Kare11

Major tax relief bill clears Minnesota House

House Democrat focus tax breaks on helping working families hit hardest by pandemic economy.

ST PAUL, Minn. — The Minnesota House Thursday night passed a sweeping tax policy bill aimed at providing $3 billion in tax relief, and raising more revenue from corporations and the wealthiest taxpayers.

It includes a mix of rebate checks, tax credits, aid to local units of government, and other policies Democrats say will make the state’s tax system fairer and sustainable.

“This bill constitutes the largest tax cut in Minnesota history,” Rep. Aisha Gomez, the House Tax Committee Chair, told her colleagues during Thursday’s debate.

“It contains targeted tax cuts. It puts money in the pockets of Minnesotans who most need it.”

Her bill calls for $275 rebate checks to individuals, $550 checks to married couples, plus an additional $275 for each dependent up to three. The rebates would be limited to couples who make $150,000 or less and single filers who make $75,000 or less. More than 2 million taxpayers would qualify for some type of check.

The tax bill also shields more Minnesota retirees from tax liability on their Social Security benefits.

Joint filers earning $100,000 or less and single filers who earn $78,000 or less would be totally exempt from state income taxes on those federal government checks. That would exempt 75% of Social Security recipients from being taxed on that income, compared to 52% of current retirees who aren’t taxed on those checks.

The bill creates a revamped childcare tax credit program, enabling lower income families to receive up to $1,175 per child. The bill also expands the K-12 Education Child Credit to $1,500 per child.

There’s also $100 million in direct aid to local governments, which is intended to slow the growth of property taxes in those communities. The measure would also boost property tax refunds for homeowners and renters.

The renter’s refund program would be rolled into regular tax returns, removing the need to apply for that refund separately.

“Right now, there are over 100,000 low-income renters who are eligible for property tax refunds, who, just because the timing, the paperwork, the complications and the barriers, leave that money on the table,” Gomez explained.

Republicans leveled blistering attacks for what’s not in the bill, namely full exemption for Social Security benefits.

“Anyone who can afford to leave the state of Minnesota in their retirement does,” Rep. Bjorn Olson of Fairmont told fellow lawmakers.

“That’s why less than 50% of Minnesotans pay taxes on their social security today.”

GOP leaders say people on both sides of the aisle campaigned on full exemption during the 2022 election cycle.

“That was a bipartisan campaign promise. All of us, when we were campaigning in our districts, everyone heard that from the doors,” Rep. Kristin Robbins of Maple Grove told reporters Thursday.

“DFLers and Republicans made that promise and it is not being kept.”

The bill would also create a fifth income tax tier, with a rate of 10.85% that would be applied to that portion of a couple’s income in excess of $1 million and $600,000 for individual filers.

Rep. Robbins said the fifth income tax tier, if it becomes law, will drive more people away from a state that already has a reputation as a high tax state.

“That would make Minnesota have the fourth highest income tax rate in the country. And just to give you some perspective we are uncompetitive at all the tiers. Our lowest tier of 5.35% is higher than the highest tier in 24 other states.”

Republicans contend the tax bill, in its current form, is transferring wealth from the middle-class taxpayers who created the surplus to lower income families.

“People who have not been paying taxes in Minnesota are getting a lot of new income, so this is spending through this refundable tax credits and is not helping the middle class that’s been paying the tax all along.”

Gomez said it’s the legislature’s imperative to help those most in need, and that includes how tax policy is designed.

“This bill is going to improve lives. It’s going to make our tax code more simple, and more fair. It focuses on families and on children who are in poverty and seniors who are struggling.”

Kare11

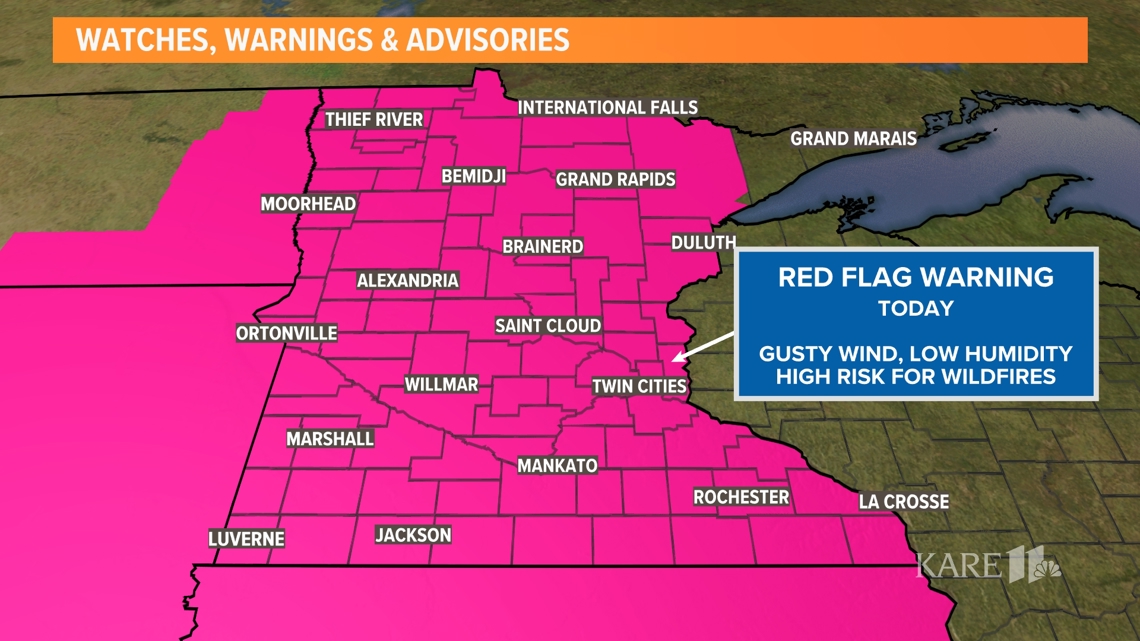

Fire danger extremely high across Minnesota Thursday

CHANHASSEN, Minn. — Predicted weather conditions have triggered a Red Flag Warning for virtually the entire state of Minnesota Thursday, indicating an extreme danger for wildfires.

The National Weather Service (NWS) says the forecast – extremely low humidity and dewpoints and wind gusts in the neighborhood of 40 mph – will exacerbate already tinder-dry conditions, increasing the likelihood that a wildfire could spark and quickly spread.

Here are the counties impacted, and when Red Flag Warnings will be in effect.

8:00 a.m. through 7:00 p.m. – Northwest Minnesota: Becker, Beltrami, Clay, Clearwater, Grant, Hubbard, Kittson, Lake Of The Woods, Mahnomen, Marshall, Norman, Otter Tail, Pennington, Polk, Red Lake, Roseau, Wadena and Wilkin.

11:00 a.m. through 7:00 p.m. – Central and southern Minnesota: Anoka, Benton, Big Stone, Blue Earth, Brown, Carver, Chippewa, Chisago, Cottonwood, Dakota, Dodge, Douglas, Faribault, Fillmore, Freeborn, Goodhue, Hennepin, Houston, Isanti, Jackson, Kanabec, Kandiyohi, Lac Qui Parle, Le Sueur, Lincoln, Lyon, Martin, McLeod, Meeker, Mille Lacs, Morrison, Mower, Murray, Nicollet, Nobles, Olmsted, Pipestone, Pope, Ramsey, Redwood, Renville, Rice, Rock, Scott, Sherburne, Sibley, Stearns, Steele, Stevens, Swift, Todd, Traverse, Wabasha, Waseca, Washington, Watonwan, Winona, Wright and Yellow Medicine.

12:00 a.m. through 7:00 p.m. – Northeast Minnesota: Aitkin, Carlton, Cass, Crow Wing, Itasca, Koochiching, Pine, and St. Louis.

Additionally a Special Weather Statement has been issued for Cook and Lake counties in northeast Minnesota where wind and relative humidity are predicted to produce near-critical fire weather conditions. Outdoor burning is not advised.

Minnesota’s Department of Natural Resources (DNR) is telling residents to refrain from burning in counties where a Red Flag Warning is in effect, and to check any recent burning to ensure the fire is completely out. The DNR will not issue or activate open burning permits for large vegetative debris burning during a Red Flag Warning, and campfires are strongly discouraged.

“When fire risk is this high it’s important to be careful with anything could spark a wildfire,” said Karen Harrison, DNR wildfire prevention specialist.

Kare11

Who is the guy in a van selling seafood in the desert?

Justin Ekelman’s business, Shrimply the Best, has a fan following.

MARICOPA COUNTY, Ariz. — There are things you expect to see along a desert highway and then there are Justin Ekelman’s hand-painted signs.

Drivers on State Route 347 between Phoenix and Maricopa usually pass them before they see the old, white cargo van Ekelman parks in a dirt lot off Riggs Road.

He is a man, with a van, who sells seafood.

“I do this year-round, I sweat it out and then when the winter comes, the snowbirds come back and it’s amazing,” Ekelman said. “You can’t bring enough; you can’t fill this thing enough.”

He is also not oblivious to what some people think when they see his Pike Place Market on four wheels: Seafood from a van in the desert? It seems a little sketchy. And a little dangerous.

But if you stop, Ekelman will proudly show you his frozen food vendor permit and other licenses one needs to sell shrimp and scallops on the side of the road.

Ekelman’s business, Shrimply the Best, has a fan following. In fact, one-third of voters in a recent InMaricopa poll named his seafood van their favorite food source.

Shrimp from Rocky Point are his bestsellers but Ekelman keeps his chest freezer stocked with Caribbean lobster tails, mussels and a variety of fish, too. An extension cord plugged into a gas-powered generator keeps everything frozen even when it’s 115 degrees outside.

“If it was sitting in a cooler in ice, it may be a little weird,” Ekelman said.

Selling seafood out of a van has provided Ekelman, a single father of two teenage boys, with enough to pay his bills and keep a roof over their heads. He feels more blessed than he did 15 years ago during the Great Recession.

Ekelman bought his first home in 2008, then lost his job as a carpet and air duct cleaner.

“Long story short, I ended up having to short sell my home, lived with my parents for a year and a half. My dad said come do this,” Ekelman said.

His father, a former door-to-door meat salesman, ventured into the roadside seafood business 40 years ago. Ekelman said his dad used wet rags to keep himself cool during the summer months.

“I did it one year like that. Why would you do that when you could buy a $130 air conditioner? I made a stand, put it in my window, now I have a little cold room,” Ekelman said, pointing to the curtains at the front of his van.

His father retired more than a decade ago and Ekelman retained many loyal customers. The business has not changed much since then, including the rudimentary hand-painted signs along the highway. Those are informative – and nostalgic.

“Ahead: Rocky Point Shrimp,” one of them reads.

“I go to Home Depot, get the wood, get them cut and paint them up, that’s how my dad always did it,” Ekelman said. “I have people stopping all the time saying ‘I can make you professional signs’ and I‘m like, ‘Bro, this is what people see. It’s a lot cheaper.’”

Ekelman also gets his seafood from the same source: His dad’s friend who owns a distributing company and gets seafood shipped to the Valley from across the globe. The company supplies seafood to restaurants, cruise liners and small fry (we couldn’t resist) like Ekelman.

“A lot of people assume I am getting it all from Mexico, it’s not,” Ekelman said. “A lot of the shrimp do but I just had salmon from Alaska, my lobster tails right now are out of the Bahamas, I have got orange roughy from New Zealand, the catfish is from here in the U.S., all sorts of different places but it is wild caught.”

Ekelman said he gets a good deal buying wholesale but the COVID pandemic forced him to raise his prices.

“My lobster tails, I was paying $5 a tail cheaper near 2019, COVID hit and everything went up,” Ekelman said. “I have tried to keep it pretty reasonable but my profit margins have gone down.”

Shrimply the Best accepts cash and credit cards.

A pound of raw, frozen shrimp ranges from $9 to $12 per pound depending on the size and type. Ekelman sells a 5-pound bag of extra jumbo, U-15 size tiger shrimp for $60 a bag. Chilean black mussel meat is $10 per pound. Wild-caught U.S. catfish sells for $6 per pound and orange roughy, a deep-sea perch caught in the waters off New Zealand goes for $12 per pound.

When Ekelman has no customers, he sits in the cab of the van with his makeshift air conditioning unit and reads his Bible.

He’s especially proud of his lobster tails, which are nearly as big as his forearm. An 18–20-ounce tail goes for $36 or two for $68.

“Mother’s Day is crazy; I could fill this thing with lobster and it’s just gone,” Ekelman said. “Father’s Day? Well, we don’t get treated as well as the ladies do sometimes.”

Watch 12News+ for free

You can now watch 12News content anytime, anywhere thanks to the 12News+ app!

The free 12News+ app from 12News lets users stream live events — including daily newscasts like “Today in AZ” and “12 News” and our daily lifestyle program, “Arizona Midday”—on Roku and Amazon Fire TV.

12News+ showcases live video throughout the day for breaking news, local news, weather and even an occasional moment of Zen showcasing breathtaking sights from across Arizona.

Users can also watch on-demand videos of top stories, local politics, I-Team investigations, Arizona-specific features and vintage videos from the 12News archives.

Roku: Add the channel from the Roku store or by searching for “12 News KPNX.”

Amazon Fire TV: Search for “12 News KPNX” to find the free 12News+ app to add to your account, or have the 12News+ app delivered directly to your Amazon Fire TV through Amazon.com or the Amazon app.

12News Digital Exclusives

Go beyond the TV broadcast and learn more about unique Arizona stories on the 12News YouTube channel. Subscribe for more digital-exclusive content!

Kare11

9 students injured in crash school bus crash in southern MN

The crash occurred at 8:15 a.m. Wednesday in Welcome, Minnesota after the bus driver failed to yield to the truck, which had the right-of-way.

WELCOME, Minn. — Nine students were injured Wednesday morning when a truck crashed into a bus in southern Minnesota.

The crash occurred at 8:15 a.m. in Welcome, Minnesota after the bus driver failed to yield to the truck, which had the right-of-way at the intersection of County Road 7 and 280th Street, according to the Redwood County Sheriff’s Office. In a press release, officials say the nine students sustained “minor injuries” and were transported to a nearby hospital.

The initial investigation indicates that the truck, an F550, was traveling north on County Road 7, while the bus, which was providing service to the Wabasso Public School District, was traveling east on 280th Street. The news release says the truck had the right-of-way at the intersection.

“We are grateful that no serious injuries happened to our students, the driver or the other driver, however, nine students were transported to area hospitals for follow-up treatment,” Superintendent Jon Fulton said in a letter to parents. “… The District and 4.0 bus transportation company is praying for a speedy recovery for the students and families involved.”

GIPHY App Key not set. Please check settings