CBS News

Women switched at birth in 1965 claim error was covered up for decades: “They kept it secret”

In 1965, a Norwegian woman gave birth to a baby girl in a private hospital. Seven days later she returned home with a baby.

When the baby developed dark curls that made her look different from herself, Karen Rafteseth Dokken assumed she just took after her husband’s mother.

It took nearly six decades to discover the true reason: Rafteseth Dokken’s biological daughter had been mistakenly switched at birth in the maternity ward of the hospital in central Norway.

The girl she ended up raising, Mona, was not the baby she gave birth to.

The babies – one born on Feb. 14 and the other on Feb. 15, 1965 – are now 59-year-old women who together with Rafteseth Dokken are suing the state and the municipality.

In their case, which opened in the Oslo District Court on Monday, they argue that their human rights were violated when authorities discovered the error when the girls were teenagers and covered it up. They claim Norwegian authorities had undermined their right to a family life, a principle enshrined in the European human rights convention, and demand an apology and compensation.

Rafteseth Dokken, now 78, was in tears as she described learning so many years later that she got the wrong baby, according to Norwegian broadcaster NRK.

“It was never my thought that Mona was not my daughter,” she said in court on Tuesday. “She was named Mona after my mother.”

Mona described a sense of never belonging as she grew up. That sense of uncertainty pushed her in 2021 to do a DNA test, which showed that she was not the biological daughter of those who raised her.

But the woman who raised the other baby knew long before.

A routine blood test in 1981 revealed that the girl she was raising, Linda Karin Risvik Gotaas, was not biologically related. The woman raising her, however, did not pursue a maternity case. Norwegian health authorities were informed of the mix-up in 1985, but refrained from telling the others involved.

Both women who were swapped at birth have said in interviews that it was a shock to learn about the mix-up, but the knowledge made pieces of their lives fall into place, explaining differences both in terms of appearance and demeanor.

Kristine Aarre Haanes, representing Mona, said the state “violated her right to her own identity for all these years. They kept it secret.”

Mona could have learned the truth when she was a young adult, but instead “she did not find out the truth until she was 57.”

“Her biological father has died. She has no contact with her biological mother,” added Aarre Haanes.

Circumstances surrounding the 1965 swap at Eggesboenes hospital are unclear, but media reports by NRK suggest there were several cases during the 1950s and 1960s where children were accidentally swapped at the same institution. At the time babies were kept together while their mothers rested in separate rooms.

In other cases the errors were spotted before the children were permanently placed with the wrong families, according to the reports.

An official from the Norwegian Ministry of Heath and Care Services said the state was unaware of similar cases and that there were no plans for a public inquiry.

Asgeir Nygaard, representing the Norwegian state, is fighting the case on the grounds that the 1965 switch took place in a private institution and that the health directorate in the 1980s did not have the legal authority to inform the other families when they discovered the error.

“Documentation from that time indicates that government officials found the assessments difficult, inter alia because it was legally unclear what they could do,” he wrote in a statement to The Associated Press ahead of the trial’s opening. “Therefore, in court, we will argue that there is no basis for compensation and that the claims being made are in any case statute-barred.”

The trial is scheduled to run through Thursday, but it was not clear when a ruling is expected.

Steffen Trumpf/picture alliance via Getty Images

A similar situation reportedly occurred in the U.S. in 1969, when two baby girls were accidentally switched at a Texas hospital, and the mistake wasn’t noticed until a DNA test was done in 2018. The women later filed a lawsuit against the corporation that later bought the hospital.

According to the DNA Diagnostics Center, in the U.S., up to 500,000 babies each year are at “potential risk of going home with the wrong parent,” but newborns inadvertently switched at birth are generally noticed almost immediately after the incident. The center says only eight incidents of babies switched at birth were physically documented in the U.S. between 1995 and 2008, although the center says that number is likely higher.

CBS News

Scathing Justice Dept report says Georgia jail left inmates vulnerable to dangerous conditions

The jail in Georgia’s largest county, Fulton County, leaves its inmates vulnerable to “substantial risk of serious harm from violence” and violates their constitutional and statutory rights, according to a new Justice Department report released Thursday.

After a more than year-long civil rights probe into the Fulton County Jail – which has long been plagued by overcrowding, understaffing and violence — federal investigators concluded detainees are subjected to “dangerous and unsanitary” conditions, like pest infestations and malnourishment. These conditions especially endanger those with mental health conditions, the report found.

“None of these problems are new,” the report said. “And despite widespread awareness of these issues, the unconstitutional and illegal conditions have persisted.”

The Justice Department launched its civil investigation into Fulton County’s jail in July 2023, after at least four Black inmates died in the mental health unit in a matter of weeks, including two who were killed by their cellmates. “Within weeks of opening our investigation, six more Black men had died in the Jail,” the Justice Department revealed. The family of one inmate, Lashawn Johnson, said he died in in the jail in 2022, after he was “eaten alive” by insects and bedbugs. About 91% of the jail’s total population is Black, according to the report, compared to 45% of the overall Fulton County population.

Justice Department investigators conducted multiple site visits, expert consultations and interviews with inmates and staff.

Crumbling infrastructure, failing security, abusive staff and insufficient medical and mental health treatment contributed to the overall unconstitutional conditions described in the report.

According to the county sheriff, 62% of the jail’s inmates suffer from mental health or substance use disorders and the staff failed to provide proper treatment or take steps to mitigate risks of suicide.

“We found that 75% of those who died in the Jail since January 2021 had a current mental health diagnosis or reported a history of mental illness,” the report said.

Justice Department investigators noted in their findings that Fulton County and the sheriff sought to remedy some of the issues, including by surging millions in emergency funding and sending some inmates to detention facilities in other districts.

Still, the problems persisted. In 2024, three men in Fulton County’s main jail have died, including one person who was stabbed 20 times in April. From 2022 to the present, according to the report, “six incarcerated people have died in violent attacks.” All six victims were Black men, the Justice Department said.

Non-lethal violent assaults are also rampant inside the jail. In 2023, the Sheriff’s Office said there were 1,054 assaults and more than 300 stabbings in the jail. The investigation also uncovered a pattern or practice of sexual abuse, according to the report.

Announcing the report’s findings, Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Department said officials in Fulton County have taken “preliminary steps” to address the issues outlined in the report, but such measures are “not enough.”

The Justice Department’s report outlines various remedial measures the jail must carry out to improve the conditions, like increased accountability measures for staff, overhauling how the jail secures its facilities from violence and contraband, and ensuring proper suicide prevention measures.

“At the end of the day, people do not abandon their civil and constitutional rights at the jailhouse door,” Clarke said. “We can fix these problems,” she added later.

The Fulton County Sheriff’s Office, which runs the jail, did not immediately respond to a request for comment. Justice Department officials on Thursday noted the sheriff had cooperated with the probe.

CBS News

Does debt consolidation or debt forgiveness make more sense with bad credit?

Getty Images

With credit card rates now averaging above 23%, millions of Americans are struggling with their credit card debt. As the interest charges compound, it’s easy for this type of debt to grow out of control, especially given today’s rates. But effectively managing any type of debt — and credit card debt, in particular — can be especially challenging when paired with a poor credit score.

A low credit score can severely limit your borrowing options, as borrowers with damaged credit are considered risky to lenders. This means that certain debt relief strategies, like using a balance transfer card to temporarily wipe out interest charges, can be out of reach. As a result, figuring out how to address your credit card debt when your credit score is low can feel like an impossible task.

Many people in this situation consider debt consolidation or debt forgiveness as potential solutions. While both strategies aim to alleviate debt burdens, they work quite differently. With debt consolidation, the goal is to roll multiple debts into one loan with a lower interest rate. With debt forgiveness, the goal is to get your creditors to agree to a lower lump-sum settlement to reduce the amount you owe. Both can provide serious relief from high-rate card debt, but which one makes more sense for those facing this type of situation?

Compare the credit card debt relief options available to you here.

Does debt consolidation or debt forgiveness make more sense with bad credit?

When dealing with bad credit, debt forgiveness often emerges as the more accessible option compared to debt consolidation. That’s because traditional debt consolidation loans are acquired from banks, credit unions or other types of lenders and typically require a decent credit score to qualify for a new loan with favorable terms. If you have bad credit, debt consolidation loans tend to come with high interest rates that might not provide meaningful relief from existing debt burdens — and in certain cases, you may not be approved at all.

On the other hand, debt forgiveness programs, which are offered by debt relief companies, don’t typically require good credit scores to be eligible. These programs focus more on factors like the total debt amount you have, the types of debt you need to settle and your ability to make consistent monthly payments toward a settlement fund. While debt forgiveness can further damage your credit by requiring you to stop making payments to your creditors, this process might offer a faster path to financial recovery, especially if you’re already struggling with poor credit.

However, debt consolidation shouldn’t be completely ruled out if you have bad credit. There are several options for those with lower credit scores, including:

- Debt consolidation programs offered by debt relief companies, which typically have more flexible lending requirements

- Secured debt consolidation loans that use collateral to lower the risk for lenders

- Home equity loans (for homeowners), which can be more accessible since they’re secured by the equity in your home

- Debt management plans through credit counseling agencies, which can consolidate your monthly payments while lowering your interest rates or fees

So, if you’d prefer to avoid damaging your credit further by enrolling in a debt forgiveness program, it can still make sense to look into these alternative debt consolidation routes. You may find that one or the other works with your current credit score and financial situation.

Tackle your expensive credit card debt today.

How to decide on the right debt relief option

When deciding between debt consolidation and debt forgiveness, it’s important to start by considering your financial stability, goals and current income. If you have a stable income but struggle with high-interest debts, debt consolidation might be more feasible and beneficial in the long term. Securing a debt consolidation loan with a lower interest rate can make monthly payments more manageable, even if your credit score isn’t ideal. If you’re not eligible for a traditional loan, there are debt consolidation programs that might work with you to secure a loan despite poor credit.

If your debts are so overwhelming that debt consolidation is out of reach, debt forgiveness may be a better option. This is often the case for people experiencing a financial crisis, such as a sudden job loss, major health expenses or other unforeseen circumstances. Debt forgiveness programs can reduce the total amount you owe by 30% to 50% on average, which can be a big relief for those who simply can no longer afford to pay off their balance in full.

It’s also worth weighing the long-term impact on your credit score when choosing between these options. Debt consolidation, if managed well, can potentially boost your credit score over time by reducing your credit utilization ratio and demonstrating a commitment to repaying debt. In contrast, debt forgiveness can lead to a temporary drop in credit, as settled debts are typically reported to credit bureaus and you may be required to miss payments during the negotiation process.

The bottom line

Deciding between debt consolidation and debt forgiveness is a highly personal choice and should be based on your unique financial situation and goals. With bad credit, each option has challenges, but they also offer distinct forms of relief. Debt consolidation may be suitable if you’re capable of managing a single monthly payment at a lower interest rate, providing an opportunity to rebuild your credit over time. Debt forgiveness, while offering immediate debt relief, may be more appropriate if your financial circumstances make consistent repayment impossible.

CBS News

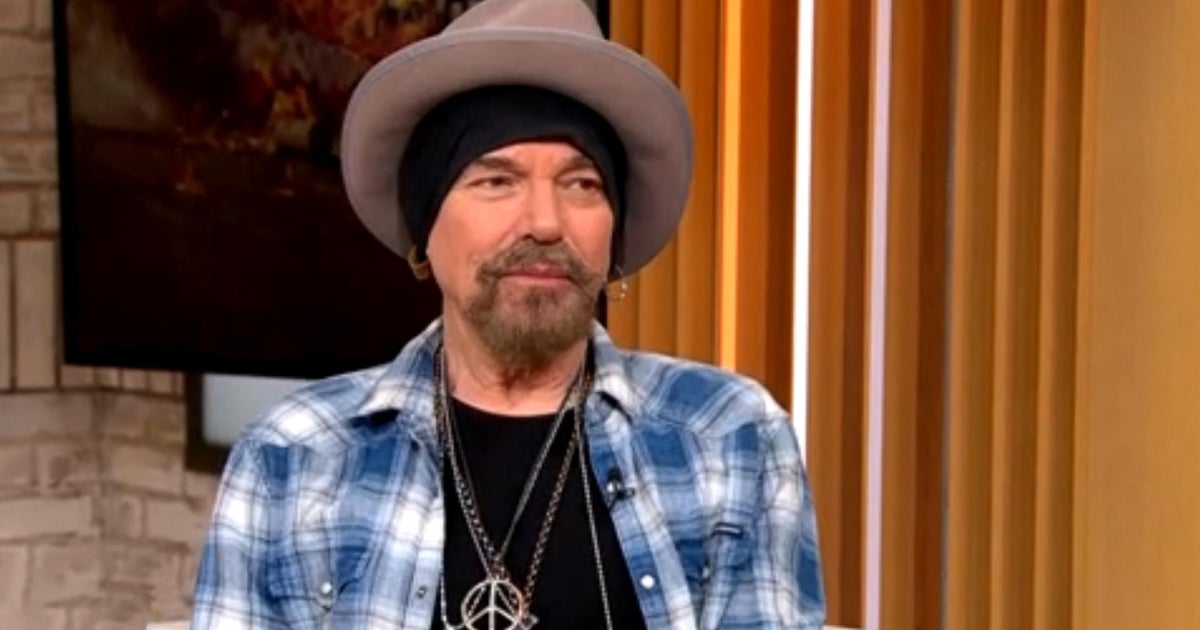

Billy Bob Thornton takes on oil industry in new series, “Landman”: “I don’t take things that I’m not right for”

Oscar-winning actor Billy Bob Thornton joined “CBS Mornings” to discuss his new role in “Landman,” the latest Paramount Plus series from “Yellowstone” creator Taylor Sheridan. Thornton stars as Tommy Norris, a man tasked with managing land and people in the oil-rich landscapes of West Texas.

Thornton’s character works in the world of oil rigs, securing land and overseeing everyone from workers to billionaires who fuel the oil industry. The role was made with Thornton in mind since Sheridan wrote the role specifically for him.

“He said, ‘I’m going to write it in your voice.’ So when I read the first script, sure enough, it’s like, yeah, if I were a landman, I think I’d try to be like that,” said Thornton.

Thornton said he prefers to stick to roles within his strengths.

‘I don’t take things that I’m not right for,” Thornton said. “If I read something and it fits like a glove, then those are the things I do if I’m interested in the subject.”

When it comes to describing what a landman is, Thornton said that a landman is a middleman between the oil company owners and the workers in the fields. His job is to protect the workers while making sure they do their tasks to extract oil, because he needs to earn money for his employer.

“The show is really about how the people who work in and around the oil business are affected, how relationships are affected. It’s a dangerous business, and it’s a gamble also,” Thornton said.

“Landman” premieres Sunday, Nov. 17, exclusively on Paramount+.