CBS News

U.S. conducts new airstrikes on Houthi targets in Yemen with B-2 bombers

The U.S. military conducted airstrikes on several Houthi weapons storage facilities in Yemen, the Pentagon said Wednesday.

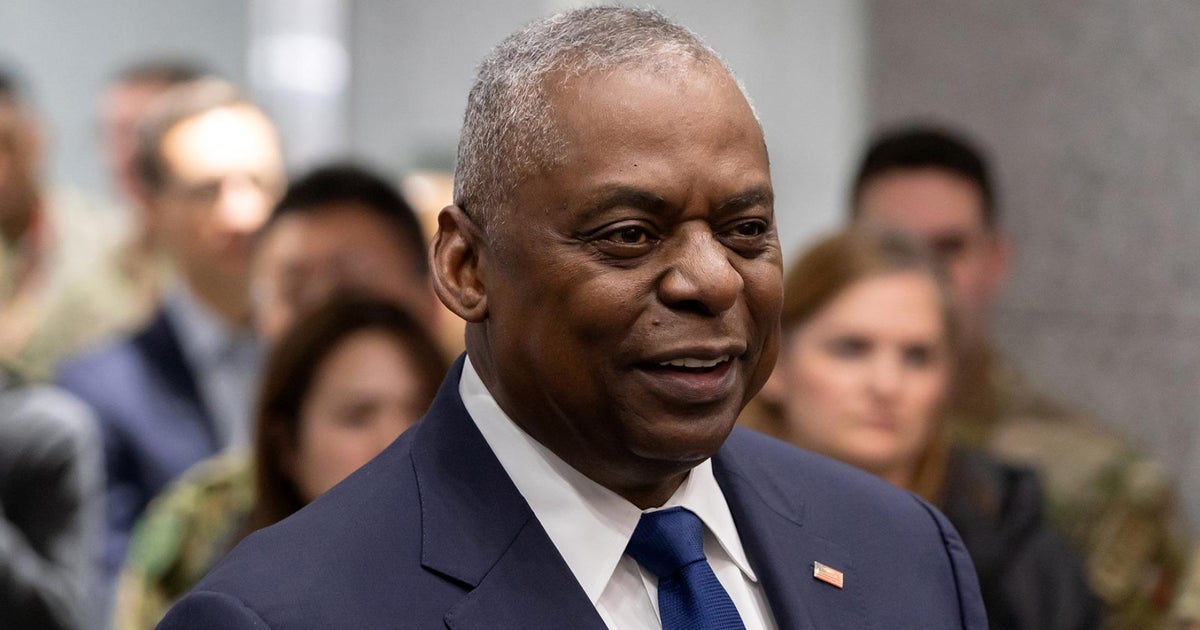

Defense Secretary Lloyd Austin said in a statement that U.S. Air Force B-2 stealth bombers were part of an operation to conduct “precision strikes” on five underground weapons storage locations in Houthi-controlled areas of Yemen.

“U.S. forces targeted several of the Houthis’ underground facilities housing various weapons components of types that the Houthis have used to target civilian and military vessels throughout the region,” Austin said.

Lloyd said he authorized the strikes at the direction of President Biden.

This marks the latest in several such U.S. airstrikes targeting the Iran-backed Houthi militant group in retaliation for Houthi missile attacks on vessels in the Red Sea. Earlier this month, U.S. Central Command reported that U.S. aircraft and warships had struck 15 targets containing Houthi offensive military capabilities.

The U.S., U.K. and its allies have conducted several rounds of joint strikes on Houthi targets in Yemen dating back to mid-January.

Since November 2023, the Houthis have conducted dozens of missile and drone attacks on commercial and military vessels in the Red Sea in what it says is a response to the Israel-Hamas war. Those attacks caused major supply chain disruptions worldwide. The Houthis have sank two commercial vessels, and a missile attack in March on a Liberian-owned ship in the Gulf of Aden killed three people.

Houthi militants hijacked an Israeli-linked cargo ship last November, taking crew members hostage.

And in an escalation of events, the Houthis directly struck downtown Tel Aviv with a drone in July which killed one person and injured eight others. That attack prompted Israel to retaliate with its own airstrikes in Yemen.

In his statement Lloyd said that “for over a year” the Houthis “have recklessly and unlawfully attacked U.S. and international vessels transiting the Red Sea, the Bab Al-Mandeb Strait, and the Gulf of Aden. The Houthis’ illegal attacks continue to disrupt the free flow of international commerce, threaten environmental catastrophe, and put innocent civilian lives and U.S. and partner forces’ lives at risk.”

In January, the Biden administration declared the Houthis to be a “specially designated global terrorist group.”

contributed to this report.

CBS News

Deal in Congress to avert government shutdown, Gaetz misconduct report coming

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

3 home equity loan risks to know going into 2025

Getty Images

Both home equity loans and home equity lines of credit (HELOCs) offer homeowners access to their accumulated home equity at a much cheaper price point than many alternative credit options. While credit card interest rates sit just under 24% now – a record high – and personal loan interest rates hover around 12%, qualified homeowners can secure a home equity loan with a rate of 8.38% now and a HELOC at 8.53%. That equates to significant savings each month – and over the typical 10 or 15-year repayment period home equity loans typically come with.

Still, borrowing from your home equity isn’t risk-free, either. If you fail to repay all that you’ve borrowed (with interest), you could risk losing your home in the exchange. But even if you can comfortably manage your home equity loan payments, there are some other notable risks to avoid, particularly in today’s evolving economic climate with inflation rising and interest rates being reduced. Below, we’ll break down three home equity loan risks to know going into 2025.

Start by seeing what home equity loan rate you could lock in here now.

3 home equity loan risks to know going into 2025

Borrowing with a home equity loan can be both smart and effective, especially in today’s unique economic climate. To make it more valuable, homeowners should be aware of these risks (and take steps to avoid them):

Interest rates could rise

The hope that inflation would cool in a straight line downward – and that interest rates would follow – hasn’t played out in recent months. Inflation rose in October and again in November and now sits at 2.7%, almost a full percentage point above the Fed’s 2% goal. So waiting for a lower home equity loan rate to materialize in 2025 is risky when you can secure one close to 8% right now.

Unlike mortgage interest rates, which are driven by a variety of factors, home equity loan rates track closely alongside the federal funds rate. So if rate cuts are paused or hiked again next year, interest rates on home equity loans could rise. And they will rise on HELOCs, which have variable interest rates that change each month. Understanding this dynamic, then, prospective borrowers can avoid this risk altogether by locking in a low home equity loan interest rate now – and refinancing it should rates fall by a considerable degree in the future.

Get started with a home equity loan online today.

Home values could change

Your home equity is calculated by deducting your current mortgage balance from your estimated home value at the time of application. But home prices can change and what your home is worth now may not be what it’s worth in six months or in December 2025. That’s a positive if your home value is on the rise as it could allow you to borrow even more money (the average home equity amount currently sits at around $320,000) but it’s a major risk if your home value drops.

A significant value decrease could lead you to be “underwater” by owing more to the lender than your home is worth. This is particularly risky with home equity loans, which offer borrowers a lump sum of money versus a HELOC that functions as a revolving line of credit. So, before applying, make sure that your home value is secure and, preferably, on the rise.

Your debt could increase

If you use your home equity loan to pay off or to consolidate high-interest rate debt, like credit cards, then you could make strides toward boosting your financial health. But if you use it for the wrong reasons, like paying for depreciating assets such as cars or one-time expenses like weddings, you could put yourself into a growing debt spiral that will be difficult to get out of. So make sure you’re using your home equity loan for safe and effective purposes (like home repairs and renovations, which come with potential tax benefits) and avoiding using it in ways that could lead to your debt becoming harder to pay down than it already is.

The bottom line

A home equity loan offers borrowers access to a large, potentially six-figure sum of money, at an interest rate much lower than some popular alternatives. But it does come with risks that homeowners will need to navigate around, too. By being aware of these risks going into 2025 and by utilizing your funds for the most appropriate and secure reasons, you can position yourself for sustained home equity borrowing success both in the new year and in the years that follow.

Learn more about borrowing with a home equity loan here now.

CBS News

Texas man fights to reunite with wife and kids, including newborn twins, who were unexpectedly deported to Mexico

A Texas man is fighting to get his wife and four children back after he says they were unexpectedly deported to Mexico.

Federico Arellano is a U.S. citizen, and says three of his four kids are too. He says there has been a misunderstanding and that his family was misled.

Now, a video call is the only way he’s been able to see his family.

Agents deport family

ICE agents deported Arellano’s wife, Christina Salazar, and their four kids to Mexico last week after they say they were told to come to the ICE field office in Houston to discuss Salazar’s immigration case.

“They told me that they were going to take her to Mexico because she had a deportation order,” Arellano said.

A judge signed off on the order in early October after Salazar missed an immigration hearing. The family says Salazar was recovering from giving birth to premature twins and doctors recommended she recover at home during that time.

Arellano said he informed the court about the situation and claims they reassured him by phone the date could be rescheduled.

Nearly two months later, Arellano said agents detained his wife and then their four children.

Immigration attorney Isaias Torres, who represents the family, said he has not seen an instance like this one that involves a family.

“I’ve seen criminals, ardent criminals, people with prior deportation. … I don’t understand why this happened,” Torres said.

Hopes to reunite

A video call is now the only way Arellano can see Salazar and their kids for the foreseeable future.

“I’m alone. I have no one to help me with my kids here and they are really sick,” Salazar said in a video call from Reynosa, Mexico.

Attorneys for the family said they are reaching out to members of Congress for help. ICE and the DOJ have not responded to CBS News for a request for comment.

Meanwhile, Arellano said he just wants his family back.

“To get them back and of course they return to me just as they were taken away. I want them to return to me,” he said.