CBS News

When will personal loan interest rates drop? Experts weigh in

Getty Images

After years of record-high inflation, and with the expensive holiday season fast approaching, many Americans are looking for some extra money to cover costs.

A personal loan is one option to get those funds. Personal loans can be more affordable than credit cards, and, unlike a home equity loan, they don’t require you to put your house at risk. They’re unsecured debts that can be easy to qualify for. In fact, personal loan options exist even for people with fair credit or bad credit.

Personal loan rates have been higher in the post-pandemic era than in the recent past, though, so many would-be borrowers are wondering if and when rate drops will occur. We asked some experts for their thoughts on when that could potentially happen.

Start by seeing what personal loan interest rate you could qualify for here.

When will personal loan interest rates drop?

Those hoping for lower personal loan rates had some good news lately. “The Federal Reserve Bank here in the U.S. has begun its rate-cutting cycle,” notes Steven Conners, founder and president of Conners Wealth Management in Scottsdale, Arizona.

The Federal Reserve is the country’s Central Bank. It reduced rates by 50 basis points in September and by 25 basis points in November. These were the first-rate cuts since the Fed began raising rates in the post-pandemic era to combat inflation.

However, while the Federal Reserve sets the benchmark interest rate, it does not directly control the rate that banks charge consumers who take out personal loans.

“There are many factors that affect personal loan interest rates including demand for credit, loan delinquencies, the Federal Reserve raising or lowering rates, treasury rates, and government spending,” explains JB Beckett, founder of Beckett Financial Group. “Currently, only one of these factors has positively affected loan rates: the Fed lowering rates two times this year. “

Understanding that the Fed can’t just cut personal loan rates helps explain why borrowing costs on personal loans dipped only slightly during the second quarter of 2024 and rose again in the third quarter. “Despite the Fed lowering rates by .75 since September, average interest rates have not changed as much,” Beckett said.

Start exploring your personal loan options online today.

Rate drops could happen but they may not be quick

While personal loan rates haven’t yet declined dramatically despite the Fed’s multiple rate cuts in the fall of 2024, this doesn’t mean they’re off the table for the foreseeable future.

“If the Fed continues to lower rates over time, it could have a greater positive impact on loan interest rates,” Beckett says. “In addition, if loan demand, loan delinquencies, and treasury rates decrease as well, personal loan interest rates could drop even more.”

The Fed has projected multiple rate cuts through 2026, and if the Central Bank follows through, cheaper access to credit may eventually spur the banks to pass the savings onto consumers in the form of reduced rates.

However, there’s no guarantee that the Fed’s planned rate reductions will occur. “If the economy starts to get going, we may not see another rate cut this year as was previously projected,” warns Domenick D’Andrea, AIF, CRC, CPFA, financial advisor and Co-Founder of DanDarah Wealth Management. “With inflation still too high, the rate cuts might not lower personal loan rates as quickly as one might think.”

D’Andrea did indicate he believes that there will be at least one Fed rate cut in 2025, as well as “hopefully the continuation of lowering inflation.” He said that if this prediction holds, you may not have to wait too long to borrow to get the best rates. “I think that the 25 basis rate cut will be priced into new loan rates, at least at a percent of the 25 basis points in the next few weeks,” he advised.

The bottom line

The reality, of course, is that no one can predict exactly where rates will trend, especially with a new presidential administration taking office in D.C. in January. Because of this uncertainty, those with good credit, solid financial credentials and the ability to qualify for a competitive personal loan may not want to put off borrowing in hopes of slightly lower rates in the future that may take a long time to arrive.

The fact is, personal loans remain affordable relative to credit cards, even at today’s rates, and getting one now could be the right move if you have a pressing need for funds.

CBS News

Homan blasts Biden immigration policies during trip to U.S.-Mexico border

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

How Trump’s team is reacting to a potential Israel-Hezbollah ceasefire deal

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

CBS News

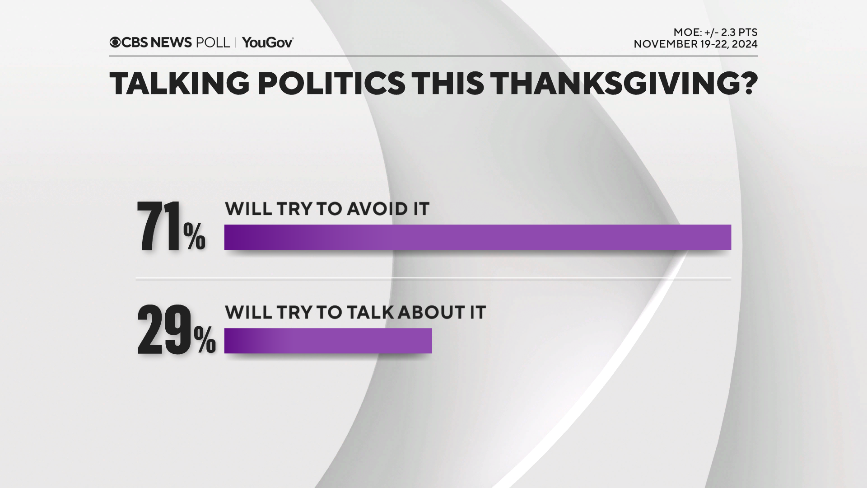

Most say they’ll try to avoid political talk at post-election Thanksgiving — CBS News poll

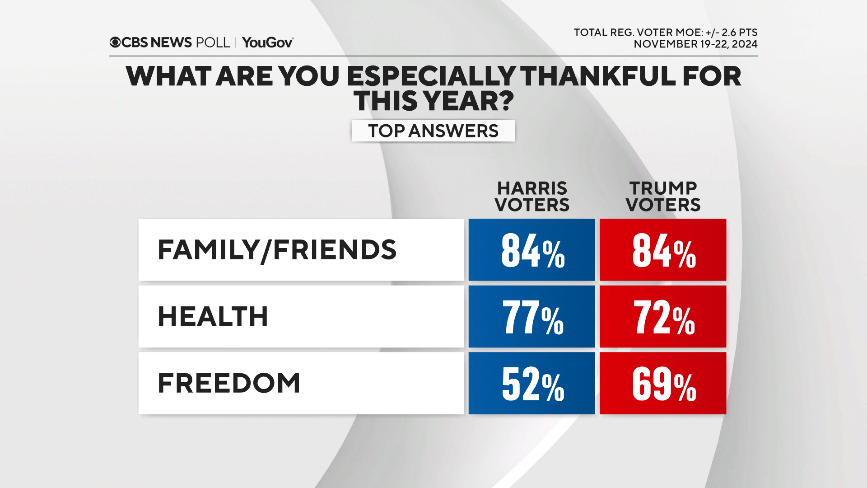

Americans say they’re most grateful for friends and family this year.

That may be one reason a big majority plans to avoid political discussions at the Thanksgiving table.

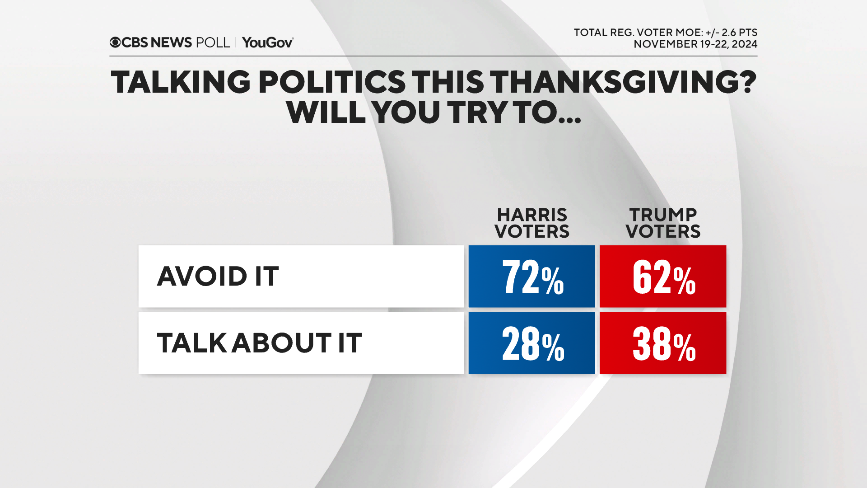

In the wake of Donald Trump’s victory, Trump voters and Republicans are relatively a bit more open to political chat than Kamala Harris voters and Democrats are, but most on either side aren’t particularly looking forward to politics with their poultry.

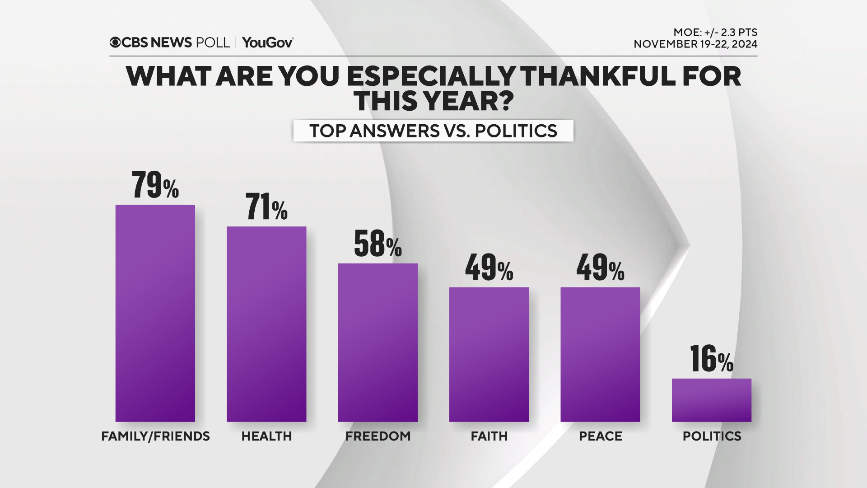

When asked to choose from a list, it’s family and friends that Americans say they’re especially thankful for this year. It is the top choice across a wide swath of Americans, including all regions, age and racial groups, and across the political spectrum.

Following family and friends, Americans say they are especially thankful for their health and freedom.

Matters of politics and government rank at the bottom of the list.

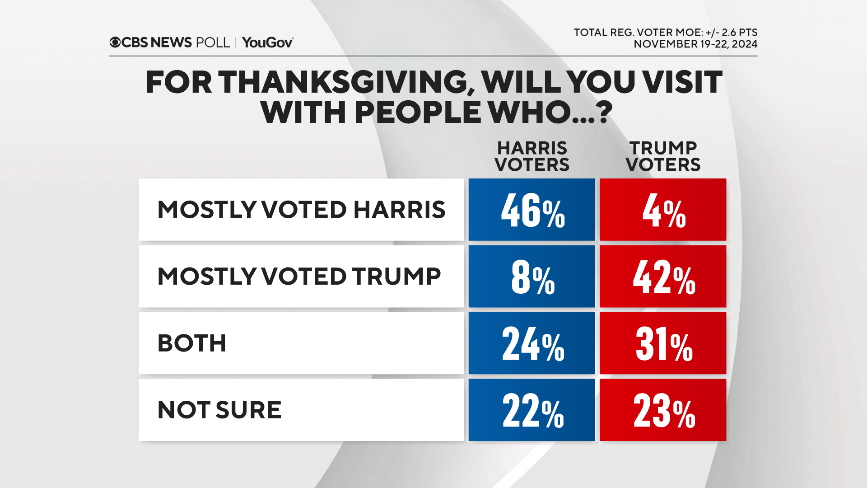

Whether people plan to engage in political conversation at Thanksgiving may depend on the company.

Many people do report that they’ll be gathering with like-minded voters this Thanksgiving: Harris voters say they’ll mostly be with fellow Harris supporters and Trump voters say they’ll mostly be with fellow Trump supporters.

When that happens, they’ll be relatively more open to political discussion than those who’ll be spending the holiday with a mix of voters, or with those who mostly voted for the other candidate.

All that said, few are going out of their way to avoid political differences altogether. Just 1 in 10 say they have changed their plans to avoid gathering with people who voted for a different presidential candidate than they did.

Despite the political differences between Trump and Harris voters, at least one thing they share is their gratitude for their family and friends.

Fred Backus contributed to this report.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,232 U.S. adults interviewed between November 19-22, 2024. The sample was weighted to be representative of adults nationwide according to gender, age, race, and education, based on the U.S. Census American Community Survey and Current Population Survey, as well as 2024 presidential vote. The margin of error is ±2.3 points.