CBS News

Thanksgiving weather forecast maps show snow storms, winter cold fronts could cause travel chaos

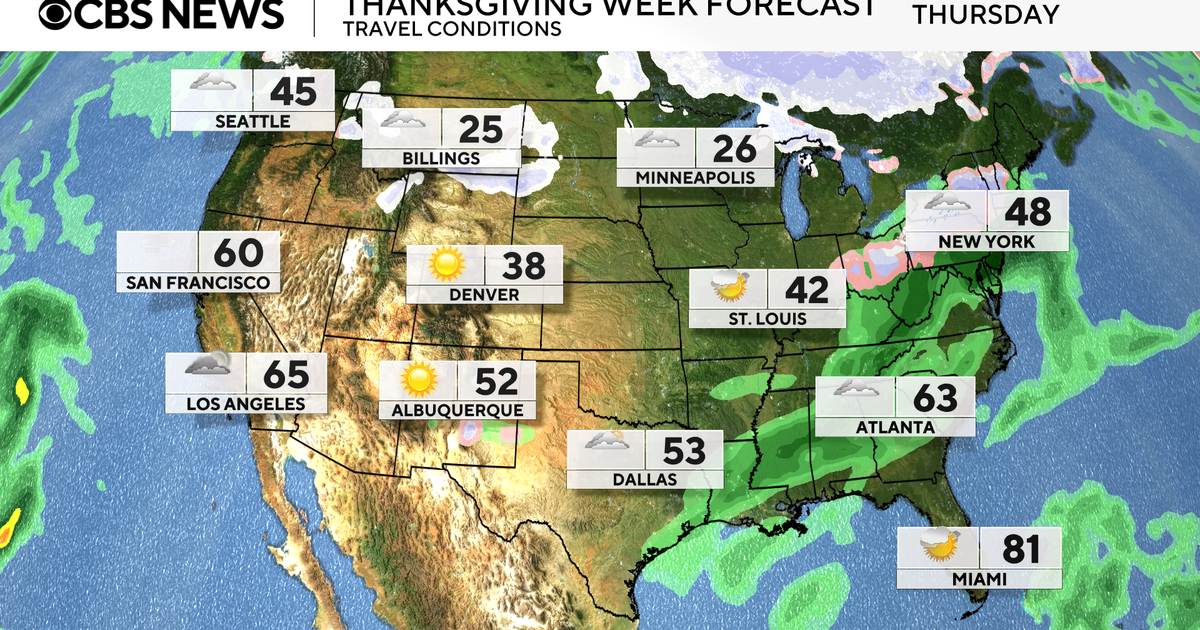

A messy spell of winter weather continued to dominate forecasts Tuesday across the United States, with a mix of rain and snow expected to materialize in different areas around the upcoming Thanksgiving holiday. Storms could potentially impact travel plans, particularly for people in eastern parts of the country, while the Mountain West could feel the effects of an “Arctic blast” overnight Wednesday into Thursday.

Map of the Thanksgiving weather forecast for 2024

“A mix of rain and snow are possible across the eastern third of the country on Thanksgiving Day,” said CBS News meteorologist Nikki Nolan, who noted forecasting models were “reaching a consensus” by Tuesday and indicated the I-95 corridor, which runs along the East Coast from Miami to the Canadian border with Maine, would likely receive rain. Interior regions of the Northeast, like upstate New York, would likely see snow.

Nikki Nolan for CBS News

Between 1 and 4 inches of snowfall could accumulate in those interior regions, Nolan said, while as much as a total 3 inches of rain could fall on affected areas.

Temperatures are expected to drop across a majority of the U.S., with northern places like Minneapolis preparing for extreme cold. Chilly conditions will probably spare southeastern states, forecasts show.

Where will winter storms hit hardest for Thanksgiving?

Winter weather advisories were in place Tuesday for northern Michigan, where forecasters at the National Weather Service warned up to 6 inches of additional snowfall could accumulate in some places by the evening. Advisories were set to remain active through 7 p.m. in the local time zone.

“Expect the lake effect snowfall to pick up this afternoon when a stronger band moves onshore. Should the band remain onshore into tonight, the Winter Weather Advisory may need to be extended in time in the future,” states an alert issued early Tuesday morning by the weather service in Marquette, Michigan. Forecasters advised people to plan for “slippery road conditions and reduced visibility,” potentially during their morning and evening commutes.

Nikki Nolan for CBS News

Additional advisories were effective in parts of the Northeast on Tuesday afternoon. In Albany, New York, forecasts warned that “pockets of freezing rain” could create dangerous road conditions in the southern Adirondacks, Lake George and Saratoga regions, and southern Vermont before transitioning into normal rainfall Wednesday morning.

“Be aware of slippery roads and sidewalks during the morning commute or if traveling early for Thanksgiving,” states a message from the weather service in Albany. Freezing rain could potentially result in up to a tenth of an inch of ice, according to Nolan.

Farther west, a low-pressure weather system tied to the ongoing atmospheric river continued to shift inward from coastal areas, bringing with it rain and snow. The wintry weather prompted warnings in Nevada, as forecasters in Las Vegas predicted up to 14 inches of snow could fall in areas with higher elevation.

Meanwhile, the threat of impending snowfall triggered a series of avalanche warnings in Colorado. Nolan said as much as 3 feet of snow could stack up in certain parts of the Colorado Rockies, with forecasts showing winds of 30-40 miles per hour could tear through the region along with the storms.

Will winter storms impact Thanksgiving travel?

Estimates suggest an unprecedented number of people will crowd roads and airports this week, as figures reported by AAA showed 80 million were expected to travel at least 50 miles over the next seven days. If the calculation hold up, it would set a new Thanksgiving record. Complicating the anticipated congestion is the major storm affecting huge sections of the U.S., from the western Rocky Mountains to the East Coast.

Nikki Nolan for CBS News

“We’ve been talking about it basically on repeat since Friday: storms on the West Coast, storms in the Northeast, and now a storm in the Mountain West,” said CBS News senior transportation correspondent Kris Van Cleave, reporting from LaGuardia Airport in Queens, New York, on Tuesday. “So airports from San Francisco to Las Vegas, Salt Lake, Denver, and here in the Northeast, D.C. to Boston, could all see delays today as these various storm systems are moving around. A lot to watch.”

The Federal Aviation Administration said 50,000 flights were scheduled Tuesday, Van Cleave reported, noting the agency expects air travel to be even busier Wednesday and Sunday.

Where will it snow on Thanksgiving?

The storm system’s track was still somewhat uncertain Tuesday, but forecasters said below-average temperatures in the Northeast — especially in interior areas — could determine whether different locations in the region are hit with rain or snow.

In the lead-up to Thanksgiving Day, forecasters at the Weather Prediction Center said heavy snow across the southern Sierra Nevada, Intermountain West and Central Rockies earlier in the week will be followed by snow showers across the Great Lakes that could result in up to 8 inches of snowfall by Thursday in Michigan’s Upper Peninsula.

As temperatures tick downward over the Northern Plains ahead of the holiday, the weather prediction center said a series of disturbances over the Central U.S. would “facilitate an arctic outbreak across the region” overnight Wednesday into Thanksgiving.

CBS News

Here’s why Trump think tariffs are good for the U.S. — and what the experts say

President-elect Donald Trump, an avowed fan of tariffs, is pledging to enact stiff import duties as soon as he’s inaugurated in January. For Trump, these new levies would both supercharge the trade policies pursued during his first administration and, more broadly, help the U.S. achieve key economic and social goals.

On his Truth Social site Monday evening, Trump unveiled plans to place a 25% tariff on all imports from Mexico and Canada on January 20, his inauguration day. The president-elect also said he intends to levy an additional 10% fee on all imports from China.

Trump’s penchant for protectionist trade policies is a source of concern for many economists and Wall Street analysts, who worry new tariffs and retaliatory measures by U.S. trade partners could slow economic growth, spur inflation and trigger a trade war.

But Trump and his allies, including his choice for Treasury Secretary, Scott Bessent, have argued that tariffs deployed during his first term didn’t boost inflation and that the upside could far outweigh any negatives.

“But tariffs are two things if you look at it,” Trump said in October in an interview with Bloomberg News editor-in-chief John Micklethwait. “No. 1 is for protection of the companies that we have here, and the new companies that will move in because we’re going to have thousands of companies coming into this country.”

Here are four ways Trump says tariffs will help with the U.S., along with what experts say.

Protect U.S. manufacturing

Trump believes that imposing tariffs on trading partners will help protect U.S. businesses at a time when domestic manufacturing jobs have fallen far from their peak in 1979.

In some instances, the tariffs that Trump imposed in 2018-19 achieved that goal, with the Brookings Institution noting there’s some evidence that jobs in specific industries may have received a boost. For instance, tariffs on imported washing machines may have created 1,800 new U.S. jobs at Whirlpool and other manufacturers, according to the centrist think tank.

But that ignores the broader impact of Trump’s first-term tariffs on U.S. manufacturing, with the Federal Reserve finding that U.S. manufacturers ended up facing higher costs for raw materials they imported, as well as from retaliatory tariffs from other nations. The number of U.S. manufacturing jobs fell slightly during Trump’s first term, from about 12.4 million to 12.2 million workers, although a range of factors could account for that decline.

“[O]ur results suggest that the tariffs have not boosted manufacturing employment or output, even as they increased producer prices,” the Fed researchers noted.

Bring new companies to the U.S.

Trump also contends that broad-based tariffs will convince some foreign manufacturers to open plants in the U.S. as a way to avoid the import duties.

“The higher the tariff, the more likely it is that the company will come into the United States and build a factory in the United States, so it doesn’t have to pay the tariff,” Trump told Bloomberg’s Micklethwait.

Although such a shift is possible, Micklethwait said such changes would “take many, many years.” (Trump disputed that, saying companies would “come right away.”) Experts note that many factors beyond tariffs affect where companies decide to operate, including supply chains, taxes, shipping costs, and labor and regulatory policies.

Already, some businesses are anticipating the impact of tariffs by shifting their manufacturing locations, but that may not be guaranteed to benefit the U.S. For instance, shoemaker Steve Madden said if Trump places new tariffs on Chinese imports, it will shift manufacturing away from China and toward nations such as Cambodia and Vietnam.

Deliver billions in new federal revenue

Trump has also touted tariffs as a way to generate new federal revenue that can offset his proposed tax cuts. During his first administration, his tariffs — more limited than his current proposals — generated $80 billion in revenue, according to the Tax Foundation.

If Trump institutes a 10% tariff on all imports, as he proposed during his campaign, the federal government would reap $2 trillion from 2025 through 2034, estimates the nonpartisan Tax Foundation, a think tank focused on tax issues.

According to Goldman Sachs, a 25% tariff on Canada and Mexico, along with a 10% tax on Chinese imports, would generate just under $300 billion in tariff revenue per year. Overall, 43% of U.S. imports come from Mexico (15.4%), Canada (13.6%),and China (13.9%).

However, that revenue would largely be paid by U.S. consumers and businesses, experts say. That’s because tariffs are not paid by the countries that export to the U.S., as Trump maintains, but rather by U.S. importers.

In other words, companies like Walmart would be faced with the decision of whether to swallow the higher costs of imports, or passing those on to consumers, Vicky Redwood, senior economic adviser for Capital Economics, wrote in a research note.

“If the costs are passed on, then customers face a choice: continue buying the (now more expensive) import or switch to buying a domestic alternative (which will cost more than the import pre-tariff),” she noted.

Trump’s tariffs could cost the typical U.S. family an additional $2,600 a year due to importers and manufacturers passing the cost of tariffs to consumers, according to an August analysis from the Peterson Institute for International Economics, a nonpartisan think tank focused on economic issues.

Stem the flow of drugs and illegal immigration

Trump also sees the threat of new tariffs as a way to curb illegal immigration and drug smuggling, citing people “pouring through Mexico and Canada, bringing Crime and Drugs at levels never seen before.” The tariffs would remain “until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!” he added.

Much of the fentanyl within the U.S. is smuggled from Mexico. During President Joe Biden’s term, border seizures of the drug rose sharply, with U.S. officials tallying about 21,900 pounds (12,247 kilograms) of fentanyl seized in the 2024 government budget year, versus 2,545 pounds (1,154 kilograms) in 2019, when Trump was president.

While it’s possible that Canada, Mexico and China could increase enforcement against drug smuggling or immigration to avoid Trump’s tariffs, it’s unclear whether such a threat along would achieve those goals. Mexican President Claudia Sheinbaum on Tuesday suggested Mexico could retaliate with tariffs of its own and described illegal drugs as a U.S. problem, while indicating a willingness to discuss the issues with Trump.

The flow of drugs into the U.S. “is a problem of public health and consumption in your country’s society,” she said.

CBS News

Best Buy says Trump’s tariffs could force it to raise prices for consumers

Best Buy CEO Corie Barry said Tuesday that personal electronics could become more expensive if President-elect Donald Trump carries out his threat to slap new tariffs on foreign goods, as large retailers scramble to assess the potential impact of the proposed levies on their business.

The warning came one day after Trump said he would impose a new round of tariffs on Mexico, Canada and China on his first day in office. Before the Nov. 5 election, he had proposed a baseline 10% tariff on all U.S. imports and a 60% tariff on goods shipped from China, arguing the such levies protect domestic manufacturers and encourage American companies to create jobs at home.

Any added costs on U.S. imports from the three counties “will be shared by our customers,” Barry told investors in the company’s Nov. 26 earnings call, noting that “there’s very little in [the] consumer electronics space that is not imported.”

“These are goods that people need, and higher prices are not helpful,” she added.

Price hikes are not guaranteed, Barry cautioned, saying that any impact on the retailer’s costs and prices are contingent on how any new tariffs might be implemented.

“I think it’s going to be a very fluid situation as we continue to work through it,” she said, adding that the company will “make sure we do everything we can to keep prices right for our customers.”

Best Buy could try to partly offset the impact of new tariffs by importing more goods ahead of levies taking effect in 2025, as well as working with vendors to source products from countries other than China, Barry said during the call. Roughly 60% of the goods Best Buy sells are imported from China.

“We are already planning for and working with our vendor partners on next steps,” she said.

Barry’s comments are echoed by other retailers and manufacturers bracing for the impact of higher tariffs on their supply chains. The Consumer Technology Association (CTA) has warned that Trump’s proposed tariffs could lead to higher prices for smartphones, laptops and tablets, connected devices, video game consoles, and computer accessories.

Ed Brzytwa, the CTA’s vice president of international trade, said a number of the trade group’s members are “front-loading 2025 imports into 2024 to get out ahead of the tariffs.”

As far as possible price hikes for consumers, “A number of people are waking up now to the fact that this could be a reality,” he said.

CBS News

Some tax refunds can come with hidden fees, government report warns

If a tax preparer offers you a tax refund product such as a refund advance loan or anticipation check, experts advise to first read the fine print.

That’s because nearly 16% of American taxpayers paid more than $842 million in fees to receive their 2023 refunds. Of those, about 96% used a refund anticipation check, or RAC, the Treasury Inspector General for Tax Administration estimated in a report last week. Another 4% used a refund anticipation loan, or RAL.

These products can appeal to taxpayers who are eager to get their refunds and who don’t want to wait days or weeks for the IRS to deposit the money into their accounts or cut a check. And while the seven tax return preparer companies that account for almost 80% of the total refund products are “largely complying with applicable guidance, not all information was clearly available for consumers,” according to the agency’s review of their websites.

“In some instances, fees and cost information for these products were not clearly advertised, and it required reading the fine print or going through multiple pages to find some cost information,” it stated.

Fees for advance tax refund loans and checks

The RAC fees ranged from $25 to $55 for filing season 2024, according to the report. The average refund for these taxpayers was $3,841, indicating that the cost of the RAC was about 1% of the total refund. The average refund for a fee-based RAL was $6,696.

Refunds might come on prepaid cards, with associated fees that can vary greatly, and many charge fees for out-of-network ATMs, cautions the Consumer Financial Protection Bureau.

Further, many taxpayers qualify for free assistance from preparers certified by the IRS.

“Many taxpayers get their refunds from the IRS in 10 to 21 days,” the CFPB advises. “Waiting a week or two can save you money.”

Here’s how to find a volunteer in your community or online:

- Go to irs.gov and search for “Free Tax Return Preparation”

- Go to AARP.org and search for “Tax-Aide Locator”

- Go to GetYourRefund.org for online tax papration

- Go to MyFreeTaxes.com to prepare your own return with assistance