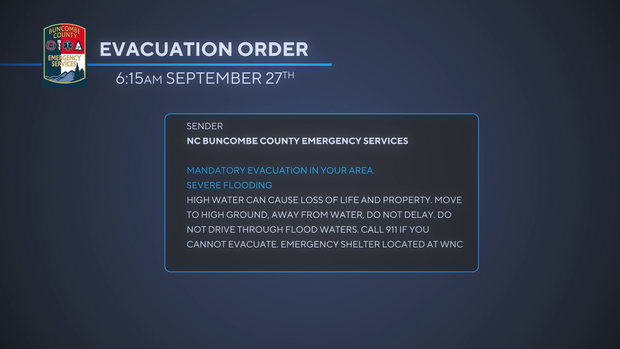

Buncombe County, where Dadian lives, sent a mandatory evacuation order out through IPAWS at 6:15 a.m. on Sept. 27.

CBS

She said the alert didn’t show up on her phone until hours later — at 1 p.m.

CBS

“And at that point, the landslide had occurred,” Dadian said. “We were digging bodies out of rubble, and there was nowhere to evacuate.”

Buncombe County officials said many cell towers were down because of the flooding, which may have delayed the transmission of the evacuation order.

“The cell towers are a critical piece,” FEMA Administrator Deanne Criswell said about the challenge of timely alerts during flash floods.

“We need to keep learning on how we can better warn people even if we don’t know exactly where the flash flooding’s going to happen,” Criswell said.

Ulysse Bellier/AFP via Getty Images

While downed cell towers may have stopped or delayed alerts from reaching everyone, some counties certified to issue IPAWS alerts did not send any, according to a CBS News analysis of available FEMA data. Of 43 counties that experienced deaths during Helene, 29 did not send out alerts using IPAWS.

Brian Toolan, Connecticut’s former emergency operations chief who now builds local alert software, said a county, especially small counties, can get overwhelmed quickly.

“The timelines are going to be critical to understand was there enough time to get an alert out, you know, was there enough time to prepare, you know, and if not, you know, how do we learn from this and make sure this doesn’t happen again?” he said.

CBS News also reviewed FEMA data during Hurricane Milton. At least 46 alerts were sent this week by 14 counties across Florida, including those along the west coast where the storm made landfall and conditions were the most dangerous. At least 25 alerted residents to evacuations.

When counties do send out critical warnings, phones have to be set up to receive them.

If government emergency notifications are turned off, people won’t get alerts sent through IPAWS. If notifications are turned on, people will get IPAWS alerts.

Some counties don’t only use IPAWS. They have their own alert systems that require people to opt in. People won’t get those alerts unless they’ve signed up in advance.

On Dadian’s phone, notifications were turned on, but she wishes she’d known sooner what was going to happen to her community.

“Never in a million years,” Dadian said, “did I imagine that it was going to be something that we weren’t going to be able to weather.”

CBS News

Why this 93-year-old has not missed a single high school football game since 1946

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.