CBS News

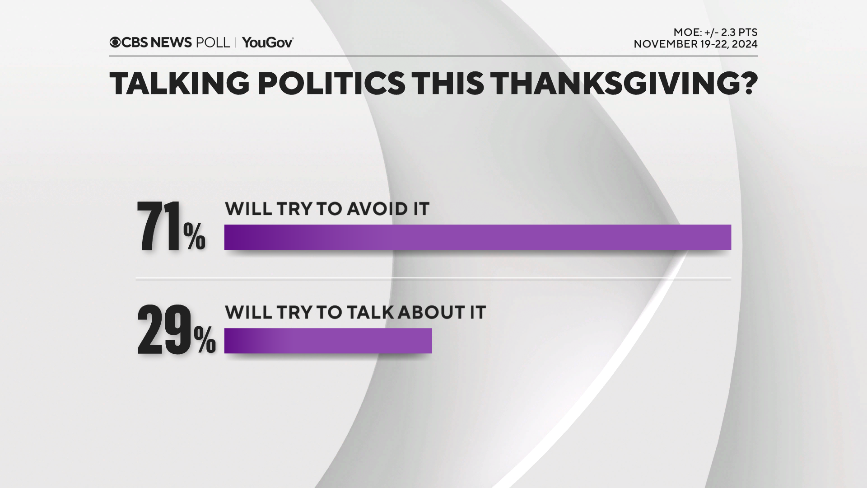

Most say they’ll try to avoid political talk at post-election Thanksgiving — CBS News poll

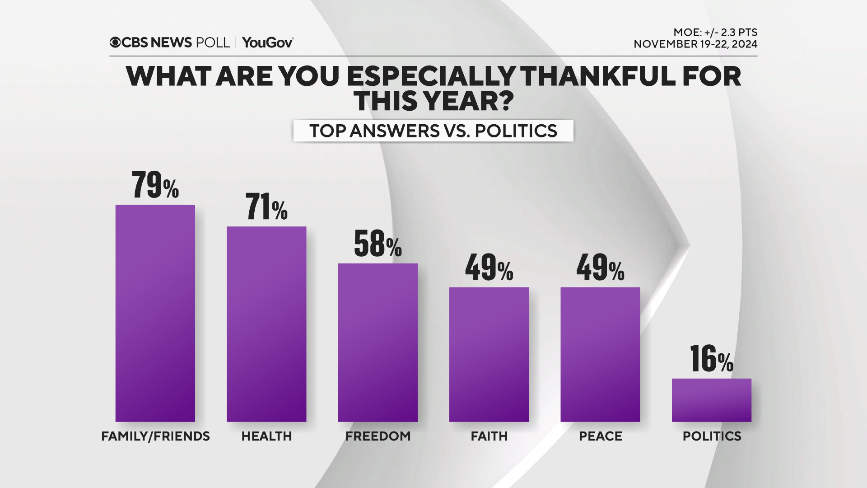

Americans say they’re most grateful for friends and family this year.

That may be one reason a big majority plans to avoid political discussions at the Thanksgiving table.

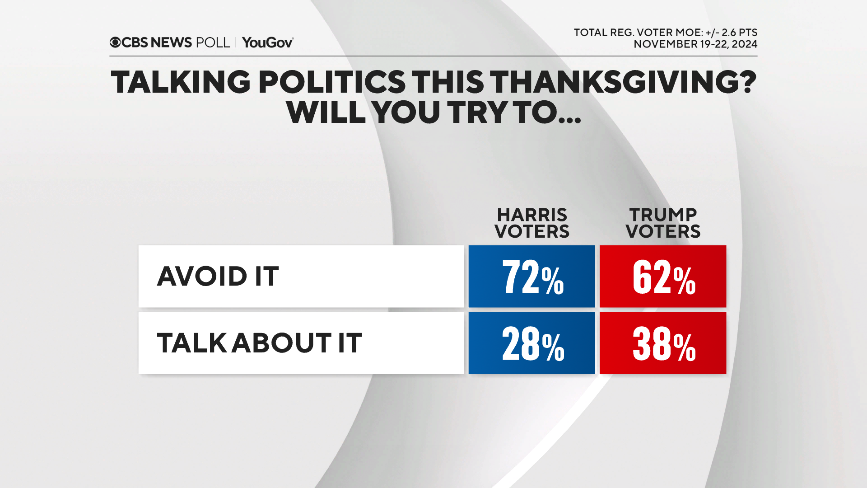

In the wake of Donald Trump’s victory, Trump voters and Republicans are relatively a bit more open to political chat than Kamala Harris voters and Democrats are, but most on either side aren’t particularly looking forward to politics with their poultry.

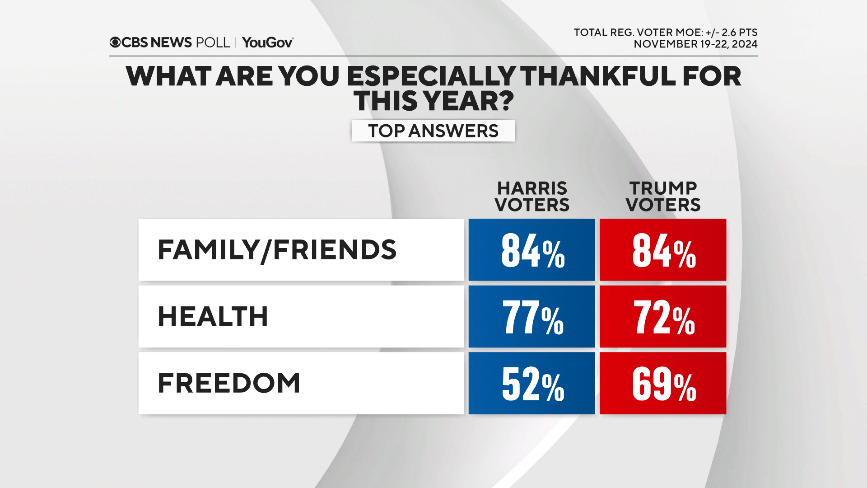

When asked to choose from a list, it’s family and friends that Americans say they’re especially thankful for this year. It is the top choice across a wide swath of Americans, including all regions, age and racial groups, and across the political spectrum.

Following family and friends, Americans say they are especially thankful for their health and freedom.

Matters of politics and government rank at the bottom of the list.

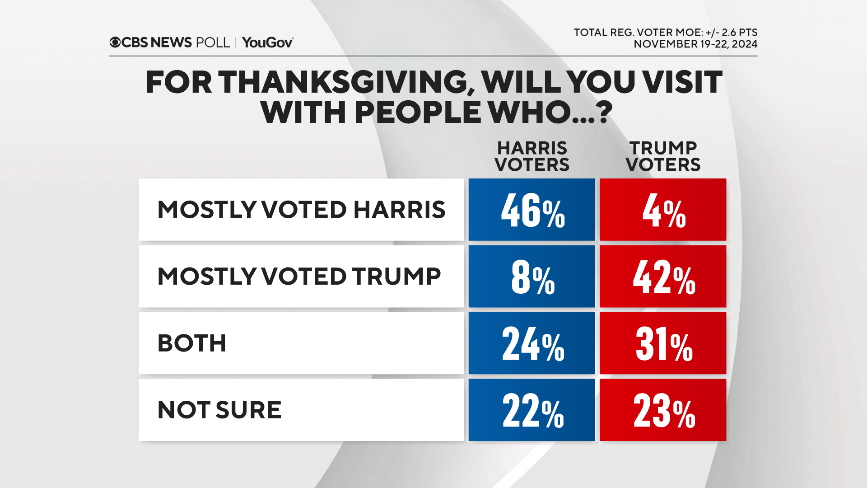

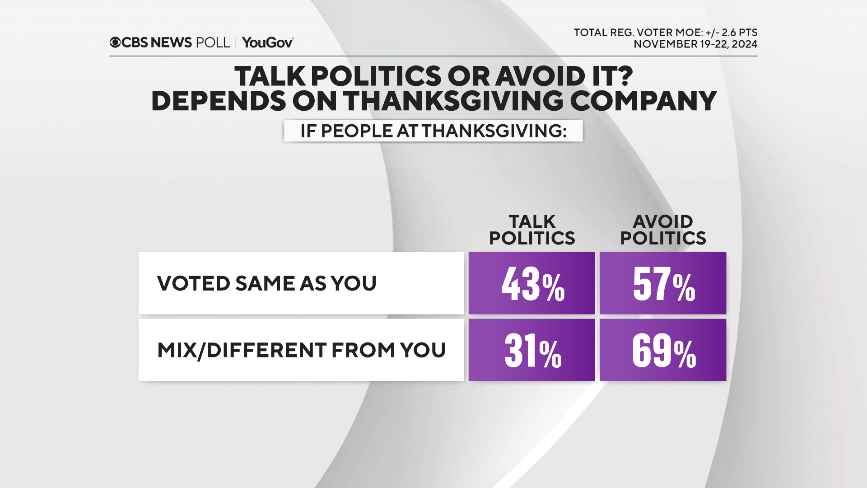

Whether people plan to engage in political conversation at Thanksgiving may depend on the company.

Many people do report that they’ll be gathering with like-minded voters this Thanksgiving: Harris voters say they’ll mostly be with fellow Harris supporters and Trump voters say they’ll mostly be with fellow Trump supporters.

When that happens, they’ll be relatively more open to political discussion than those who’ll be spending the holiday with a mix of voters, or with those who mostly voted for the other candidate.

All that said, few are going out of their way to avoid political differences altogether. Just 1 in 10 say they have changed their plans to avoid gathering with people who voted for a different presidential candidate than they did.

Despite the political differences between Trump and Harris voters, at least one thing they share is their gratitude for their family and friends.

Fred Backus contributed to this report.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,232 U.S. adults interviewed between November 19-22, 2024. The sample was weighted to be representative of adults nationwide according to gender, age, race, and education, based on the U.S. Census American Community Survey and Current Population Survey, as well as 2024 presidential vote. The margin of error is ±2.3 points.

CBS News

Here’s why Trump think tariffs are good for the U.S. — and what the experts say

President-elect Donald Trump, an avowed fan of tariffs, is pledging to enact stiff import duties as soon as he’s inaugurated in January. For Trump, these new levies would both supercharge the trade policies pursued during his first administration and, more broadly, help the U.S. achieve key economic and social goals.

On his Truth Social site Monday evening, Trump unveiled plans to place a 25% tariff on all imports from Mexico and Canada on January 20, his inauguration day. The president-elect also said he intends to levy an additional 10% fee on all imports from China.

Trump’s penchant for protectionist trade policies is a source of concern for many economists and Wall Street analysts, who worry new tariffs and retaliatory measures by U.S. trade partners could slow economic growth, spur inflation and trigger a trade war.

But Trump and his allies, including his choice for Treasury Secretary, Scott Bessent, have argued that tariffs deployed during his first term didn’t boost inflation and that the upside could far outweigh any negatives.

“But tariffs are two things if you look at it,” Trump said in October in an interview with Bloomberg News editor-in-chief John Micklethwait. “No. 1 is for protection of the companies that we have here, and the new companies that will move in because we’re going to have thousands of companies coming into this country.”

Here are four ways Trump says tariffs will help with the U.S., along with what experts say.

Protect U.S. manufacturing

Trump believes that imposing tariffs on trading partners will help protect U.S. businesses at a time when domestic manufacturing jobs have fallen far from their peak in 1979.

In some instances, the tariffs that Trump imposed in 2018-19 achieved that goal, with the Brookings Institution noting there’s some evidence that jobs in specific industries may have received a boost. For instance, tariffs on imported washing machines may have created 1,800 new U.S. jobs at Whirlpool and other manufacturers, according to the centrist think tank.

But that ignores the broader impact of Trump’s first-term tariffs on U.S. manufacturing, with the Federal Reserve finding that U.S. manufacturers ended up facing higher costs for raw materials they imported, as well as from retaliatory tariffs from other nations. The number of U.S. manufacturing jobs fell slightly during Trump’s first term, from about 12.4 million to 12.2 million workers, although a range of factors could account for that decline.

“[O]ur results suggest that the tariffs have not boosted manufacturing employment or output, even as they increased producer prices,” the Fed researchers noted.

Bring new companies to the U.S.

Trump also contends that broad-based tariffs will convince some foreign manufacturers to open plants in the U.S. as a way to avoid the import duties.

“The higher the tariff, the more likely it is that the company will come into the United States and build a factory in the United States, so it doesn’t have to pay the tariff,” Trump told Bloomberg’s Micklethwait.

Although such a shift is possible, Micklethwait said such changes would “take many, many years.” (Trump disputed that, saying companies would “come right away.”) Experts note that many factors beyond tariffs affect where companies decide to operate, including supply chains, taxes, shipping costs, and labor and regulatory policies.

Already, some businesses are anticipating the impact of tariffs by shifting their manufacturing locations, but that may not be guaranteed to benefit the U.S. For instance, shoemaker Steve Madden said if Trump places new tariffs on Chinese imports, it will shift manufacturing away from China and toward nations such as Cambodia and Vietnam.

Deliver billions in new federal revenue

Trump has also touted tariffs as a way to generate new federal revenue that can offset his proposed tax cuts. During his first administration, his tariffs — more limited than his current proposals — generated $80 billion in revenue, according to the Tax Foundation.

If Trump institutes a 10% tariff on all imports, as he proposed during his campaign, the federal government would reap $2 trillion from 2025 through 2034, estimates the nonpartisan Tax Foundation, a think tank focused on tax issues.

According to Goldman Sachs, a 25% tariff on Canada and Mexico, along with a 10% tax on Chinese imports, would generate just under $300 billion in tariff revenue per year. Overall, 43% of U.S. imports come from Mexico (15.4%), Canada (13.6%),and China (13.9%).

However, that revenue would largely be paid by U.S. consumers and businesses, experts say. That’s because tariffs are not paid by the countries that export to the U.S., as Trump maintains, but rather by U.S. importers.

In other words, companies like Walmart would be faced with the decision of whether to swallow the higher costs of imports, or passing those on to consumers, Vicky Redwood, senior economic adviser for Capital Economics, wrote in a research note.

“If the costs are passed on, then customers face a choice: continue buying the (now more expensive) import or switch to buying a domestic alternative (which will cost more than the import pre-tariff),” she noted.

Trump’s tariffs could cost the typical U.S. family an additional $2,600 a year due to importers and manufacturers passing the cost of tariffs to consumers, according to an August analysis from the Peterson Institute for International Economics, a nonpartisan think tank focused on economic issues.

Stem the flow of drugs and illegal immigration

Trump also sees the threat of new tariffs as a way to curb illegal immigration and drug smuggling, citing people “pouring through Mexico and Canada, bringing Crime and Drugs at levels never seen before.” The tariffs would remain “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” he added.

Much of the fentanyl within the U.S. is smuggled from Mexico. During President Joe Biden’s term, border seizures of the drug rose sharply, with U.S. officials tallying about 21,900 pounds (12,247 kilograms) of fentanyl seized in the 2024 government budget year, versus 2,545 pounds (1,154 kilograms) in 2019, when Trump was president.

While it’s possible that Canada, Mexico and China could increase enforcement against drug smuggling or immigration to avoid Trump’s tariffs, it’s unclear whether such a threat along would achieve those goals. Mexican President Claudia Sheinbaum on Tuesday suggested Mexico could retaliate with tariffs of its own and described illegal drugs as a U.S. problem, while indicating a willingness to discuss the issues with Trump.

The flow of drugs into the U.S. “is a problem of public health and consumption in your country’s society,” she said.

CBS News

Best Buy says Trump’s tariffs could force it to raise prices for consumers

Best Buy CEO Corie Barry said Tuesday that personal electronics could become more expensive if President-elect Donald Trump carries out his threat to slap new tariffs on foreign goods, as large retailers scramble to assess the potential impact of the proposed levies on their business.

The warning came one day after Trump said he would impose a new round of tariffs on Mexico, Canada and China on his first day in office. Before the Nov. 5 election, he had proposed a baseline 10% tariff on all U.S. imports and a 60% tariff on goods shipped from China, arguing the such levies protect domestic manufacturers and encourage American companies to create jobs at home.

Any added costs on U.S. imports from the three counties “will be shared by our customers,” Barry told investors in the company’s Nov. 26 earnings call, noting that “there’s very little in [the] consumer electronics space that is not imported.”

“These are goods that people need, and higher prices are not helpful,” she added.

Price hikes are not guaranteed, Barry cautioned, saying that any impact on the retailer’s costs and prices are contingent on how any new tariffs might be implemented.

“I think it’s going to be a very fluid situation as we continue to work through it,” she said, adding that the company will “make sure we do everything we can to keep prices right for our customers.”

Best Buy could try to partly offset the impact of new tariffs by importing more goods ahead of levies taking effect in 2025, as well as working with vendors to source products from countries other than China, Barry said during the call. Roughly 60% of the goods Best Buy sells are imported from China.

“We are already planning for and working with our vendor partners on next steps,” she said.

Barry’s comments are echoed by other retailers and manufacturers bracing for the impact of higher tariffs on their supply chains. The Consumer Technology Association (CTA) has warned that Trump’s proposed tariffs could lead to higher prices for smartphones, laptops and tablets, connected devices, video game consoles, and computer accessories.

Ed Brzytwa, the CTA’s vice president of international trade, said a number of the trade group’s members are “front-loading 2025 imports into 2024 to get out ahead of the tariffs.”

As far as possible price hikes for consumers, “A number of people are waking up now to the fact that this could be a reality,” he said.

CBS News

Some tax refunds can come with hidden fees, government report warns

If a tax preparer offers you a tax refund product such as a refund advance loan or anticipation check, experts advise to first read the fine print.

That’s because nearly 16% of American taxpayers paid more than $842 million in fees to receive their 2023 refunds. Of those, about 96% used a refund anticipation check, or RAC, the Treasury Inspector General for Tax Administration estimated in a report last week. Another 4% used a refund anticipation loan, or RAL.

These products can appeal to taxpayers who are eager to get their refunds and who don’t want to wait days or weeks for the IRS to deposit the money into their accounts or cut a check. And while the seven tax return preparer companies that account for almost 80% of the total refund products are “largely complying with applicable guidance, not all information was clearly available for consumers,” according to the agency’s review of their websites.

“In some instances, fees and cost information for these products were not clearly advertised, and it required reading the fine print or going through multiple pages to find some cost information,” it stated.

Fees for advance tax refund loans and checks

The RAC fees ranged from $25 to $55 for filing season 2024, according to the report. The average refund for these taxpayers was $3,841, indicating that the cost of the RAC was about 1% of the total refund. The average refund for a fee-based RAL was $6,696.

Refunds might come on prepaid cards, with associated fees that can vary greatly, and many charge fees for out-of-network ATMs, cautions the Consumer Financial Protection Bureau.

Further, many taxpayers qualify for free assistance from preparers certified by the IRS.

“Many taxpayers get their refunds from the IRS in 10 to 21 days,” the CFPB advises. “Waiting a week or two can save you money.”

Here’s how to find a volunteer in your community or online:

- Go to irs.gov and search for “Free Tax Return Preparation”

- Go to AARP.org and search for “Tax-Aide Locator”

- Go to GetYourRefund.org for online tax papration

- Go to MyFreeTaxes.com to prepare your own return with assistance